da-kuk/E+ by way of Getty Photos

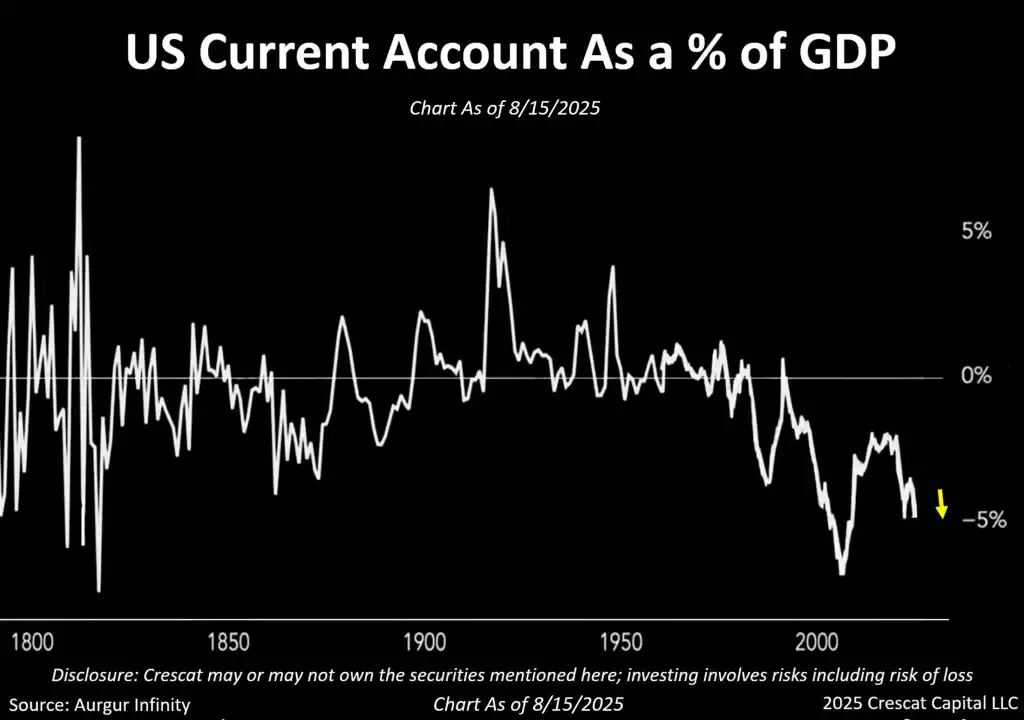

The US now faces a textbook twin deficit drawback: a swollen fiscal shortfall on one aspect and a commerce imbalance on the opposite. The fiscal deficit is extensively mentioned, however the commerce hole is simply as hanging — worse than at any level because the 1800s, besides briefly in the course of the international monetary disaster when GDP collapsed.

In the present day’s imbalance, in contrast, is structural, not cyclical.

For the primary time, the US is working twin deficits whereas authorities debt has reached excessive ranges, and the greenback stands at considered one of its most overvalued ranges in historical past. This mixture is unsustainable. One thing should function the outlet for these pressures, and the more than likely escape valve is the greenback itself.

To date this yr, the US greenback has suffered a very steep decline. Whereas many argue the selloff has gone too far, we see it as doubtless the opening section of a broader, long-term weakening pattern — pushed by the rising necessity of economic repression quite than mere coverage alternative.

In contrast to the nineteenth century, when present account deficits have been a mirrored image of a younger nation drawing in British capital to finance its development, at this time’s imbalances stem from a mature system stretched by many years of capital inflows and financial growth.

A lot of the world’s accessible capital has already been absorbed by US markets, leaving little room for additional inflows. As that reservoir reveals indicators of exhaustion, the path of circulation might start to reverse, leaving the US more and more uncovered.

It’s also vital to emphasize the magnitude of the debt burden. Even in the course of the Civil Warfare and Reconstruction period, federal debt by no means exceeded one-third of GDP. In the present day it’s greater than thrice that stage. This scale of obligations leaves few adjustment mechanisms apart from the forex.

Echoes of 1971: Nixon’s Greenback Disaster and In the present day’s Higher Imbalances

In the present day’s escalating tariffs and commerce disputes evoke a well-recognized interval in US financial historical past. Within the late Sixties and early Seventies, the US remained tied to the Bretton Woods system, with the greenback mounted to gold. However heavy spending on the Vietnam Warfare and Johnson’s Nice Society packages, mixed with a steadily eroding commerce benefit, left the nation’s exterior place severely weakened.

By 1971, confidence within the greenback was collapsing, gold reserves have been beneath relentless strain from international redemption calls for, and President Nixon confronted a stark alternative: defend the peg with painful austerity at house or shift the burden overseas.

He selected the latter.

In August of that yr, he suspended the greenback’s convertibility into gold and imposed a ten% surcharge on imports, forcing America’s buying and selling companions to permit their currencies to strengthen.

The yen, the Deutsche mark, and others revalued sharply in opposition to the greenback. What started as a single adjustment shortly developed into an enduring pattern: via the Seventies, these currencies continued to strengthen as fundamentals strengthened the shift, and the greenback entered a protracted period of weak spot.

The parallels at this time are exhausting to disregard. Nixon’s deficits, thought of giant on the time, have been modest in contrast with the dimensions of America’s present challenges. In the present day’s fiscal and commerce imbalances are multiples bigger in each absolute and relative phrases, whereas the debt burden has reached ranges unimaginable within the Seventies. On high of this, the worldwide monetary system is way extra interconnected, amplifying the chance of a disorderly adjustment.

Within the Seventies, the greenback absorbed the strain via a pointy preliminary devaluation adopted by years of gradual depreciation in opposition to foreign currency. With at this time’s disequilibrium far better, we consider the adjustment forward is prone to be much more extreme. In our view, the problem is not whether or not the greenback weakens, however how far and how briskly this might unfold.

Extra importantly:

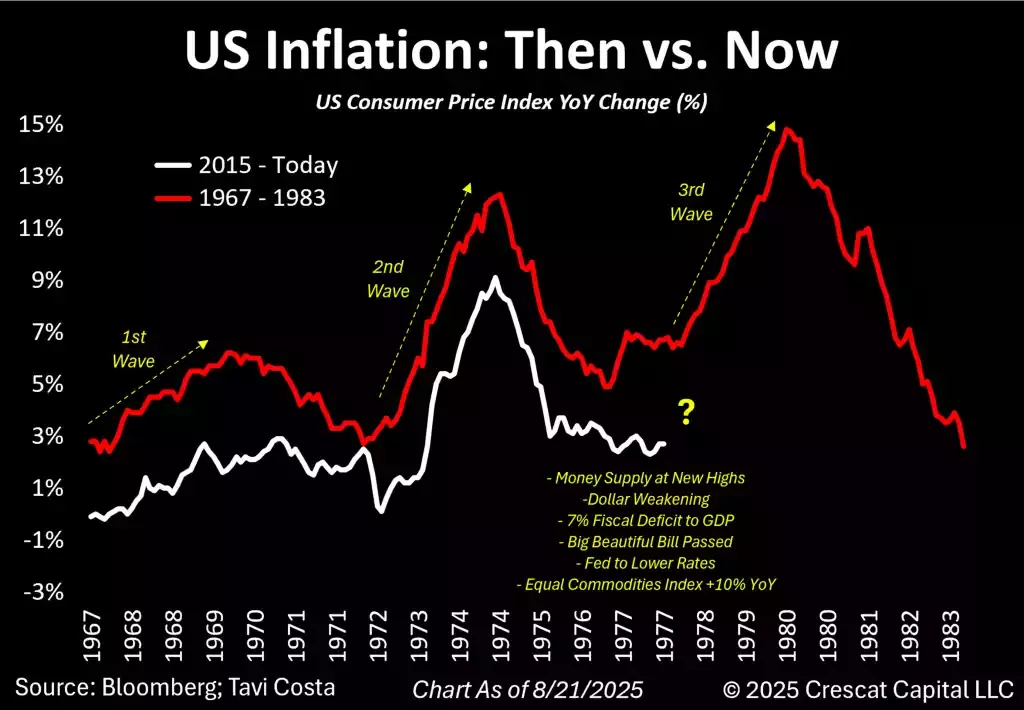

Pair what we see as a probable multi-year decline within the US greenback with a 7% fiscal deficit and an AI- and onshoring-driven building increase, and the end result is unavoidable in our view: inflation is prone to stay an entrenched and unresolved drawback.

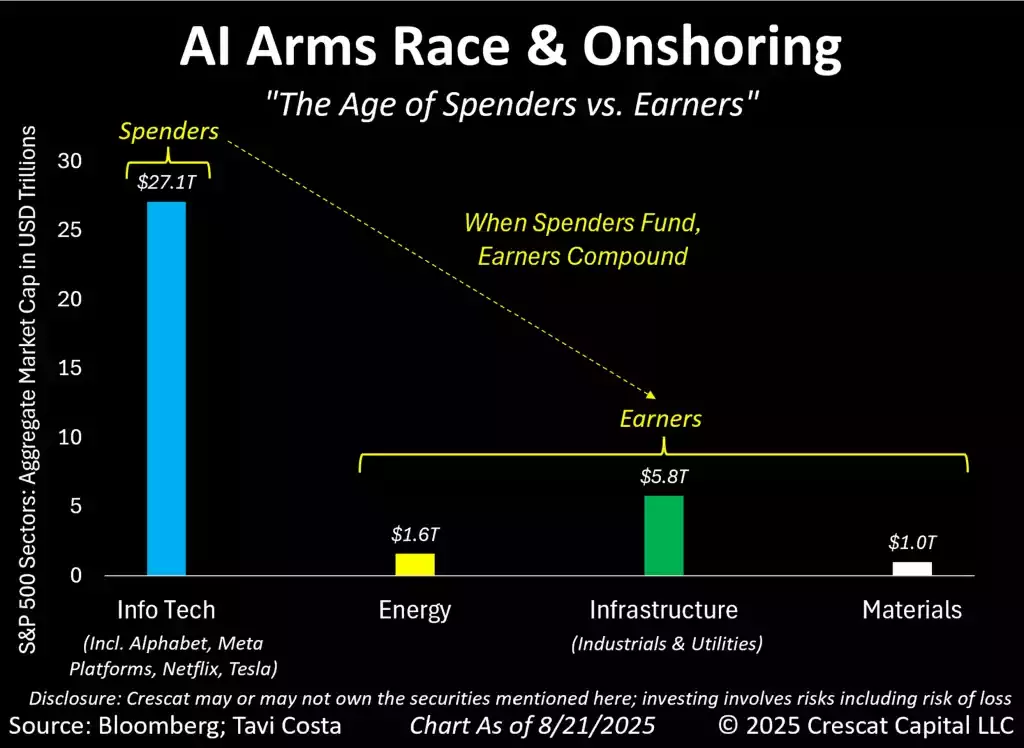

The Age of Spenders vs. Earners

The defining characteristic of the approaching market atmosphere might be a profound divide between spenders and earners. This isn’t a marginal pattern however a structural reordering of capital flows. On one aspect are the entities compelled to spend on a scale not often seen outdoors of wartime; on the opposite are the industries positioned to earn from that tidal wave of funding.

