Tesla’s second quarter earnings signaled the corporate continues to undergo a tough patch, with each income and adjusted earnings per share lacking the typical Wall Avenue estimates. Income was $22.5 billion, down roughly 12% year-over-year, the sharpest decline in no less than a decade. Adjusted earnings per share have been 40 cents, down from 52 cents a 12 months in the past. Analysts, on common, had forecast income between $22.62–$22.64 billion and adjusted EPS of $0.41–$0.42 per share, with Tesla beneath the midpoint on every.

Tesla’s double-digit proportion income decline was primarily attributed to the continued hunch in car deliveries. Improved vitality storage deployments and new service choices offered minor offsets, however couldn’t outweigh the hit from lagging automobile gross sales and chronic worth competitors throughout the electrical car business.

Working revenue additionally fell considerably, coming in at $923 million, which was beneath consensus estimates of $1.23 billion. Internet revenue dropped year-over-year as margins continued to shrink, pressured by decrease common promoting costs, greater uncooked materials prices, and world commerce headwinds.

Tesla had beforehand reported deliveries of greater than 384,000 autos within the quarter—a drop of greater than 13% from the earlier 12 months—with manufacturing holding regular at simply over 410,000 autos. This marks the second quarter in a row of lowered year-over-year deliveries.

Wall Avenue had entered the earnings week with tepid expectations, citing declining gross sales, compressed margins, and elevated spending on analysis and growth as elements dampening short-term prospects. Whereas Tesla’s outcomes have been barely weaker than forecast, shares noticed solely a modest uptick in after-hours buying and selling, as traders centered on the corporate’s long-term ambitions quite than present gross sales struggles.

Robotaxi, AI, and a brand new reasonably priced mannequin

Tesla’s management used the earnings launch to reaffirm its pivot towards next-generation applied sciences. CEO Elon Musk highlighted the launch of Tesla’s first Robotaxi pilot service in Austin, Texas, together with imprecise remarks associated to the continued growth of a long-rumored “extra reasonably priced” Tesla mannequin.

Musk signaled that, amid stiffer automotive competitors, Tesla’s technique more and more facilities on breakthroughs in autonomy, synthetic intelligence, and vitality options as pillars for future development.

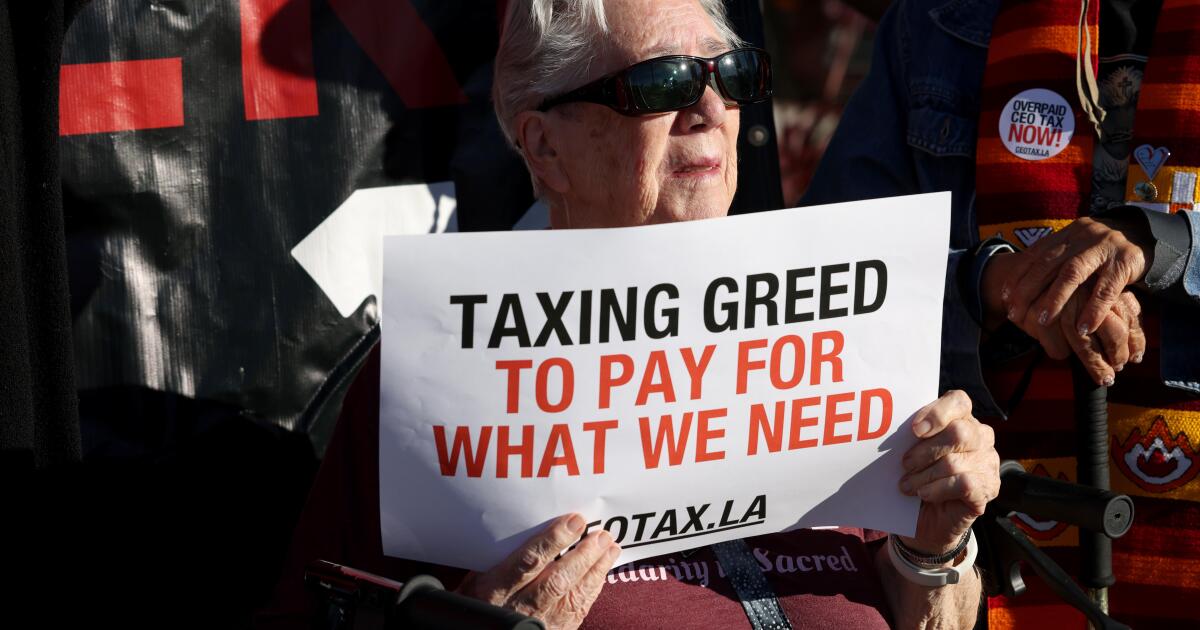

A number of challenges proceed to weigh on Tesla, together with expiring U.S. electrical car tax credit in October 2025, ongoing commerce disputes and tariffs affecting prices and world provide, and intensifying competitors from established automakers and Chinese language EV manufacturers. Extra usually, the model has rising reputational points related to Musk and his assist of President Donald Trump, even after the 2 had a falling out that coincided with fierce criticism of every upon the opposite. Throughout Musk’s transient position serving to the administration, his generally profitable makes an attempt at slashing authorities spending provoked ire from a lot of Tesla’s conventional buyer base, with environmentalist and left-leaning politics. Different traders mentioned they wished the distraction would go away.

For this story, Fortune used generative AI to assist with an preliminary draft. An editor verified the accuracy of the data earlier than publishing.