Tariff revenues are dramatically falling wanting preliminary White Home expectations, producing roughly $100 billion lower than projected, in line with a latest evaluation from Pantheon Macroeconomics. Treasury Secretary Scott Bessent predicted in August that tariffs would elevate “effectively over half a trillion, possibly in the direction of a trillion-dollar quantity,” however knowledge compiled by November 25 implies that customs and excise taxes annualize to solely $400 billion.

This shortfall stems from an Common Efficient Tariff Fee (AETR) that’s far decrease than anticipated. The AETR is at present estimated at simply 12%, falling considerably wanting the near-20% extensively anticipated earlier this spring. Even the Congressional Finances Workplace (CBO) was stunned, decreasing its estimate of the pre-substitution tariff fee to 16.5% from 20.5% final month. Pantheon Macro Chief U.S. Economist Samuel Tombs and Senior U.S. Economist Oliver Allen recognized three major elements driving the lower-than-expected AETR, beginning with the U.S.’s relationship with China. In brief, the plunge in buying and selling exercise with China isn’t being made up for with recent tariff income.

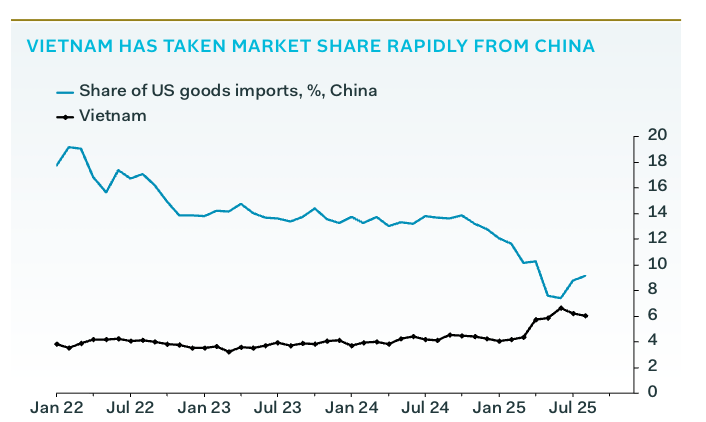

1. China imports plunge and rerouting

The primary main issue is the sharp decline in imports from China, which have plunged by 30%. China’s share of complete U.S. imports has dropped to simply 9%, down from 13% in 2024. Firms are fairly clearly rerouting commerce by Vietnam, Pantheon discovered. Imports from Vietnam have surged to account for six% of all imports, up from 4% final 12 months, pushed by “big will increase in imports of recreation consoles, TVs and garments.” All of those bear a 20% tariff, under the near-50% fee utilized to Chinese language imports.

2. USMCA compliance exceeds expectations

Second is the results of a Trump coverage from his first time period in workplace: the long-heralded renegotiation of NAFTA referred to as the United States-Mexico-Canada Settlement (USMCA). It seems the proportion of products getting into the U.S. tariff-free from Canada and Mexico below USMCA is far increased than preliminary estimates prompt.

The White Home estimated in March that 38% of Canadian imports and 50% of Mexican imports had been coated by the USMCA. After Trump’s shock tariff hikes on every nation this 12 months, topic to negotiation downward, items not compliant with USMCA guidelines are at present tariffed at 35% from Canada and 25% from Mexico, excluding a ten% tariff on vitality assets from Canada.

This means the realized AETRs for these international locations ought to have been roughly 18% and 13%, respectively. Nonetheless, the info exhibits realized AETRs in August had been simply 5% in each Canada and Mexico. This suggests a considerable improve within the share of imports getting into below the USMCA deal.

Pantheon Macro says companies in Canada and Mexico have possible grow to be way more rigorous in offering info to U.S. customs to show the origin of elements of their merchandise, a apply that they had little incentive to comply with below the earlier tariff construction. In different phrases, Canada and Mexico are ensuring they get the USMCA tariff exemption, and it’s throwing off the White Home calculations, which had been based mostly off earlier, much less compliant cross-border commerce.

3. Surge in tariff-exempt AI gear

The third issue diluting the general AETR is a surge in imports of products exempt from tariffs this 12 months. Particularly, imports of “computerized knowledge processing machines”—which largely embody private computer systems and superior chips used for synthetic intelligence—have soared. These imports now account for 9% of all complete imports, a major improve from 4% in 2024. This surge in high-tech imports truly disguised a ten% year-over-year fall in imports of different merchandise in August.

This seems to be a one-off, or one-year type of exception. “We we expect U.S. corporations are depleting stock of imported items for now,” Pantheon wrote, including the probability of the Supreme Court docket putting down roughly 60% of the present tariff regime below the IEEPA regulation “is briefly incentivizing companies to postpone putting new orders for imports.”

If the present tariffs stay in place, the one-year nature of this stock depletion means tariff-applicable imports ought to get better subsequent 12 months, with Pantheon calculating them at $36 billion per 30 days, with the AETR ticking as much as 13%. “Even so, tariff revenues nonetheless could be a lot decrease than the White Home envisaged when it introduced the charges.”

That mentioned, the $400 billion annualized quantity is even bigger than another earlier calculations that had been deemed “very vital” by Torsten Sløk, chief economist of Apollo International Administration. A revered voice on Wall Avenue, Sløk wrote in September that even a $350 billion income determine from tariffs represented a major merchandise within the U.S. funds. However every discount in tariffs is wiping out an increasing number of deficit discount, with the CBO slashing its estimates just lately to disclose one thing round $1 trillion in financial savings which have evaporated amid Trump decreasing his levies on different international locations’ items.

Within the meantime, the tariffs that stay are functioning an increasing number of like a tax, since different international locations and worldwide firms don’t pay for them—U.S. firms and customers do. LendingTree calculated tariffs will value American consumers some $29 billion this vacation season, whereas funding financial institution UBS states it plainly: “the tariffs are an enormous tax improve.” Essentially the most speedy impression of the commerce regime is felt in rising costs, that are “holding issues elevated.” Estimating a weighted-average tariff fee of 13.6%, UBS calculated that tariffs will add 0.8 share factors to core PCE inflation in 2026, erasing roughly a 12 months’s value of disinflation progress.