Synthetic intelligence has sparked a world technological arms race. In contrast to previous improvements resembling railroads or the web, the place adoption unfolded regularly, AI is driving governments and firms into an pressing competitors to safe infrastructure and capability first. Compounding this urgency is the parallel push towards onshoring — a reversal of globalization that calls for speedy home buildouts of factories, datacenters, and provide chains. Collectively, these forces level towards what may develop into one of the vital excessive building booms in fashionable financial historical past.

This isn’t a traditional funding cycle. It marks the onset of a brand new financial order, one pushed by necessity quite than alternative. In our view, the spenders will fund the transformation, and the earners will doubtless compound the returns.

The Spenders

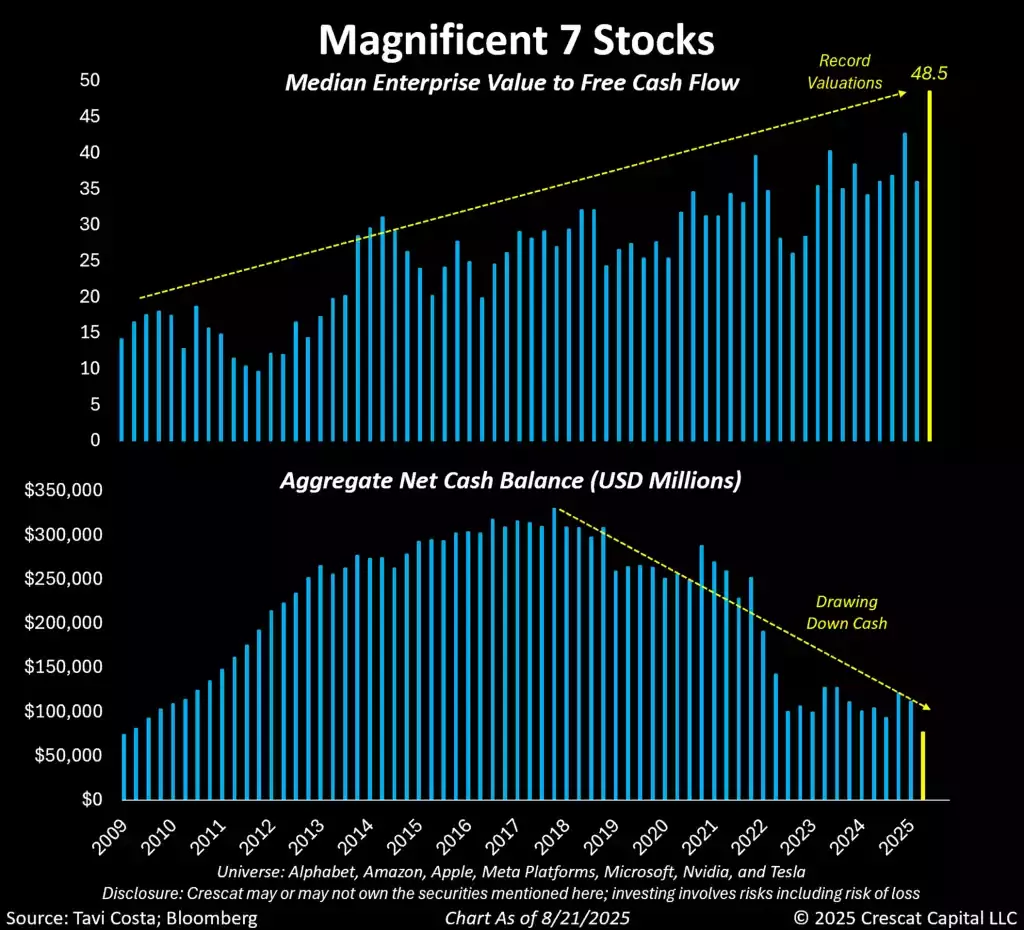

The federal government, weighed down by historic debt ranges, can not realistically bear this burden. As an alternative, the duty falls to mega-cap firms with fortress steadiness sheets. The “Magnificent Seven” exemplify this dynamic. Collectively, these corporations carry comparatively low debt balances and, after accounting for his or her money holdings, all collectively truly sit on constructive internet money of roughly $70 billion. With whole property exceeding $2.7 trillion, they possess extraordinary capability to boost and deploy capital.

It ought to come as no shock if, by the tip of this decade, these corporations have shifted dramatically from internet money positions to carrying substantial leverage. Over the previous 5–7 years, they’ve steadily drawn down money reserves, and the dimensions of spending forward will virtually actually push them to rely closely on debt financing.

The urgent query, nevertheless, is whether or not present valuations might be sustained as steadiness sheets deteriorate. The median Magnificent 7 inventory is already buying and selling close to 50 instances annual free money circulation — the very best a number of in historical past.

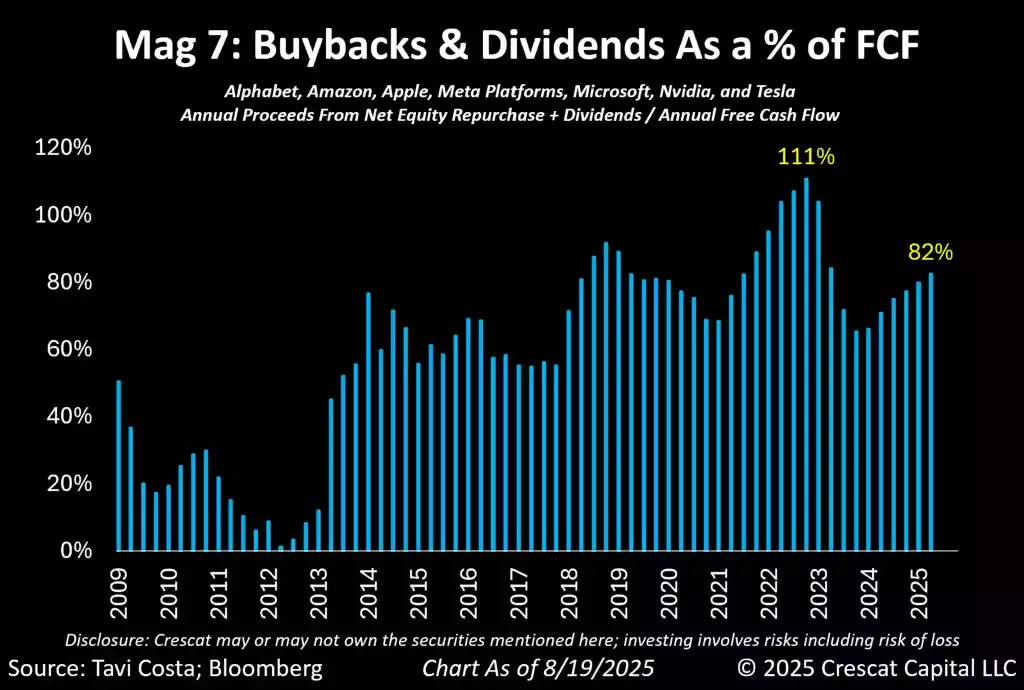

Dividends, Buybacks, and the Untapped Trillions

In the present day, almost 82% of the Magnificent 7’s free money circulation is funneled into dividends and buybacks. Redirecting even a fraction of that towards capital expenditure would unlock trillions in potential funding. On high of this, they’ve huge untapped capability to situation debt ought to policymakers demand it. Whether or not it’s Apple (AAPL) being compelled to onshore manufacturing or Tesla (TSLA)/SpaceX (SPACE)/xAI deploying huge sums into initiatives like Colossus, we consider these corporations could also be poised to develop into the defining spenders of this period.

The trade-off is obvious: shifting capital from shareholder-friendly insurance policies into transformative initiatives may compress multiples within the close to time period. However the actuality is plain — these corporations have many instruments at their disposal to finance this wave of funding. And in an AI-driven arms race, necessity will drive their hand. Spenders will spend.

The Earners

On the opposite aspect of this equation are the industries positioned to learn straight from this surge in capital expenditure. We see three classes of structural winners:

- Power – Securing considerable and dependable power is key to successful the AI race. Pure gasoline stands out as probably the most scalable and cost-effective near-term answer, although nuclear will doubtless develop in significance over the long run. Coal property, regardless of their age, are already experiencing a revival, whereas photo voltaic is rising as one other precedence for brand new funding, positioned to enrich the power combine and increase capability at scale.

- Infrastructure – Increasing power capability calls for huge infrastructure upgrades. Pipelines for gasoline, grids for energy distribution, reactors for nuclear power, photo voltaic panel deployment, and retrofitting coal vegetation will all require substantial funding. Datacenters and factories will speed up the necessity to modernize and increase electrical grids on a historic scale.

- Uncooked Supplies – The important constraint is provide. A long time of underinvestment in mining and supplies have left shortages throughout key commodities. But these inputs are indispensable for AI and onshoring alike. From copper, nickel, zinc, silver to iron ore, metal, and cement, uncooked supplies will doubtless be on the heart of this increase. Valuable and base metals are poised to learn not simply from cyclical demand, however from structurally improved business fundamentals.

We consider we’re getting into an period that might be outlined by huge spenders and indispensable earners. The biggest firms will doubtless be compelled to lever their steadiness sheets on a scale unseen outdoors wartime, financing the huge buildout of AI, onshoring, and infrastructure — whereas power, infrastructure, and useful resource producers emerge because the pure earners, their strengthened fundamentals drawing within the subsequent wave of capital.

As we take into account how these shifts might unfold, it’s important to account for the function of policymakers — significantly the Federal Reserve and the Trump administration — over the approaching months, given the heightened stress and coverage divergence between the 2.

Classes from LBJ to Trump: The Fed, the President, and the Battle Over Inflation

We regularly deal with at this time’s occasions as in the event that they have been with out precedent, however the conflict between Fed Chair Jerome Powell and President Donald Trump is hardly distinctive. Historical past presents loads of echoes, and one episode particularly offers a hanging roadmap for what may lie forward.

