Nicolae Popescu/iStock by way of Getty Pictures

Introduction

We marked the three-year anniversary of the fund in August ‘2025. I’m extraordinarily happy with the progress we now have made and the worth the fund has delivered to every of its traders. We’re lucky to have such a beautiful group of traders, and I’m actually blessed to have these people in my sphere, making our interactions each pleasing and productive.

Because the fund continues to develop by sturdy efficiency and the addition of latest traders, I’ll at all times worth the essential function every of you has performed in its success.

Our efficiency this 12 months was gratifying, not simply in absolute returns however, considerably, as a result of lead we maintained over our benchmark, the S&P 500, and plenty of different broad-based market indices. Since inception, we now have been in a position to additional lengthen this lead, reinforcing the precept that concentrated investments in high-quality companies at honest valuations can outperform indices over the long run. A real comparability ought to embody a full financial cycle, and we will definitely revisit our efficiency when that milestone is reached.

The 12 months was outlined by important information, significantly concerning tariffs, which launched appreciable market volatility. We skilled a fast correction in April, adopted by a traditionally sturdy market rebound. The Synthetic Intelligence (‘AI’) theme has been instrumental in carrying this market by durations of volatility to new heights, leading to over 38 new all-time highs this 12 months. This naturally results in the query, “Are we in a Bubble?” I handle this subject in a later part of this letter.

Concerning portfolio exercise, we had a good quantity of motion this 12 months, leading to an approximate 6.9% turnover. Whereas that is barely increased than in earlier years, it stays nicely under trade requirements. We actively keep away from the extreme churning of portfolios seen elsewhere, which saves on friction prices, similar to transaction charges and taxes.

Particularly, we added three corporations to the portfolio- IBKR, GLBE, and ADBE-while fully exiting two (MODG and HHH) and decreasing our place in one other (FNMA).

Regardless of a profitable 12 months, I imagine there are necessary classes to be discovered, which I’ve detailed within the subsequent sections of this letter.

Efficiency: Tapasya Funding Fund I (TIFI) outcomes since inception

Supply: IBKR for Gross and NAV Consulting (Fund Administrator) for LP Returns. CAGR – Compounded Annual Development Charge

Month-to-month Outcomes – Web of charges in ‘%’

Whereas we have chosen the S&P 500 as our benchmark index, it is essential to observe different indices as nicely. Index investing affords a wonderful different to actively managed funds, significantly if we battle to outperform over the long run.

Indices (IBKR)

Gross Returns as of Dec 31′ 202 5

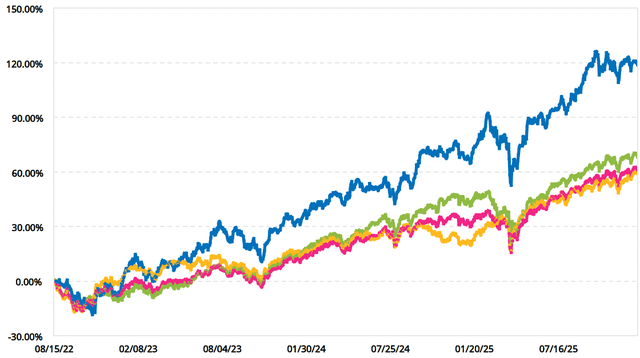

Gross Efficiency vs Indices Since Inception (IBKR)

Shifting to nation allocation, the under chart gives extra particulars. US continues to be bulk of our holding adopted by Netherlands (Prosus, Adyen and Common Music Group) adopted by China (Alibaba), Israel (International-E) and Canada (Lululemon).

2025 in Assessment

Initially of the 12 months, I expressed issues about excessive fairness valuations within the US, noting restricted alternatives and highlighting extra promising prospects overseas, significantly in Europe and China.

Although US markets had a superb 12 months it did underperform Europe and China. Our investments in these markets paid off this 12 months.

The market panorama modified fairly dramatically this 12 months with the “Liberation Day”announcement. As talked about in my bi-annual letter, we did benefit from this volatility shopping for into IBKR (Interactive Brokers) which has now develop into a core holding for us and amongst the highest 10 positions we maintain. It has additionally carried out exceedingly nicely since our buy.

Liquidity and Capital Effectivity

This 12 months, we refined our strategy to managing uninvested capital. In earlier years, holding important money balances to attend for “fats pitch” alternatives created a efficiency drag throughout rising markets. To resolve this, we now have adopted a extra capital-efficient technique: quite than letting capital sit idle, we now deploy a portion of our uninvested liquidity into broad-based, liquid indices.

