Gold costs have certainly soared to all-time highs in 2025, prompting headlines a few historic rally. However based on Financial institution of America (BofA) International Analysis, the story is extra nuanced: The gold sector, whereas booming, hasn’t returned to all the metrics that outlined earlier cyclical peaks, particularly relating to its worth relative to the broader fairness market and its personal historic valuations.

This yr, gold surged previous main thresholds, as the standard hedge towards inflation and macroeconomic uncertainty has been propelled by a preponderance of each. On September 2, gold shot previous $3,500/oz, climbing additional to $3,600/ozon the Monday following the disappointing U.S. jobs information for August, which raised bets on simpler financial coverage. The BofA Commodities staff is “bullish,” they are saying, now forecasting the quarterly common value reaching $4,000/ozwithin the second quarter of 2026, with the spot value already up 4.1% week-over-week to $3,589/oz.

Rob Haworth, senior funding strategist at U.S. Financial institution Wealth Administration, instructed Fortune in March that gold could also be a very good funding for some but it surely’s not precisely liquid. “You’re not sending gold to purchase your Domino’s pizza,” he stated, including that gold’s rally lately has been pushed by central banks shopping for the dear metallic because the U.S. greenback weakens and nations like China search alternate options.

Right here’s why Financial institution of America says perspective is essential in evaluating gold’s document excessive, and it is dependent upon the way you have a look at it.

Sector market cap doubling previous peaks, however …

The worldwide gold sector’s complete market capitalization has ballooned to only over $550 billion, almost twice the peaks seen in 2011 and 2020 ($331-$334 billion), greater than 8x the 2016 cycle low ($70 billion), and greater than 3x the current cycle low of $170 billion in 2022. This rally, based on BofA, displays not simply value positive factors. but in addition investor curiosity heightened by inflation and sector price pressures.

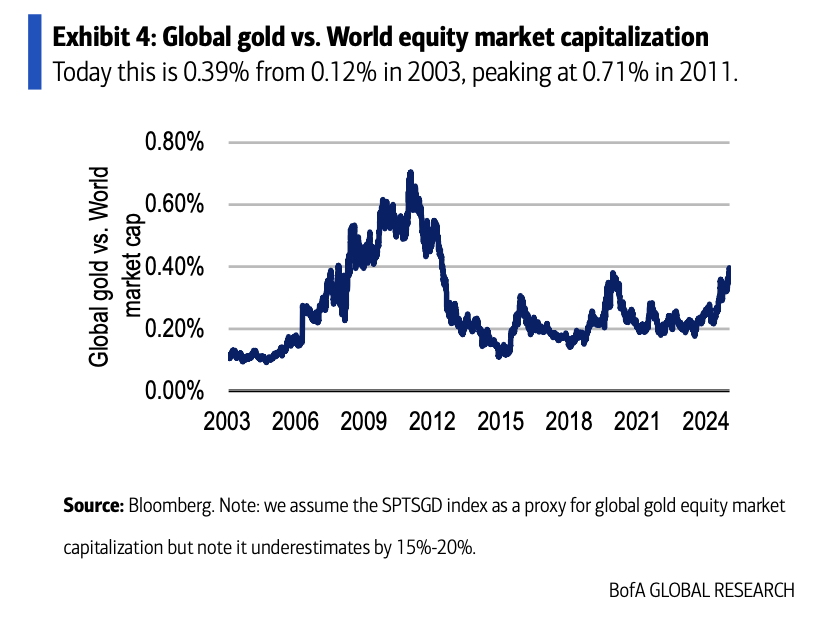

But, when considered as a share of the whole world fairness market, gold’s ascent appears much less dramatic and it’s “far under” its earlier highs, the Commodities staff says. The sector now stands at 0.39% of world market capitalization, matching the 2020 peak however nonetheless far under 2011’s excessive of 0.71%. If the sector returned to that 2011 share, it will suggest a market cap of almost $990 billion—a possible upside provided that the cycle continues lengthy sufficient.

Room to run

Regardless of excessive metallic costs, gold equities will not be buying and selling at historic prime valuations. The sector’s next-12-month (NTM) EV/EBITDA a number of sits at 11x, effectively under the 2020 peak of 15.4x. Value-to-net-asset-value (P/NAV) for the sector rests at 1.88x, in comparison with 2.27x in 2020 and a couple of.19x in 2011. Adjusted for present spot gold costs, sector multiples counsel even additional upside, with NTM EV/EBITDA at 11.7x and P/NAV at 1.39x.

Gold equities have responded to the value rally, however not uniformly. Main indices such because the S&P/TSX International Gold Index (+5.5% WoW), Philadelphia Gold and Silver Index (+4.8%), and NYSE Arca Gold Bugs Index (+4.1%) all surged alongside bullion’s breakout. 12 months-to-date, Fresnillo is the perfect performer, climbing over 268%, spotlighting disparate returns within the sector.

BofA’s analysis factors to room for development—if present tendencies in financial coverage, inflation, and investor sentiment persist. Nevertheless, the gold sector stays a small slice of the worldwide fairness pie, with fairness valuations nonetheless effectively under historic highs. For market observers, the surging value of gold is just a part of the story; the basics counsel this growth is just not but a rerun of earlier peaks, and “document highs” ought to be considered in context.

For this story, Fortune used generative AI to assist with an preliminary draft. An editor verified the accuracy of the knowledge earlier than publishing.