In December 1965, the US witnessed one of the vital dramatic confrontations within the historical past of central banking. President Lyndon B. Johnson, recent off a landslide victory and decided to push via his “Nice Society” packages whereas escalating the conflict in Vietnam, was driving a surge in federal spending. The environment was charged: development was brisk, however inflationary pressures have been beginning to present.

On the heart of all of it was William McChesney Martin Jr., the long-serving chairman of the Federal Reserve. Martin, first appointed by Truman after which reappointed by each events, was revered for his independence. He believed the financial system was “overheating” due to a mixture of conflict spending, social outlays, and a 1964 tax lower. In early December, the Fed narrowly voted to boost the low cost price for the primary time in 5 years, from 4% to 4.5%.

President Johnson noticed this as a direct menace. Nonetheless recovering from gallbladder surgical procedure, he summoned Martin to his Texas ranch. In a gathering that has since develop into legendary, Johnson berated and even bodily shoved the Fed chair round his lounge, accusing him of betrayal:

“You’ve bought me able the place you’ll be able to run a rapier into me, and also you’ve achieved it. My boys are dying in Vietnam, and also you received’t print the cash I want!”

Johnson, used to bending opponents to his will, demanded loyalty. Martin, shaken however agency, stood his floor. “The Federal Reserve Act positioned duty for rates of interest with the Board,” he replied. “On this, the choice must be last.” Johnson backed down. The speed hike stood, and with it a important precedent for Fed independence.

The fiscal backdrop can also be value recalling. In 1965 and 1966, the federal deficit was tiny by at this time’s requirements — simply 0.2% of GDP in 1965. However that restraint didn’t final. Warfare prices and welfare packages quickly swelled the deficit, and inflation adopted.

The longer value pressures have been allowed to linger, the extra deeply they embedded within the financial system. By the Seventies, inflation had spiraled uncontrolled, fueled partly by political strain to prioritize development over stability. But even that deterioration pales compared to at this time’s fiscal panorama, with deficits working near 7% of GDP earlier than a recession has even set in.

That episode underscores the hazard of short-term politics overwhelming long-term financial self-discipline. And the parallels to at this time are exhausting to disregard. Inflation has been re-accelerating, whereas Trump overtly presses Powell to chop charges to be able to relieve the burden of mounting federal debt.

Now, from a market standpoint, the greenback seems to be standing on a decade-long line within the sand.

It’s value noting that the DXY index continues to be hovering simply above a decade-long help line. A decisive break beneath that threshold may set off the broader dynamics we’ve outlined. Notably, each the euro and the British pound have already damaged via comparable long-term pattern ranges, suggesting they might be main indicators of what lies forward for the index as a complete.

What’s attention-grabbing is that many macro-sensitive property — rising markets, smaller useful resource corporations, and others — appear to be ready for this potential breakdown to unlock upside momentum.

A confirmed breakdown within the greenback may catalyze a wave of macro tendencies which were constructing quietly within the background. Onerous property have proven notable resilience via this section, and I believe that energy is structural — not non permanent.

We could also be getting into a pivotal second. Thrilling instances forward, in our view.

The Unavoidable Commerce-Off: Fiscal Dominance vs. Inflation Management

This time, one may argue that either side have a case. Powell is correct to fret about inflation, whereas Trump has cause to hunt reduction from hovering curiosity prices.

Nonetheless, the truth is that fiscal dominance is turning into unavoidable. The US is approaching some extent the place price suppression would be the solely choice, even when it means tolerating larger inflation.

Even with out curiosity funds, the US continues to be working a deficit of round 4% of GDP — a unprecedented imbalance. Chopping charges might purchase time, however except spending is reined in, the fiscal math solely will get worse. Necessary outlays are troublesome to scale back with out radical reform, so the adjustment is prone to come on the expense of growth-oriented initiatives.

From Powell’s perspective, the image is equally difficult. The Taylor Rule, which presents a information for setting rates of interest primarily based on inflation and output, means that charges needs to be roughly 150 foundation factors larger than the place they stand at this time.

But Treasury Secretary Scott Bessent just lately argued that charges needs to be 150 foundation factors decrease than they’re — a spot of 300 foundation factors from the Taylor Rule.

Trump, for his half, desires charges at 1%. If that occurred, it could possibly be nirvana for hard-asset buyers, however it will additionally all however assure that inflation continues to pulse via the system.

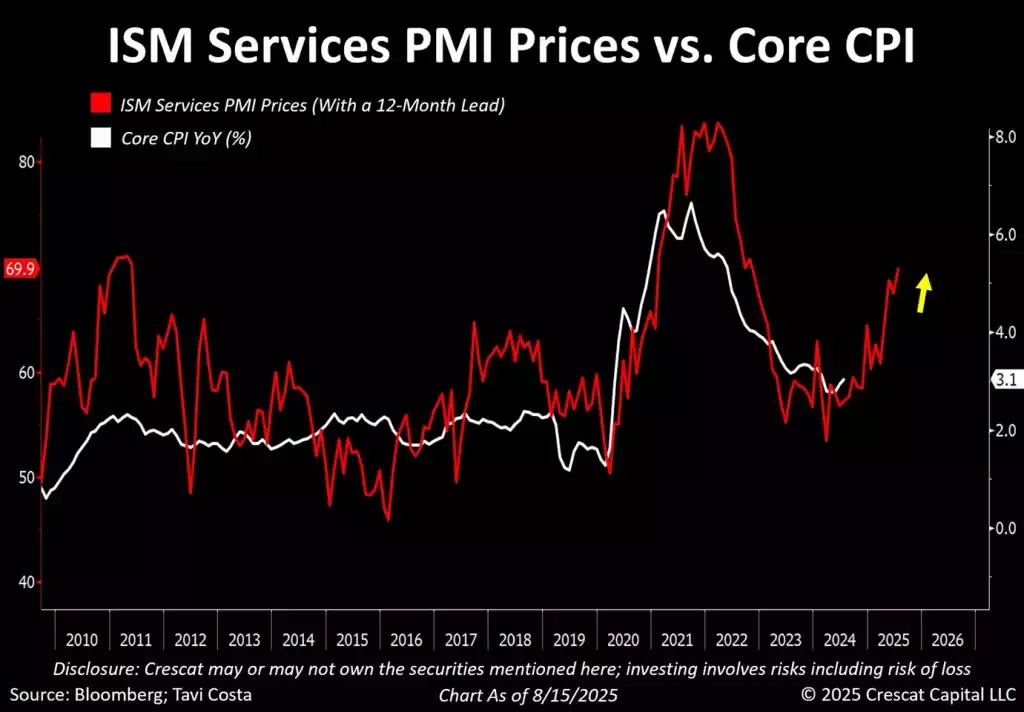

The latest narrative has been dominated by the re-emergence of inflationary pressures. The central query at current is whether or not the newest information represents a transitory outlier or the early indication of a sustained resurgence in client costs.

As an example this, take into account the connection between the ISM Providers PMI Costs index and Core CPI. Traditionally, actions within the former are likely to precede shifts within the latter by roughly 12 months. If this historic relationship persists, it means that inflation is on the verge of re-acceleration.

The Unfinished Battle In opposition to Inflation

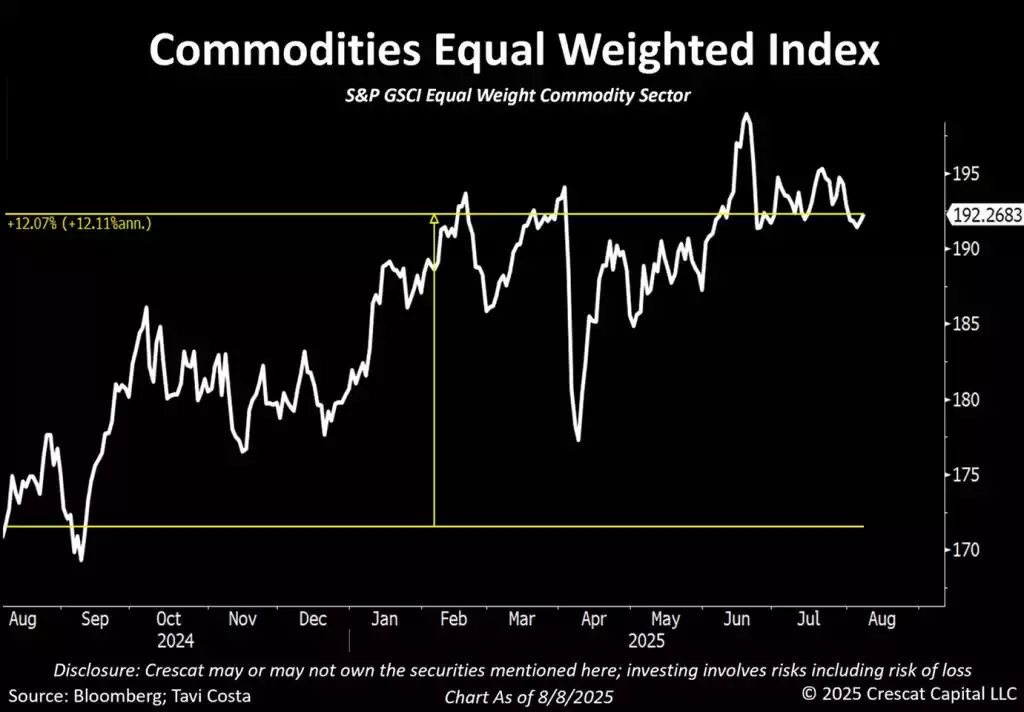

It’s noteworthy that some observers contend inflationary pressures are abating. Nonetheless, the equal-weighted commodities index has risen roughly 12% over the previous yr, reflecting tangible value pressures in the actual financial system.

