NEWNow you can take heed to Fox Information articles!

FIRST ON FOX: The White Home rolled out an interactive map of the U.S. displaying the financial savings Individuals can count on from initiatives below President Donald Trump’s One Massive, Lovely Invoice Act on a state-by-state foundation, Fox Information Digital realized Tuesday.

Trump signed the large piece of laws into legislation on the Fourth of July, touting that its tax cuts will make the U.S. economic system just like a “rocket ship” as Individuals start feeling its results.

On Tuesday, the White Home revealed an interactive map of the 50 states that gives breakdowns of how a lot Individuals can count on to avoid wasting and see of their pocketbooks in comparison with if the invoice had not been handed and signed into legislation.

The interactive map centered on information resembling: actual wage will increase, that are understood as the rise to a employee’s earnings after accounting for inflation; a household’s anticipated actual take-home pay improve; what number of seniors profit from the no tax on Social Safety; the share of a state’s labor drive who’re anticipated to learn from not paying taxes on suggestions; the variety of jobs protected in a state, and different information.

TRUMP SIGNS ‘BIG, BEAUTIFUL’ BILL IN SWEEPING VICTORY FOR SECOND TERM AGENDA, OVERCOMING DEMS AND GOP REBELS

President Donald Trump rallied Republican lawmakers to move an enormous piece of laws advancing his administration’s agenda. (Evan Vucci/The Related Press)

In California, the nation’s most populated state, residents can count on an actual wage improve of $4,900 to $8,800 and an actual take-home pay improve of $8,500 to $12,500 for a typical household with two children, in response to the map.

“A typical household with two kids in California can count on to see increased take-home pay of about $8500 to $12500 with OBBB in comparison with if it was not handed,” states the map, which incorporates hyperlinks to extra detailed information on any given state. “Round 4% of the labor drive is employed in occupations that might seemingly profit from the no taxes on suggestions provision of the OBBB. Round 6.0 million seniors in California may gain advantage from the no taxes on Social Safety provision of the OBBB.”

STEVE MOORE: TRUMP JUST SCORED THE BIGGEST CONSERVATIVE VICTORY IN THREE DECADES

Residents in a Heartland State resembling Nebraska can count on an actual wage improve of $3,700 to $6,600 and an actual take-home pay improve for a typical household with two kids of $7,300 to $10,300. The map additionally touts 300,000 seniors within the Cornhusker State are anticipated to learn from the shortage of tax on Social Safety, and an anticipated 29% of the state’s labor drive is predicted to learn from the shortage of tax on extra time pay.

On the East Coast, residents of New Jersey can count on actual wage will increase of $5,000 to $9,000, and an actual take-home pay improve of $8,600 to $12,700 for typical households with two kids, in response to the information reviewed by Fox Information Digital. New Yorkers can count on a $4,400 to $8,000 actual wage improve, and an actual take-home pay improve of $8,000 to $11,700, information present.

Trump had been rallying Republican lawmakers to move the laws because the early days of his administration this yr, because it advances his agenda on taxes, immigration, power, protection and the nationwide debt.

Home Speaker Mike Johnson performed a pivotal function in passing the One Massive, Lovely Invoice Act for Trump’s signature on July 4, 2025. (Kevin Dietsch/Getty Photographs)

Home and Senate Republicans delivered the laws to Trump’s desk in July after a hard-fought battle that included a handful of Republicans becoming a member of Democrats of their condemnation of the invoice, principally over its improve to the debt restrict.

The invoice contains key provisions to completely set up particular person and enterprise tax breaks included in Trump’s 2017 Tax Cuts and Jobs Act, and incorporates new tax deductions to chop duties on suggestions and extra time pay. It additionally rescinds sure Biden-era inexperienced power tax credit, allocates roughly $350 billion for protection and Trump’s mass deportation efforts, and institutes Medicaid reforms.

WHITE HOUSE HANDS AMERICANS ‘BIG BEAUTIFUL BILL’ CALCULATOR TO DETERMINE HOW MUCH THEY’D SAVE UNDER ACT

“We’ve got formally made the Trump tax cuts everlasting,” Trump stated through the signing ceremony. “That is the most important tax minimize within the historical past of our nation.… After this kicks in, our nation goes to be a rocket ship economically. We have delivered no tax on suggestions, no tax on extra time, and no tax on Social Safety for our nice seniors.… It makes the kid tax credit score everlasting for 40 million American households.… The Golden Age of America is upon us.”

