NEWNow you can hearken to Fox Information articles!

FIRST ON FOX: Texas Rep. Nathaniel Moran is popping tariffs right into a debt-cutting device, unveiling laws that may funnel billions in new commerce revenues right into a belief fund aimed solely at shrinking America’s staggering $37 trillion nationwide debt.

The Tariff Income Used to Safe Tomorrow (TRUST) Act would set up a particular account on the Treasury Division referred to as the Tariff Belief Fund. Beginning in fiscal 12 months 2026, any tariff cash collected above the 2025 baseline stage would robotically go into this fund. By regulation, that cash may solely be spent in a technique: to shrink the federal deficit at any time when the federal government is operating within the purple.

“President Trump’s daring use of tariffs has already confirmed efficient in bringing international nations again to the negotiating desk and securing higher commerce offers for America. That short-term success has produced record-high revenues, and now we’d like to ensure Washington doesn’t squander them,” Moran instructed Fox Information Digital.

TRUMP SAYS US WOULD BE ‘DESTROYED’ WITHOUT TARIFF REVENUE

“The TRUST Act ensures these {dollars} go the place they’re wanted most—towards decreasing our nationwide debt and defending the monetary way forward for our nation.”

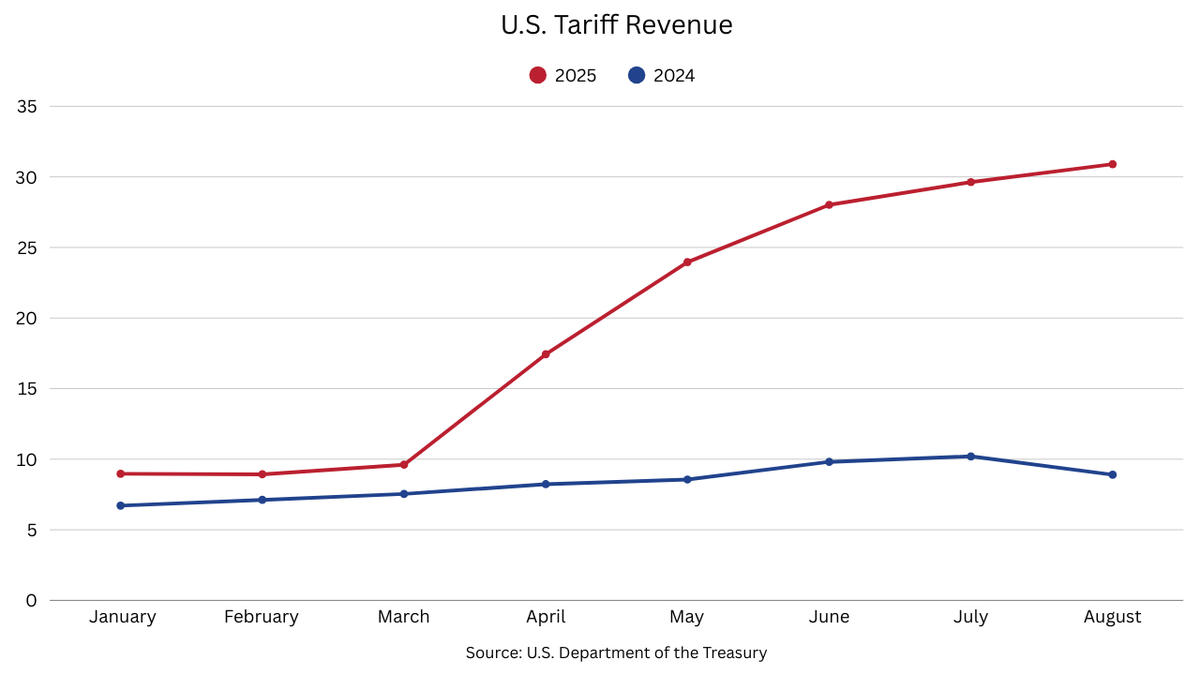

Moran’s laws comes after the U.S. collected greater than $31 billion in tariff revenues in August, the very best month-to-month complete to this point for 2025. Complete tariff income for 2025 has reached greater than $183.6 billion, in keeping with the “Customs and Sure Excise Taxes” knowledge launched on Aug. 29 by the Treasury Division.

Tariff revenues rose steadily from $17.4 billion in April to $23.9 billion in Could, earlier than climbing to $28 billion in June and reaching $29 billion in July. On the present tempo, the U.S. may accumulate as a lot tariff income in simply 4 months to 5 months because it did throughout all the earlier 12 months. At this level in fiscal 12 months 2024, tariff revenues have been at $86.5 billion.

Rep. Nathaniel Moran, R-Texas, walks down the Home steps after the ultimate votes within the Capitol earlier than Congress’ October recess on Wednesday, Sept. 25, 2024. (Invoice Clark/CQ-Roll Name/Getty Photos)

TRUMP CALLS TARIFF WINDFALL ‘SO BEAUTIFUL TO SEE’ AS CASH SAILS IN

The surge in income coincides with a federal appeals court docket ruling that President Donald Trump overstepped his authority through the use of emergency powers to impose sweeping international tariffs.

In its Aug. 29 determination, the court docket mentioned the facility to set such tariffs rests squarely with Congress or inside current commerce coverage frameworks. The ruling doesn’t have an effect on tariffs imposed by different authorized authorities, reminiscent of Trump’s levies on metal and aluminum imports.

Legal professional Basic Pam Bondi introduced the Justice Division will attraction the choice to the Supreme Courtroom. Within the meantime, the court docket allowed the tariffs to stay in place by means of Oct. 14.

A year-over-year comparability of tariff collections. (U.S. Treasury)

Treasury Secretary Scott Bessent beforehand mentioned that the Trump administration may apply a part of the tariff income towards reducing the nationwide debt.

The nation’s debt, which is the amount of cash the U.S. owes its collectors, is nearing $37.4 trillion as of Sept. 3, in keeping with the Treasury Division.

The staggering determine has intensified the long-standing debate in Washington over authorities spending, taxation and efforts to rein within the ballooning deficit.

Treasury Secretary Scott Bessent throughout a Home Methods and Means Committee listening to in Washington, D.C., on June 11, 2025. (Eric Lee/Bloomberg/Getty Photos)

CLICK HERE TO GET THE FOX NEWS APP

“Complacency is not an choice. We should act with urgency and start to carry down our nationwide debt instantly,” Moran added in an announcement.

Bessent has additionally beforehand mentioned that tariffs may generate greater than $500 billion in income for the federal authorities. U.S. companies pay these import taxes to the federal authorities, however the fee typically falls on shoppers, as firms increase costs to offset the financial burden.