The Financial Engine Behind Inflation

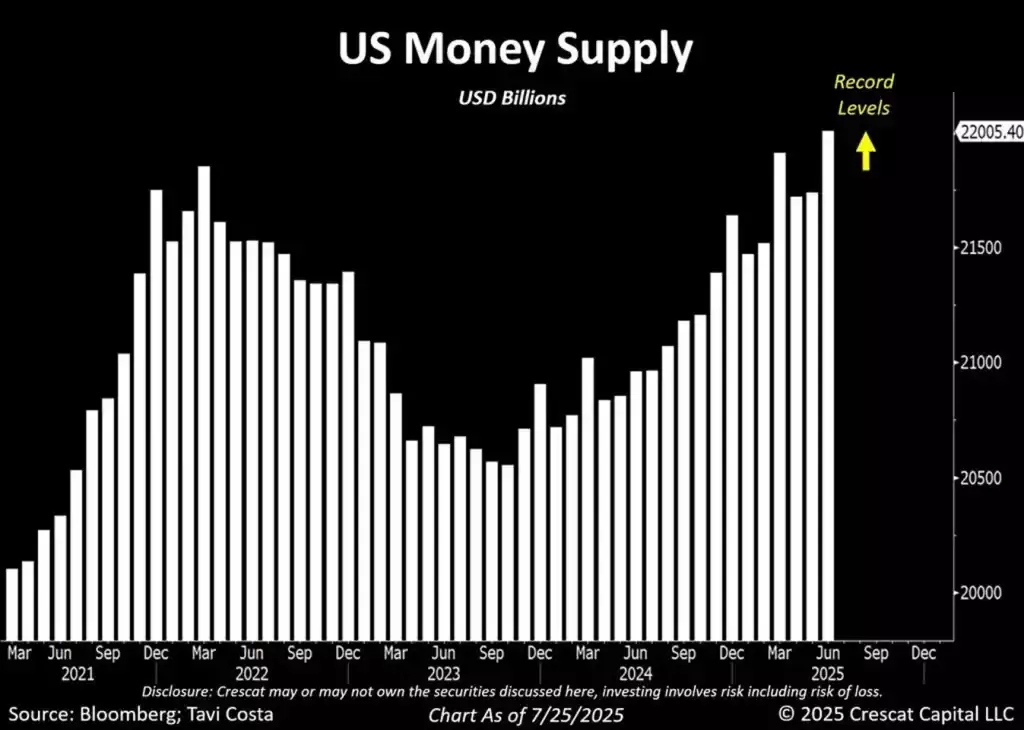

Moreover, cash provide has just lately reached file ranges. You will need to recall that inflation is, at its core, a financial phenomenon. Sustained credit score growth mixed with persistent fiscal deficits — presently round 7% of GDP yearly — makes it extremely inconceivable that inflationary pressures might be resolved beneath such situations.

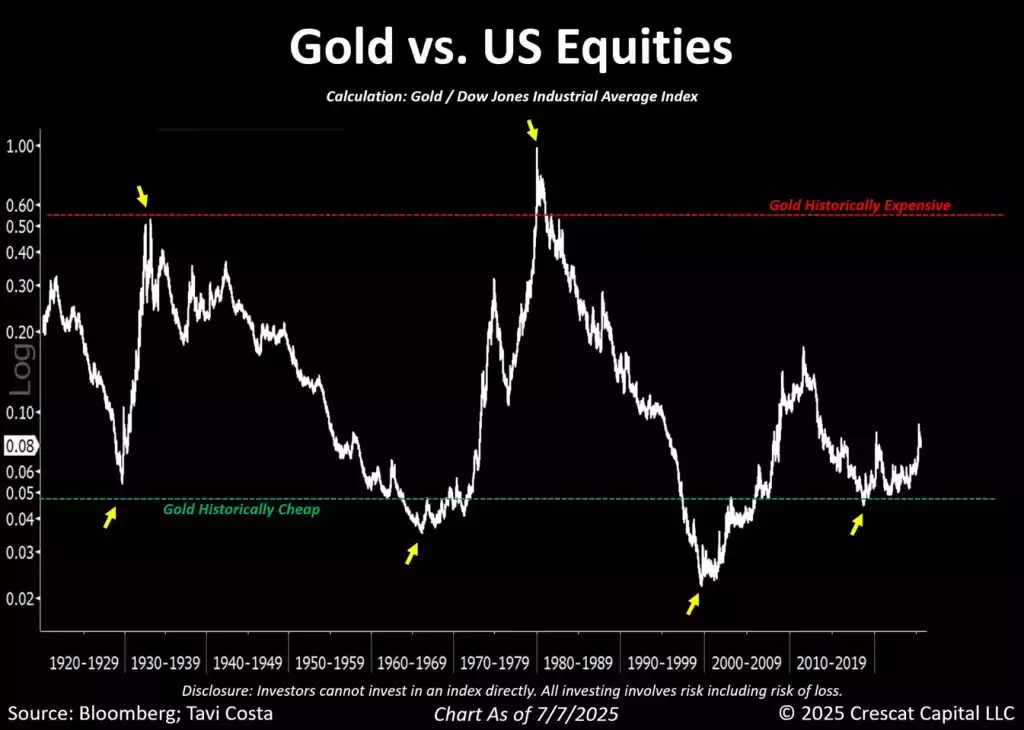

Capitalizing on Fiscal Dominance: Gold, Metals, and Miners

With inflation re-accelerating and financial dominance showing to be more and more unavoidable, the case for gold, different metals, and mining corporations comes sharply into focus. In our view, these property signify one of many clearest methods to capitalize on the profound imbalances within the international financial system and the war-like arms race now unfolding in infrastructure funding pushed by AI and onshoring.

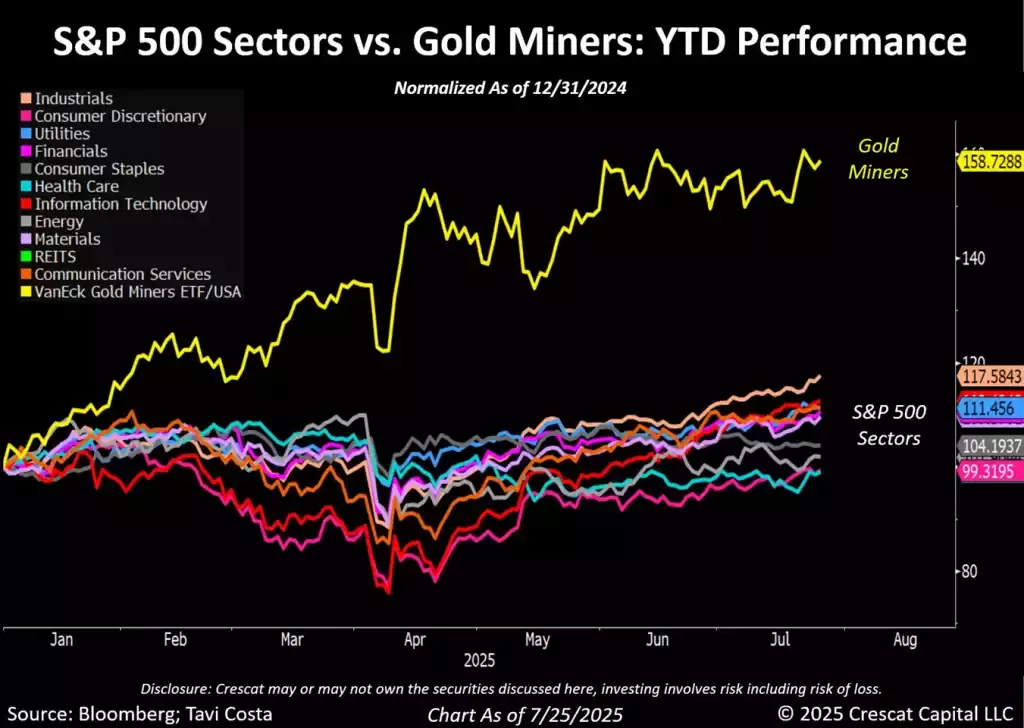

After two years of sturdy positive aspects in gold costs, buyers are starting to maneuver additional up the chance curve, allocating capital to mining corporations and different metals. Notably, gold miners are outperforming each sector of the S&P 500 (SP500), (SPX) this yr — a pattern that, in our view, is probably going nonetheless in its early levels.

From Gold to Explorers: Indicators of a True Bull Market

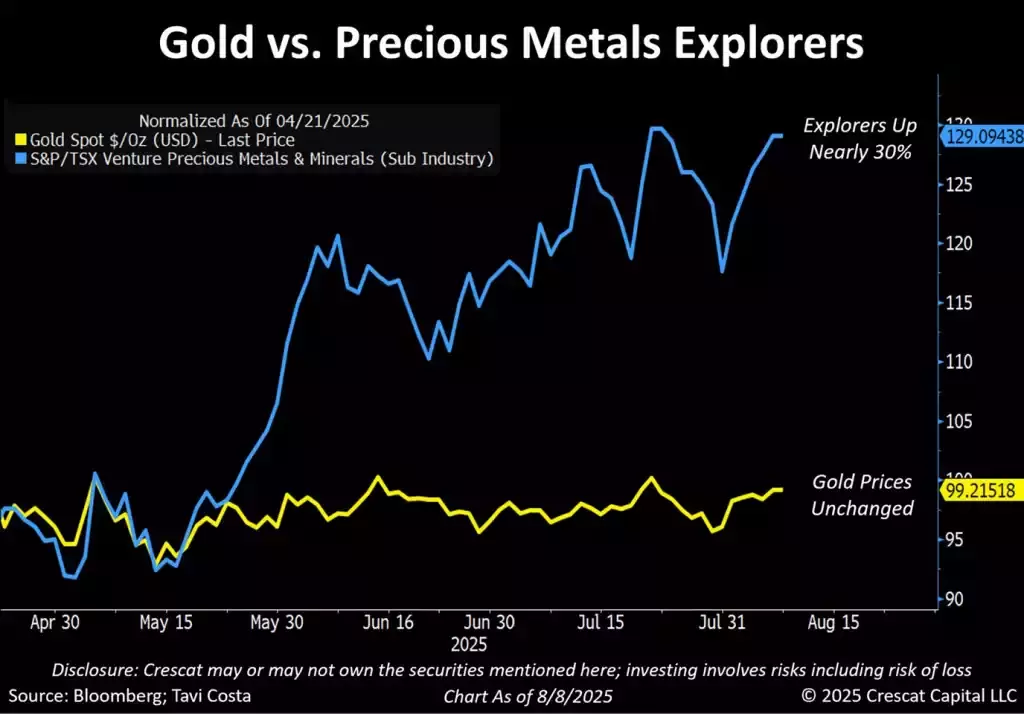

Bull markets are sometimes characterised by buyers transferring progressively up the chance curve as confidence of their thesis grows. On this context, notice that whereas gold costs have been flat since April 2021, valuable metals exploration shares are up 30%.

A real bull market doesn’t take form till explorers begin attracting capital, in our view. These corporations often enlarge the cycle — bearing the brunt of downturns but additionally delivering the strongest positive aspects within the upswings.

In our view, we are actually doubtless simply getting into a long-term bull section for mining shares.