NEW PROJECTION SIGNALS GOOD NEWS FOR FAMILIES, WORKERS IN TRUMP’S ‘BIG, BEAUTIFUL BILL’

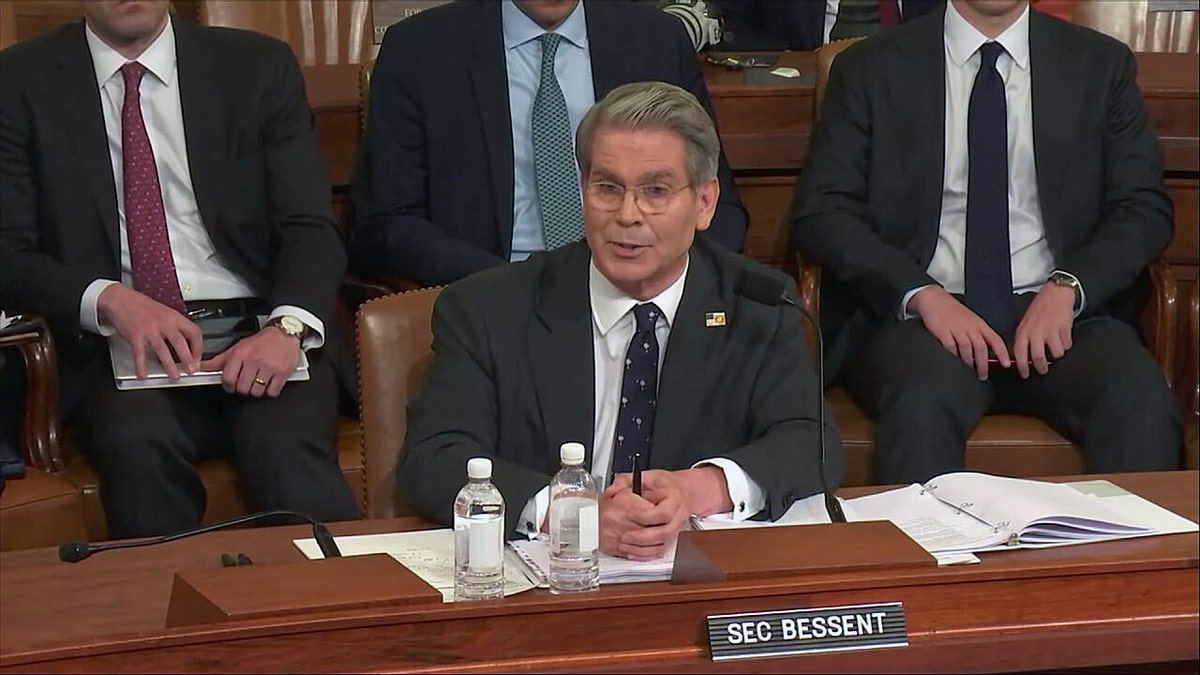

Treasury Secretary Scott Bessent praised the invoice in an opinion piece revealed on Fox Information Digital earlier in July, celebrating that Individuals can count on to maintain “an extra $4,000 to $7,200 in annual actual wages.”

Treasury Secretary Scott Bessent hailed the passage of the “huge, lovely invoice” for the prosperity it should carry to the U.S. (Pool)

“The invoice prevents a $4.5 trillion tax hike on the American individuals. This can permit the typical employee to maintain an extra $4,000 to $7,200 in annual actual wages and permit the typical household of 4 to maintain an extra $7,600 to $10,900 in take-home pay. Add to this the president’s formidable deregulation agenda, which may save the typical household of 4 an extra $10,000. For hundreds of thousands of Individuals, these financial savings are the distinction between having the ability to make a mortgage fee, purchase a automotive, or ship a toddler to school,” he wrote in an op-ed revealed on the 4th of July.

CLICK HERE TO GET THE FOX NEWS APP

“The One Massive Lovely Invoice additionally codifies no tax on suggestions and no tax on extra time pay – each insurance policies designed to offer monetary aid to America’s working class. These tax breaks will guarantee Essential Road employees hold extra of their hard-earned earnings. And they’re going to bolster productiveness by rewarding Individuals who work additional hours. All Individuals can find out how President Trump’s tax cuts will affect their lives for the higher with a brand new White Home calculator,” he added.

Fox Information Digital’s Diana Stancy and Aleandra Koch contributed to this report.