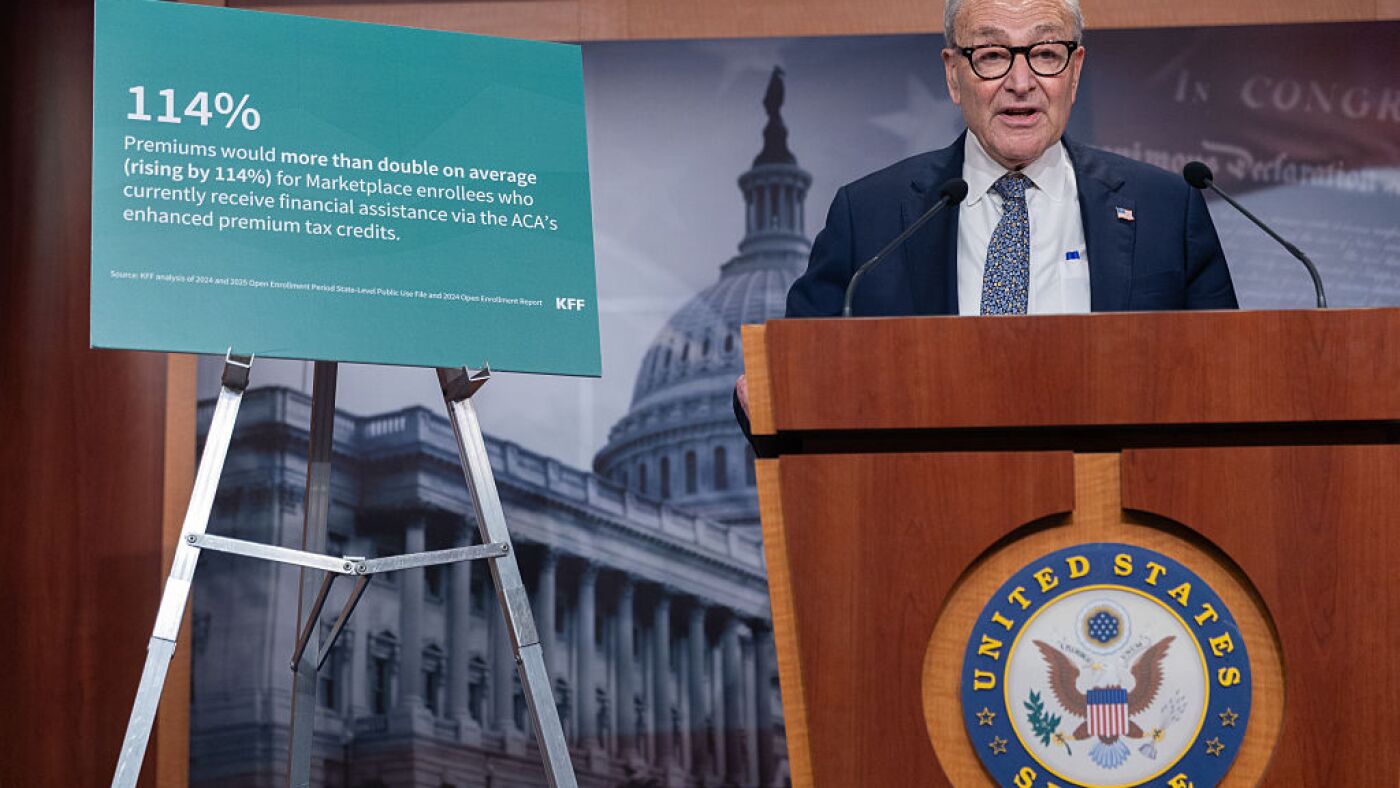

Senate Minority Chief Chuck Schumer, D-N.Y., speaks at a press convention in Washington, D.C., on Tuesday with different members of Senate Democratic management following two failed votes to fund the federal government.

Nathan Posner/Anadolu/Getty Photographs

disguise caption

toggle caption

Nathan Posner/Anadolu/Getty Photographs

A battle over well being coverage drove the present federal authorities shutdown.

At difficulty is the price of premiums for well being care plans individuals purchase on the Inexpensive Care Act, or Obamacare, marketplaces.

Enhanced tax credit for these premiums expire on the finish of the yr. Since 2021, these have saved ACA plans inexpensive for individuals who get their insurance coverage this fashion.

Earlier this week, Democrats within the Senate refused to vote for the Republican short-term funding invoice that didn’t embrace an extension of the improved premium tax credit.

So why do they matter?

The improved tax credit are vital for individuals who do not get medical insurance via their job or a public program like Medicare or Medicaid. This yr enrollment hit a document 24 million.

That’s solely about 7% of the U.S. inhabitants, however the individuals who depend on these plans are an influential group that features small enterprise house owners, farmers and ranchers, says Cynthia Cox, vp and director of the Program on the ACA on the nonpartisan well being analysis group KFF.

Cox and her workforce simply did an evaluation on what’s going to occur to individuals’s premiums subsequent yr if Congress does not lengthen the improved subsidies.

“On common, we’re anticipating premium funds by enrollees to extend by 114%,” she says.

Meaning lots of people are going to must pay double the month-to-month premium they’re paying now.

Or, says Cox, they may have to change to a higher-deductible plan, change jobs to 1 that gives insurance coverage, or they may lose their protection.

The Congressional Price range Workplace estimates that 4 million individuals will change into uninsured if the improved tax credit expire.

It additionally estimates that extending the coverage will value the federal government lots — $350 billion over 10 years.

Premium tax credit have been vital to rising enrollment in ACA plans.

When the ACA was handed in 2010, Congress created a sliding scale to provide individuals a break on their premiums based mostly on earnings. However premiums have been nonetheless too excessive for lots of people and people with incomes above 400% of the federal poverty stage needed to pay full worth, says Sabrina Corlette, mission director on the Heart on Well being Insurance coverage Reforms at Georgetown College.

“So there was a bit of oldsters who simply have been actually struggling to afford” their premiums, she says. And enrollment was sluggish.

So in 2021, Congress stepped in with much more federal funding, which made premiums extra inexpensive for individuals of all earnings ranges.

It was an “extremely profitable effort to get extra individuals into protection and scale back the uninsured charge,” says Corlette.

Some Republican lawmakers say the present enhanced tax credit are simply too costly. Different Republicans say they’re open to extending the coverage however not as a part of the shutdown battle.

“That premium help program does not even expire till subsequent yr. So why are you shutting down the federal government on Oct. 1 due to a program that does not even expire for one more few months?” Vice President Vance stated on Fox Information on Wednesday.

Sen. Patty Murray, D-Wash., says that really, it’s an pressing difficulty. As she defined in a press convention Wednesday, open enrollment for ACA plans begins Nov. 1.

“Later is just too late,” she stated. “The brand new increased well being care charges, these are being set proper now. Notifications to households — they’re within the mail now. Open enrollment is weeks away and households are panicking.”

For Cox, having this comparatively small slice of the medical insurance pie dominating the political universe takes her again to the repeal and change battle of 2017 and numerous standoffs over the Inexpensive Care Act since then.

“Obamacare has at all times been the middle of a political firestorm, no less than in well being coverage,” she stated. “Right here we’re once more.”