Canada’s Function in Mining Finance

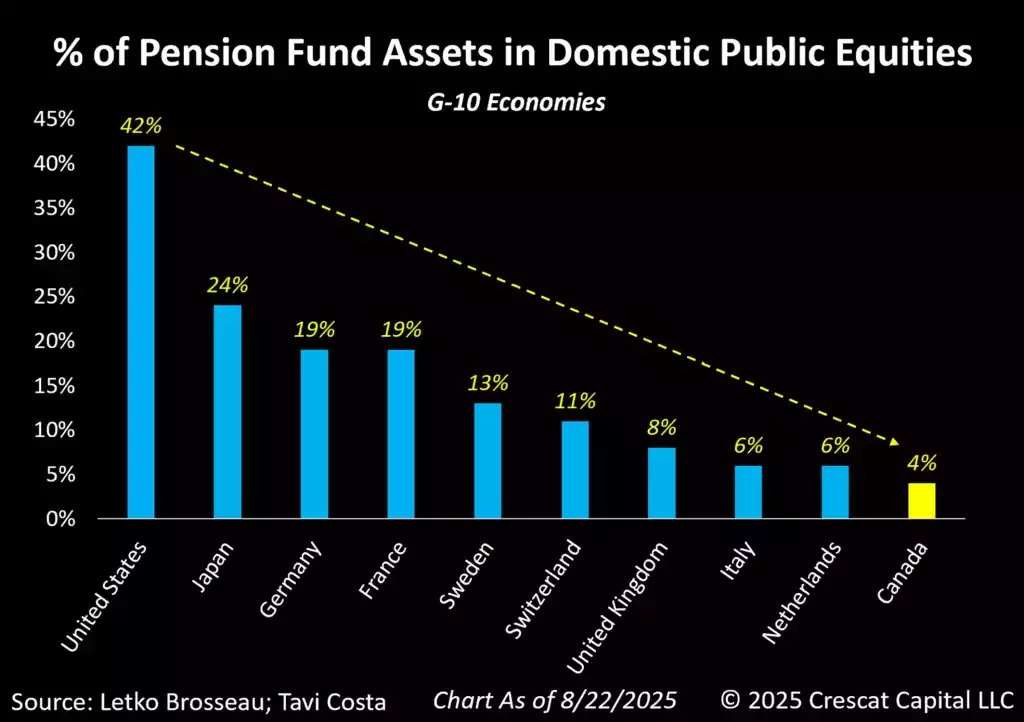

In a latest Gold Telegraph podcast interview, mining billionaire Pierre Lassonde highlighted a hanging statistic about Canada: its pension funds, now roughly the scale of the nation’s whole financial system, allocate solely a negligible share of capital domestically. This power underinvestment, he instructed, helps clarify why Canada’s mining business has confronted persistent difficulties accessing capital.

For many years, Canadian exchanges have been the popular vacation spot for mining corporations worldwide, no matter whether or not they function Canadian initiatives. The nation’s regulatory framework — most notably Nationwide Instrument 43-101 (NI 43-101) — enforces rigorous disclosure and reporting requirements that foster investor belief and credibility.

This, mixed with deep swimming pools of mining-focused capital, versatile itemizing necessities tailor-made to early-stage and worldwide miners, in depth sector experience, and strong liquidity, positioned Canada as the worldwide hub for mining finance.

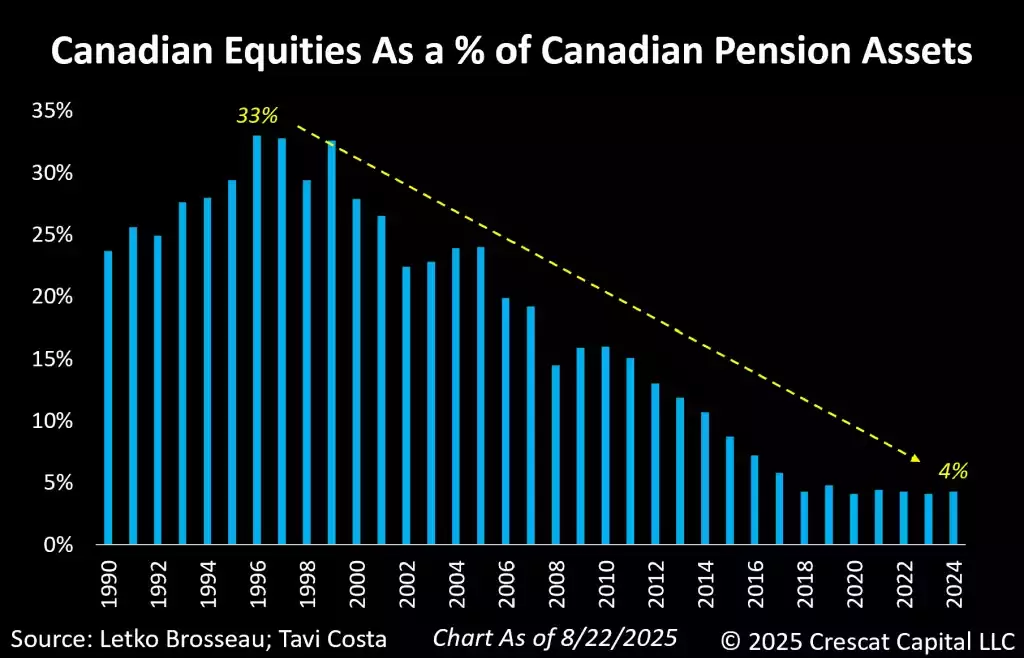

Nonetheless, what was as soon as a structural benefit has develop into a structural headwind.

Canadian pension funds, whose property now signify almost 85% of GDP, have steadily redirected capital overseas. In the present day, solely about 4% of their property stay invested in home public markets — the bottom share amongst all G-10 economies.

The implications for mining are profound. Canada is house to roughly 40% of the world’s publicly listed valuable metals corporations, but the sector is starved for liquidity exactly as a result of the biggest swimming pools of home institutional capital not take part meaningfully of their markets.

The Finish of an Period, The Begin of One other

Extra importantly, because the chart beneath reveals, home equities beforehand accounted for greater than one-third of Canadian pension fund allocations.

Whereas this withdrawal has severely constrained entry to funding, the present state of under-allocation may mark a turning level.

Right here, we align with the angle of macro strategist Russell Napier, who argues that the worldwide financial system is getting into a brand new period outlined by de-globalization and rising state affect. On this atmosphere, Western governments — not simply the US, but additionally Canada and Europe — are pursuing insurance policies to onshore important industries and reinforce home manufacturing capability.

This shift, pushed by geopolitical tensions, fragile provide chains, and specific coverage incentives, is encouraging institutional buyers to reallocate capital towards their home priorities. If such tendencies proceed, Canada’s mining business might as soon as once more profit from renewed entry to native pension fund capital — however this time inside a framework the place state-directed methods, quite than free-market dynamics, set the tone for funding flows.

Valuable Metals: Readability, But Nonetheless Early Days

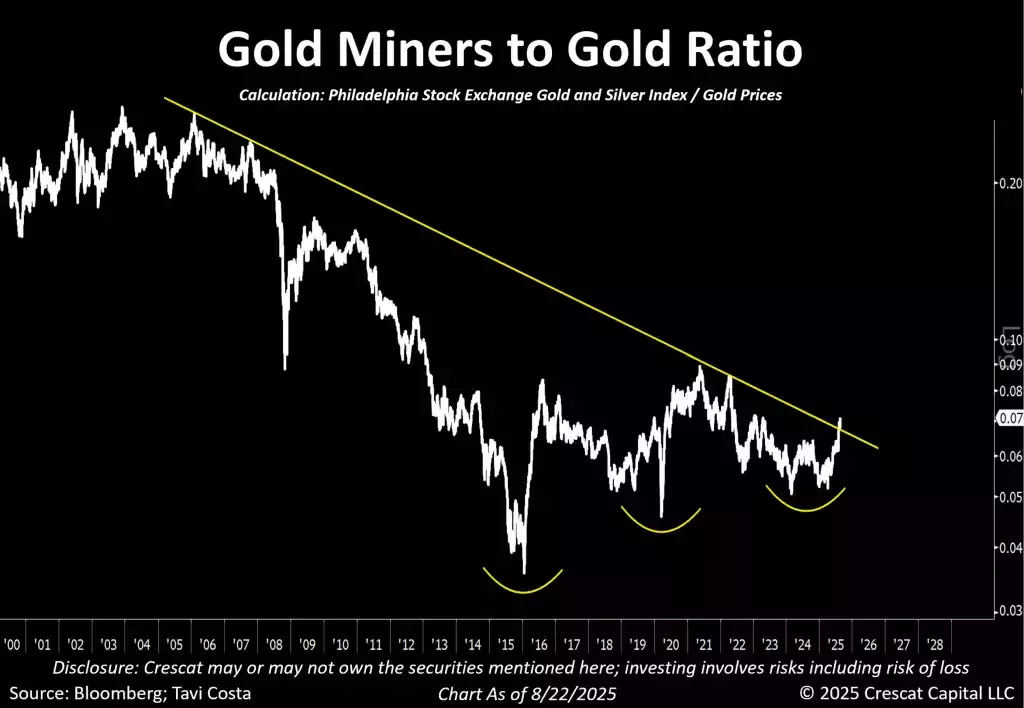

Apparently, whereas the dear metals bull market has began to point out some readability, in some ways it has barely begun. One clear indication is the relative efficiency of miners versus gold costs. Mining shares have solely simply damaged out of a significant downward pattern that stretches again to 2006.