This technique ensures that our companions keep market publicity and aren’t penalized for our persistence. We view this not as a separate funding technique, however as a “holding sample” for capital that’s awaiting deployment into our high-conviction concepts.

To make sure we stay agile, we keep entry to a safe line of credit score. This enables us to execute rapid purchases in periods of volatility without having to attend for the settlement of our index positions. We’ll proceed to judge this allocation dynamically primarily based on total market valuations, guaranteeing that our “dry powder” is working for us whereas preserving our means to strike shortly.

Commerce-offs

There’s an inherent trade-off on this strategy. Whereas money acts as a drag in a rising bull market, like the present surroundings, it gives a useful benefit throughout swift downturns by permitting us to capitalize on volatility. Moreover, money dampens total portfolio volatility and improves outcomes throughout a down or bear market.

Dwelling Builders and the Affordability Problem

The anticipated restoration within the homebuilder sector has stalled, primarily as a result of persistent affordability points. Affordability is dictated by the three-legged stool of wages, rates of interest, and residential costs. Whereas rates of interest have not too long ago lowered and wages have remained comparatively sturdy, excessive dwelling costs proceed to dampen the housing market, resulting in a major slowdown regardless of a transparent shortage of houses. The American dream of homeownership is more and more tough to realize due to this affordability hole.

Provided that this can be a extremely regulated sector, with many laws being native (county-level, and so forth.), deregulation is unlikely. Consequently, constructing smaller houses could be the most viable path towards extra reasonably priced housing.

Funding Technique within the Sector

When it comes to our investments on this area, we now have made some changes. We absolutely exited one place, Howard Hughes Holding, and trimmed our funding in Fannie Mae. The Fannie Mae commerce was a short-term success, yielding a 10x return on our authentic funding worth, though we offered about half of the place when it was at just a little over 4x its value.

We keep a powerful conviction in Builder FirstSource (BLDR) and haven’t any intention of promoting. BLDR is a superb firm with a top-tier administration crew. They’ve demonstrated excellent capital allocation, notably shopping for again over half of their shares since 2021 and strategically buying corporations to realize market share in a fragmented trade. We anticipate BLDR will carry out nicely as soon as the housing market finally rebounds.

Reviewing Portfolio Exits: The Anatomy of Errors

Our funding philosophy typically favors a long-term holding technique. Consequently, I categorize a “SELL” resolution as a mistake, apart from particular short-term trades like Fannie Mae (FNMA). This evaluation examines latest exits from our portfolio.

Abstract of Exits (2023-2025):

ASOS (Offered 2023):

- Thesis & End result: The preliminary thesis was a high-risk/high-reward turnaround play. The place was small (<2%) to mitigate danger if the turnaround failed. The inventory worth has halved because the sale.

- The Lesson: Fast exits protect capital. Whereas we incurred losses, the success was in our self-discipline to promote shortly when the thesis broke.

AirBNB (Offered 2024):

- Context: Our household continuously makes use of ABNB, and we’re followers of the service. Nevertheless, the inventory had been stagnant for a number of years.

- Purpose for Sale: Just like HHH, the first motive for promoting was alternative value to redeploy capital for probably increased returns.

- End result: We exited at a small revenue. The inventory has moved sideways because the sale.

Topgolf Callaway (MODG) (Offered 2025):

- Thesis & End result: The intent was a short-term holding (simply over a 12 months) anticipating a cut up of Topgolf and Callaway by mid-2025. The corporate’s administration, which has a historical past of faltering, did not execute the cut up.

- Takeaway: We incurred losses, however the small place measurement (<2%) minimized the influence on the general portfolio. The funding was a mistake as a result of administration did not ship on the anticipated motion.

Howard Hughes Holding (HHH) (Offered 2025):

- Frustration: Regardless of the standard of its actual property portfolio and potential for asset monetization, the market has not acknowledged HHH’s worth. The inventory was largely flat over the three years we held it.

- Purpose for Sale: The exit was pushed purely by alternative cost-the need to deploy capital into belongings/corporations with increased potential returns.

- End result: We didn’t incur a realized loss on the worth however suffered a possibility loss because the asset didn’t recognize whereas the broader market did. The place measurement was small (~4%).

Reflection: It’s at all times preferable for the unique funding thesis to show appropriate than to need to promote a inventory. Whereas it is higher to promote a stagnant inventory that continues to maneuver sideways or decrease, the numerous mistake traders typically make is promoting after which being psychologically prevented (worth anchoring) from re-entering when the inventory strikes considerably increased.