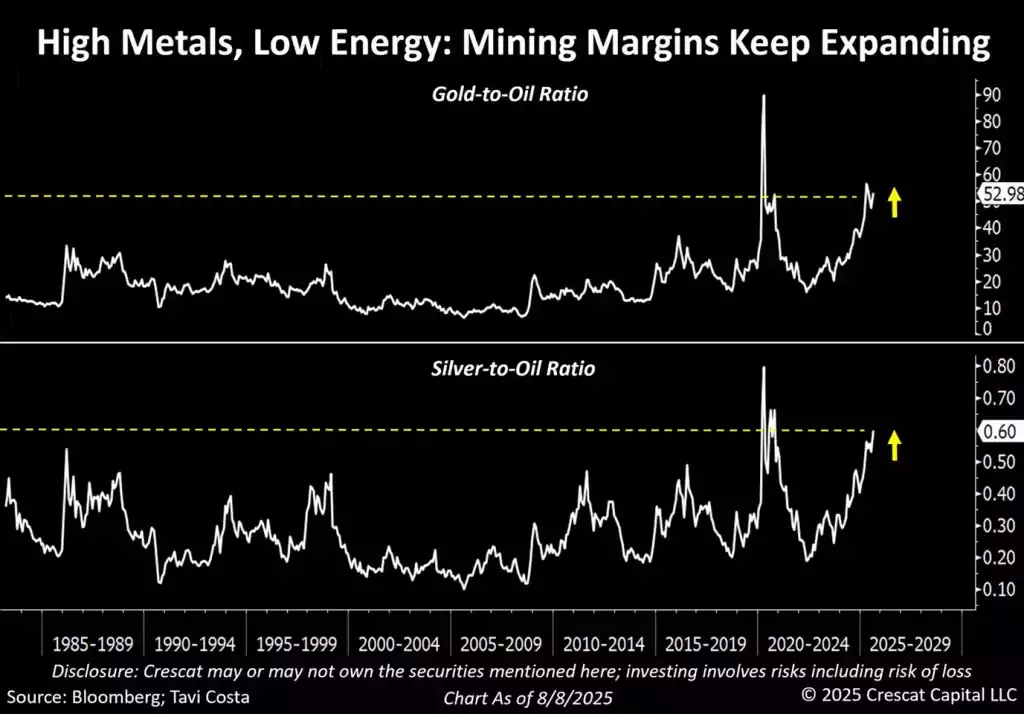

Mining Margins in a New Period

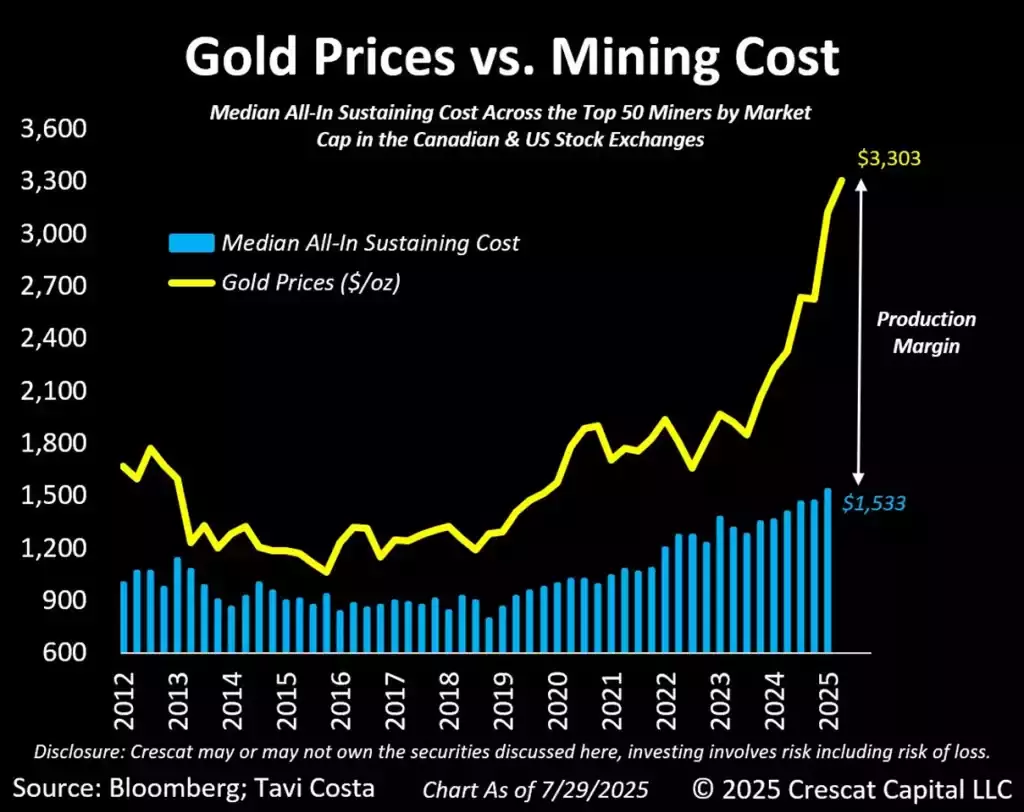

So long as metals stay elevated relative to power costs, mining margins will proceed to flourish. Buyers are solely starting to take discover, with corporations persistently reporting outcomes that exceed analyst expectations. In our view, we might have entered a real “Golden Age of Mining.”

To increase on the purpose above, we consider many mining shares proceed to commerce as if gold have been priced beneath $2,000/oz. In actuality, most miners are presently producing gold with all-in sustaining prices at roughly half at this time’s gold value. In our view, these new excessive margins ought to quickly be driving a considerable upward re-rating of valuations.

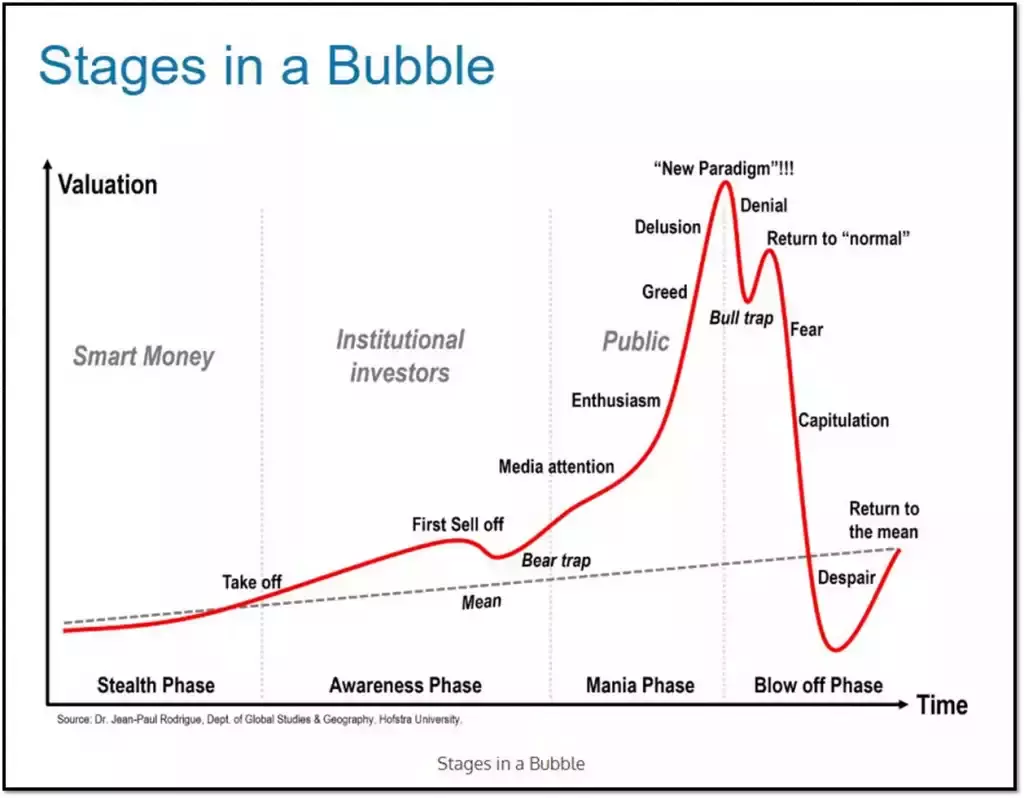

Taking Off

The chart beneath is, in fact, only a conceptual illustration — however we could also be approaching the early levels of the “take-off” section, in our view. Institutional curiosity is beginning to construct, whilst media protection stays nearly nonexistent.

Consolidation Earlier than the Subsequent Leg Increased

From a historic perspective, secular bull markets in metals are not often linear; they have a tendency to advance in waves, with durations of consolidation serving to reset sentiment and strengthen the muse for the subsequent leg larger. By a number of measures, metals nonetheless stay deeply undervalued relative to broader asset lessons, significantly when put next in opposition to monetary property which have benefited disproportionately from years of financial and financial extra. In our view, this hole underscores each the longevity of the chance and the chance that we’re nonetheless within the early innings of a a lot bigger cycle.

The latest value motion in gold, quite than signaling weak spot, needs to be interpreted as a wholesome consolidation section — the sort of pause that usually precedes one other main upward transfer.

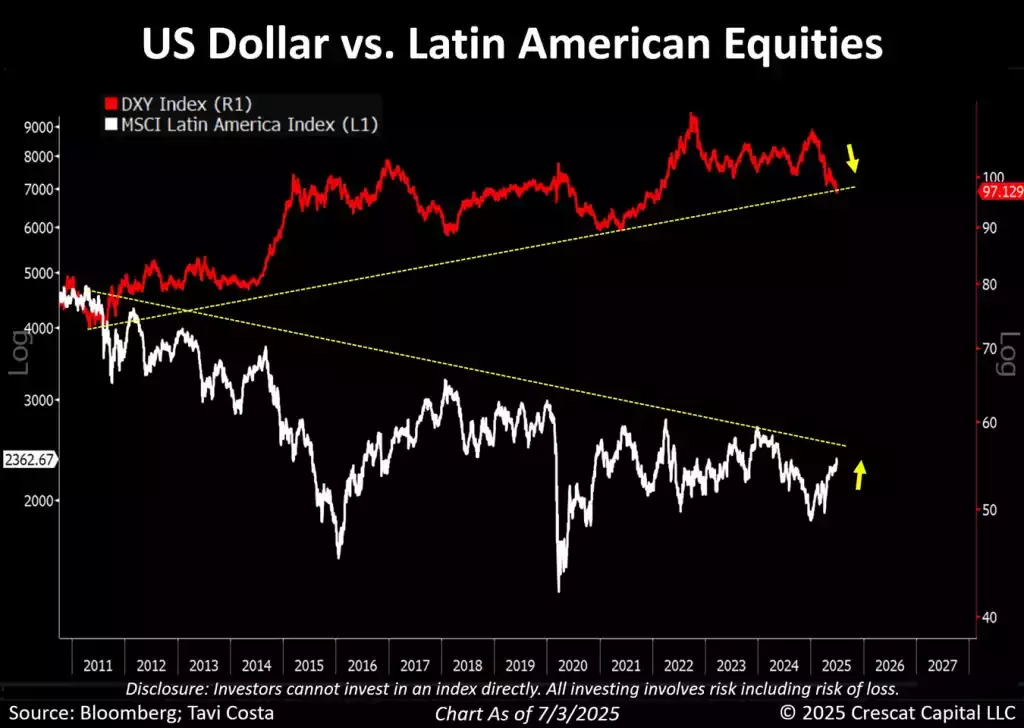

US Greenback vs. Latin American Equities

What we’re seeing at this time seems like a traditional macro “alligator mouth” — a widening hole that, in our view, received’t keep open for lengthy. As international buyers start rotating out of US greenback–primarily based property, that mouth is prone to shut.

One of many largest alternatives right here, in our opinion, lies in rising market equities. They continue to be one of the vital essentially undervalued areas of the market and have traditionally thrived throughout extended durations of US greenback weak spot.

Our case is simple: US yields are prone to stay capped, whereas the greenback faces devaluation. That mixture eases monetary pressures worldwide — particularly for economies burdened with dollar-denominated debt — and redirects capital towards cheaper, higher-growth alternatives overseas.

We consider that the shift is already starting. With US property stretched, deficits widening, and structural strain constructing on the greenback, we could also be getting into a multi-year cycle the place rising markets lead international fairness efficiency.

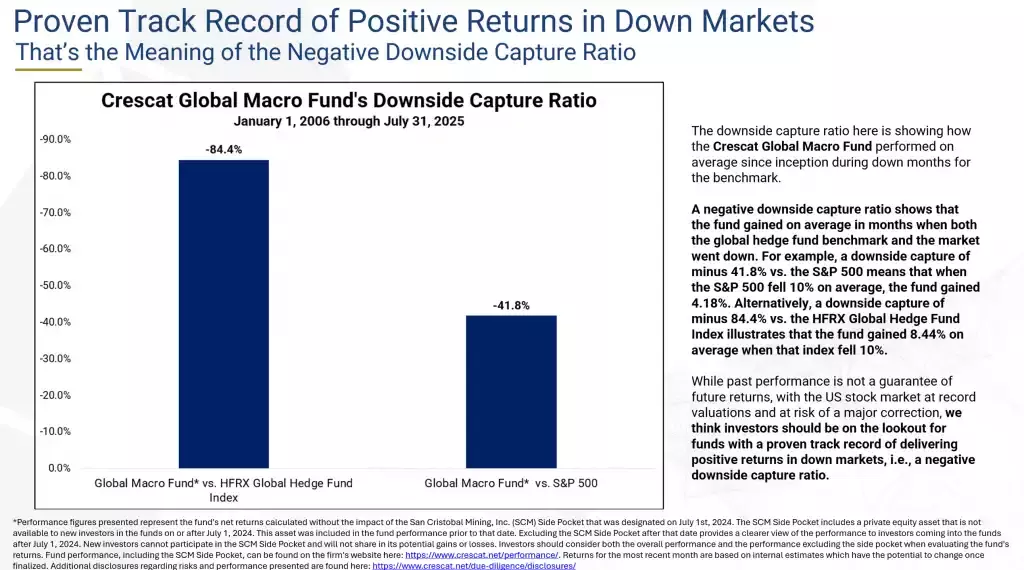

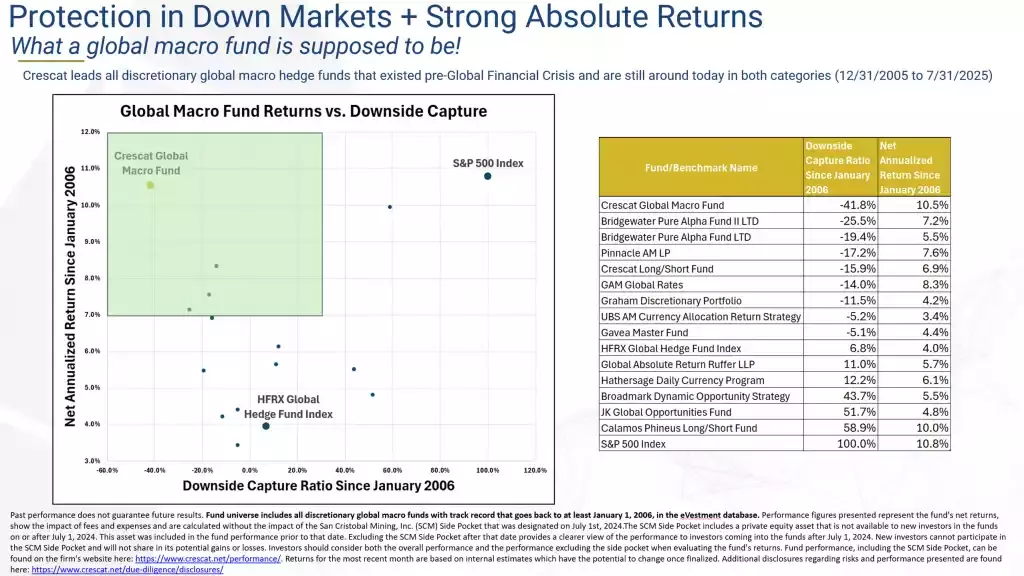

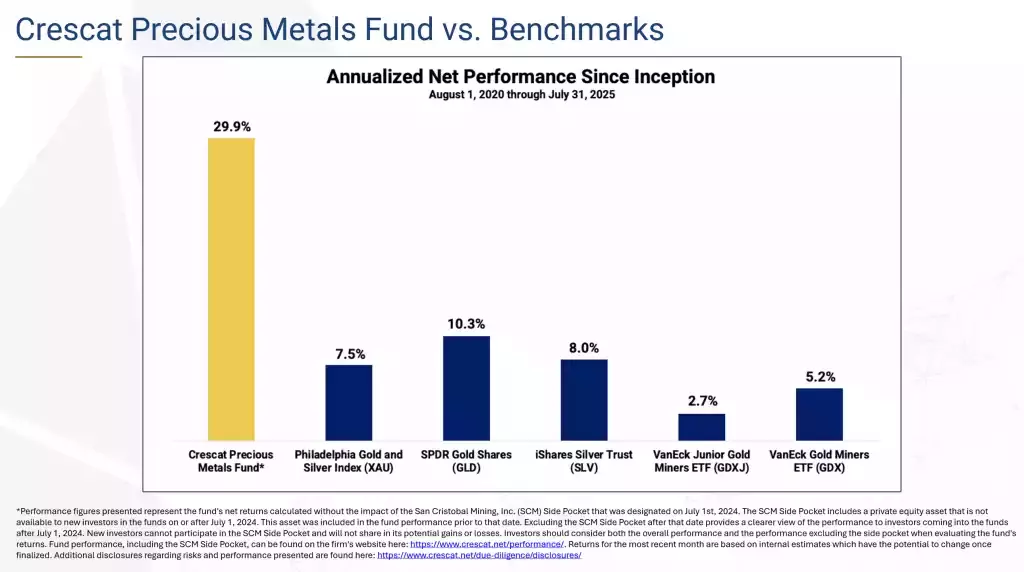

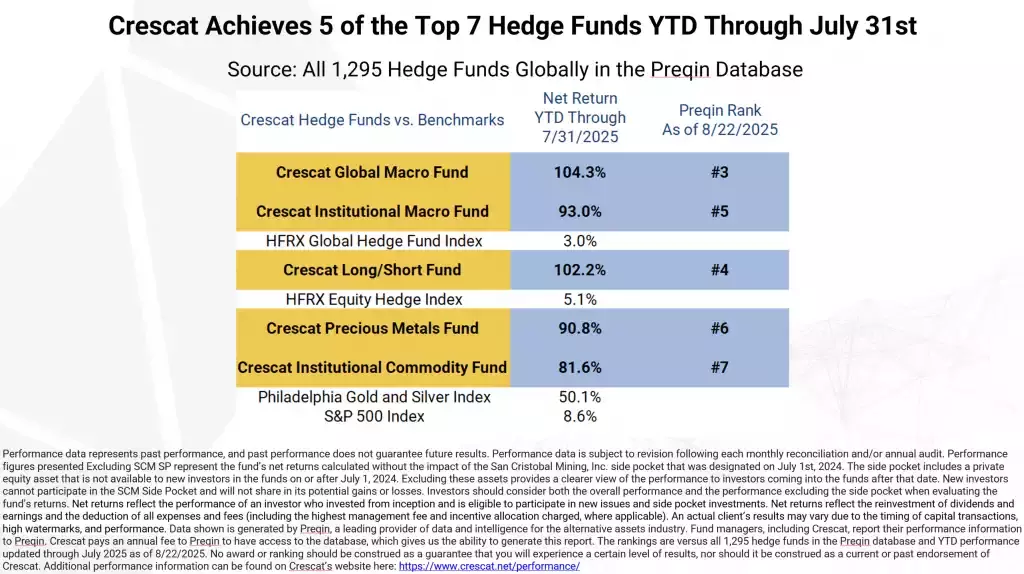

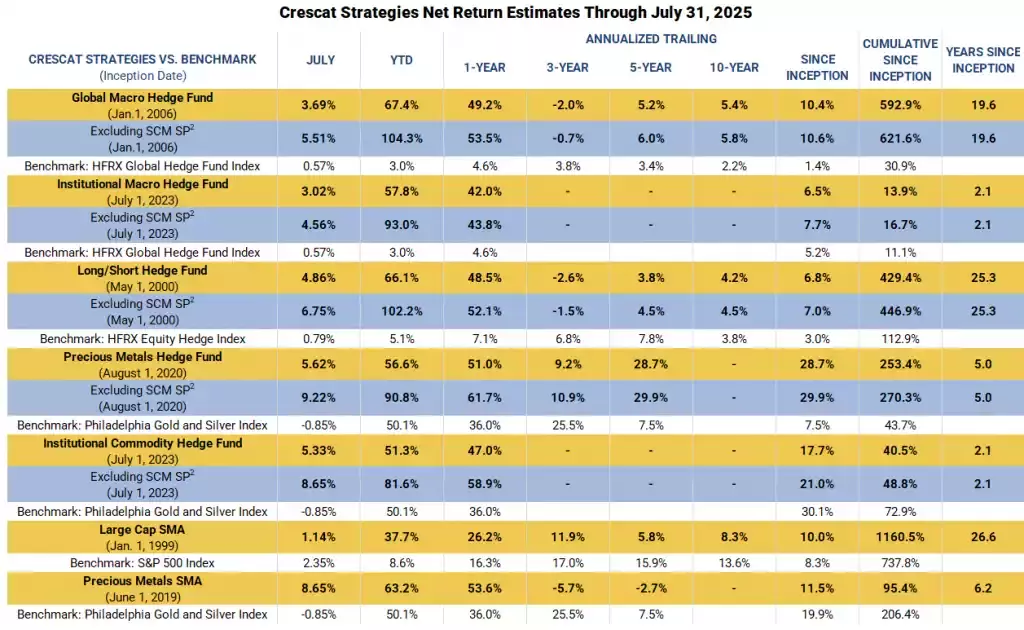

Crescat Fund Efficiency Charts via 7/31/2025

All Crescat Funds and SMA Composites vs. Benchmarks Efficiency

| Efficiency information represents previous efficiency, and previous efficiency doesn’t assure future outcomes. Efficiency information is topic to revision following every month-to-month reconciliation and/or annual audit. Efficiency figures introduced Excluding SCM SP signify the fund’s internet returns calculated with out the impression of the San Cristobal Mining (OTC:SCMIF), Inc. aspect pocket that was designated on July 1st, 2024. The aspect pocket features a personal fairness asset that’s not accessible to new buyers within the funds on or after July 1, 2024. Excluding these property offers a clearer view of the efficiency to buyers coming into the funds after that date. New buyers can not take part within the SCM Aspect Pocket and won’t share in its potential positive aspects or losses. Buyers ought to take into account each the general efficiency and the efficiency excluding the aspect pocket when evaluating the fund’s returns. Internet returns mirror the efficiency of an investor who invested from inception and is eligible to take part in new points and aspect pocket investments. Internet returns mirror the reinvestment of dividends and earnings and the deduction of all bills and costs (together with the very best administration payment and incentive allocation charged, the place relevant). An precise consumer’s outcomes might fluctuate as a result of timing of capital transactions, excessive watermarks, and efficiency. Efficiency figures for the SMA composites have been restated and will differ from efficiency beforehand introduced in Crescat supplies for these methods. Please see vital disclosures concerning this desk beneath. |

We’re excited concerning the alternatives within the markets forward and encourage you to succeed in out to any of us listed beneath if you need to study extra about how our funding autos may match together with your particular person wants and goals.

Sincerely,

Kevin C. Smith, CFA, Founding Member & Chief Funding Officer

Tavi Costa, Member & Macro Strategist

Quinton T. Hennigh, PhD, Member & Geologic and Technical Advisor

|

For extra data, together with methods to make investments, please contact: Marek Iwahashi Head of Investor Relations miwahashi@crescat.internet (720) 323-2995 Linda Carleu Smith, CPA Co-Founding Member & Chief Working Officer lsmith@crescat.internet (303) 228-7371 © 2025 Crescat Capital LLC Necessary Disclosures Dialogue and particulars offered are for informational functions solely. This letter shouldn’t be meant to be, nor ought to or not it’s construed as, a proposal to promote or a solicitation of a proposal to purchase any safety, providers of Crescat, or its Funds. The data offered on this letter shouldn’t be meant as funding recommendation or advice to purchase or promote any kind of funding, or as an opinion on, or a suggestion of, the deserves of any specific funding technique. This letter might comprise sure forward-looking statements, opinions and projections which are primarily based on the assumptions and judgments of Crescat with respect to, amongst different issues, future financial, aggressive and market situations and future enterprise choices, all of that are troublesome or not possible to foretell precisely and lots of of that are past the management of Crescat. Due to the numerous uncertainties inherent in these assumptions and judgments, you shouldn’t place undue reliance on these ahead wanting statements, nor must you regard the inclusion of those statements as a illustration by Crescat that these goals might be achieved. CPM has not sought or obtained consent from any third get together to make use of any statements or data indicated herein which were obtained or derived from statements made or revealed by such third events. All content material posted on CPM’s letters together with graphics, logos, articles, and different supplies, is the property of CPM or others and is protected by copyright and different legal guidelines. Efficiency Efficiency information represents previous efficiency, and previous efficiency doesn’t assure future outcomes. Efficiency information, together with Estimated Efficiency, is topic to revision following every month-to-month reconciliation and/or annual audit. Particular person efficiency could also be decrease or larger than the efficiency information introduced. The forex used to precise efficiency is U.S. {dollars}. Earlier than January 1, 2003, the outcomes mirror accounts managed at a predecessor agency. Crescat was not accountable for the administration of the property in the course of the interval mirrored in these predecessor efficiency outcomes. We’ve got decided the administration of those accounts was sufficiently related and offers related efficiency data. 1 – Internet returns mirror the efficiency of an investor who invested from inception and is eligible to take part in new points and aspect pocket investments. Internet returns mirror the reinvestment of dividends and earnings and the deduction of all bills and costs (together with the very best administration payment and incentive allocation charged, the place relevant). An precise consumer’s outcomes might fluctuate as a result of timing of capital transactions, excessive watermarks, and efficiency. 2 – Efficiency figures introduced, excluding SCM SP, signify the fund’s internet returns calculated with out the impression of the San Cristobal Mining, Inc. aspect pocket that was designated on July 1st, 2024. The aspect pocket features a personal fairness asset that’s not accessible to new buyers within the funds on or after July 1, 2024. Excluding these property offers a clearer view of the efficiency to buyers coming into the funds after that date. New buyers can not take part within the SCM Aspect Pocket and won’t share in its potential positive aspects or losses. Buyers ought to take into account each the general efficiency and the efficiency excluding the aspect pocket when evaluating the fund’s returns. 3 – The SMA composites embody all accounts which are managed based on CPM’s valuable metals or giant cap SMA technique over which it has full discretion. Funding outcomes proven are for taxable and tax-exempt accounts. Any attainable tax liabilities incurred by the taxable accounts aren’t mirrored in internet efficiency. Efficiency outcomes are time weighted and mirror the deduction of advisory charges, brokerage commissions, and different bills {that a} consumer would have paid, and contains the reinvestment of dividends and different earnings. 4 – Knowledge proven is generated by Preqin, a number one supplier of information and intelligence for the choice property business. Fund managers, together with Crescat, report their efficiency data to Preqin. Crescat pays an annual payment to Preqin to have entry to the database, which supplies us the power to generate this report. The rankings are versus all 873 hedge funds within the Preqin database with a minimal 3-year observe file and YTD efficiency up to date via March 2025 as of 4/25/2025. No award or rating needs to be construed as a assure that you’ll expertise a sure stage of outcomes, nor ought to or not it’s construed as a present or previous endorsement of Crescat. 5 – The activist metals portfolio subset consists of firmwide holdings throughout all Crescat funds and SMA accounts within the mining business the place Crescat strives to assist corporations construct financial steel sources via exploration and drilling. Crescat offers capital and geologic steerage to assist corporations construct sources throughout Crescat’s activist portfolio. Crescat goal useful resource estimates are primarily based on inner modeling carried out by Crescat’s Geologic and Technical Director, Quinton T. Hennigh, PhD and embody numerous assumptions primarily based on his evaluation of geology, geophysics, geochemistry, historic drill assays, and metallurgical restoration information obtained to this point. Goal useful resource estimates are discounted primarily based on drilling progress to this point, an evaluation of the administration and technical group’s strengths and weaknesses affecting their skill to advance the mission, and environmental, local people, and authorities allowing threat components. Estimates are displayed on a gold equal foundation primarily based on present price-to-gold ratios for silver, copper, and different metals if the first steel is apart from gold. Additional drilling, assaying, useful resource modeling, and engineering research might be required to find out whether or not Crescat’s goal useful resource estimates might be moderately anticipated to be achieved. Crescat’s goal useful resource estimates are up to date month-to-month throughout all the portfolio. The variety of lively drills contains the variety of drills presently in operation doing exploration and/or infill drilling or anticipated to be deployed over the subsequent twelve months primarily based on every firm’s drilling plans and Crescat’s evaluation of the corporate’s skill to finance and execute these plans. 6 Efficiency estimates via April thirtieth, 2025. *Efficiency figures introduced signify the fund’s internet returns calculated with out the impression of the San Cristobal Mining, Inc. (SCM) Aspect Pocket that was designated on July 1st, 2024. The SCM Aspect Pocket features a personal fairness asset that’s not accessible to new buyers within the funds on or after July 1, 2024. This asset was included within the fund efficiency previous to that date. Excluding the SCM Aspect Pocket after that date offers a clearer view of the efficiency to buyers coming into the funds after July 1, 2024. New buyers can not take part within the SCM Aspect Pocket and won’t share in its potential positive aspects or losses. Buyers ought to take into account each the general efficiency and the efficiency excluding the aspect pocket when evaluating the fund’s returns. Fund efficiency, together with the SCM Aspect Pocket, might be discovered on the agency’s web site right here:Truth Sheets & Efficiency Reviews Returns for the newest month are primarily based on inner estimates which have the potential to alter as soon as finalized. Further disclosures concerning dangers and efficiency introduced are discovered right here:Necessary Disclosures Benchmarks PHILADELPHIA STOCK EXCHANGE GOLD AND SILVER INDEX. The PHLX Gold/Silver Sector Index (XAU) is a capitalization-weighted index composed of corporations concerned within the gold or silver mining business. The Index started on January 19, 1979. S&P 500 INDEX. The S&P 500® is extensively thought to be the perfect single gauge of large-cap U.S. equities. The index contains 500 main corporations and covers roughly 80% of obtainable market capitalization. S&P Choose Trade Indices are designed to measure the efficiency of slender GICS® sub-industries. The Metals and Mining Choose Trade Index includes shares within the S&P Whole Market Index which are categorised within the GICS Aluminum, Coal & Consumable Fuels, Copper, Diversified Metals & Mining, Gold, Valuable Metals & Mining, Silver and Metal sub-industries. References to indices, benchmarks or different measures of relative market efficiency over a specified time period are offered on your data solely. Reference to an index doesn’t indicate that the fund or individually managed account will obtain returns, volatility or different outcomes just like that index. The composition of an index might not mirror the way by which a portfolio is constructed in relation to anticipated or achieved returns, portfolio tips, restrictions, sectors, correlations, concentrations, volatility or monitoring. Hedge Fund disclosures: Solely accredited buyers and certified purchasers might be admitted as restricted companions to a CPM hedge fund. For pure individuals, buyers should meet SEC necessities together with minimal annual earnings or internet value thresholds. CPM’s hedge funds are being supplied in reliance on an exemption from the registration necessities of the Securities Act of 1933 and aren’t required to adjust to particular disclosure necessities that apply to registration beneath the Securities Act. The SEC has not handed upon the deserves of or given its approval to CPM’s hedge funds, the phrases of the providing, or the accuracy or completeness of any providing supplies. A registration assertion has not been filed for any CPM hedge fund with the SEC. Restricted accomplice pursuits within the CPM hedge funds are topic to authorized restrictions on switch and resale. Buyers mustn’t assume they’ll have the ability to resell their securities. Investing in securities entails threat. Buyers ought to have the ability to bear the lack of their funding. Investments in CPM’s hedge funds aren’t topic to the protections of the Funding Firm Act of 1940. Those that are contemplating an funding within the Funds ought to rigorously overview the related Fund’s providing memorandum and the knowledge regarding CPM. For added disclosures together with vital threat disclosures and Crescat’s ADV please see our web site: Necessary Disclosures |

Editor’s Notice: The abstract bullets for this text have been chosen by Looking for Alpha editors.