In conclusion, reflecting on every little thing, I’m reminded of George Soros’s highly effective phrases:“ It is not whether or not you are proper or fallacious that is necessary, however how a lot cash you make if you’re proper and the way a lot you lose if you’re fallacious”.

Investing errors are inevitable. As George Soros implied, a significant error is not simply shedding cash, however quite holding a powerful conviction a couple of profitable concept and solely committing a small portion of capital. This missed alternative, whereas not mirrored in commonplace accounting, considerably impacts one’s whole internet price.

A worthwhile, but much less frequent, funding metric is the proportion of the portfolio, weighted by greenback measurement, that generates alpha (outperforms the market). A measure of 55% or increased is often thought of good. For instance, the present 12 months stands at about 70%.

Particular person traders are strongly inspired to trace this metric, as it would have a profound impact on long-term internet price accumulation.

Are we in an AI Bubble

The query of whether or not we’re at the moment in an AI bubble is a topic of widespread dialogue. To deal with this, it is important to first set up a typical understanding of what constitutes a ‘ Bubble’.

I desire the next two definitions:

A bubble is characterised by a fast and sometimes irrational surge within the worth of an underlying asset, resulting in a major divergence from its intrinsic worth. Cliff Asness defines a bubble as a scenario the place no affordable future final result can justify present asset costs.

(For these serious about a deeper dive, I’ve beforehand shared my views on Market Bubbles in International Funding Assessment VIII.)

The introduction of any main new technology-from trains and electronics (like radio) to EV cars-has traditionally offered alternatives for important revenue, which in flip has virtually invariably led to hypothesis. The present scenario is following this established sample.

My main focus, subsequently, is figuring out the required steps to guard investor pursuits within the occasion {that a} speculative bubble develops.

Present Evaluation: No General Market Bubble. I don’t imagine we’re in a bubble right now.

Nevertheless, I acknowledge that valuations are extraordinarily stretched in sure sectors, particularly semi-conductors, AI-associated {hardware}, power corporations, and Quantum computing shares. We’re not invested in these sectors as a result of I lack the boldness to forecast their future money flows. The power to confidently label these corporations as a bubble-as per Cliff Asness’s definition-requires a capability to precisely mission these money flows. The AI Disruption seems to be a transformative power. Based mostly on my technical background, present utilization, and analysis, I imagine this expertise would be the most vital “Digital” disruptor of our lifetime. This accelerating tempo of technological change will inevitably make investing tougher, particularly as conventional aggressive benefits (moats) are quickly eroded.

The Menace of Sectoral Bubbles: We must be extra involved with sectoral bubbles, which happen extra continuously than total market bubbles just like the 2000 Dotcom disaster or the Nice Monetary Disaster (GFC). Sectoral busts are sometimes shortly forgotten.

For instance, the Electrical Automobile (EV) sector skilled a bubble burst in 2022. The chart under illustrates the numerous decline in EV firm valuations from their highs ( Information as of February 27, 2024) from my International Funding Assessment VIII

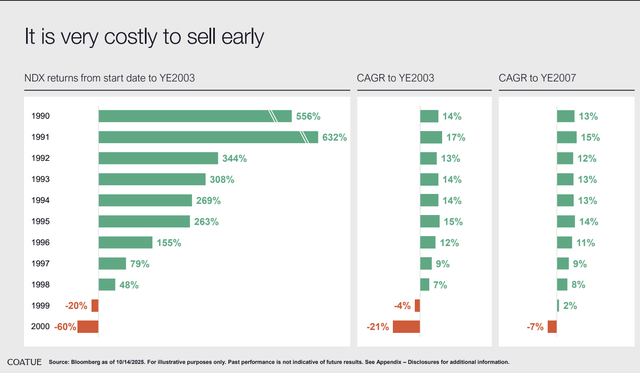

Avoiding the market as a result of worry of bubbles is often a shedding technique, as demonstrated by knowledge shared by the profitable hedge fund Coatue.

NDX Efficiency (Bloomberg)

Our price-based investing ideas imply we frequently underperform in periods of utmost sectoral valuation surges, like these at the moment seen. Nevertheless, I absolutely count on our long-term outcomes to achieve success, in step with our efficiency over the previous three-plus years.

We’re all prone to cognitive biases:

Destructive Bias: Dangerous information naturally captures extra consideration than excellent news. Psychologists verify that folks desire and higher keep in mind unfavourable data, a bias the media readily exploits.

Affirmation Bias: We have a tendency to hunt out and eat data that reinforces our current beliefs.

These two tendencies will be significantly detrimental in investing, typically main us to make incorrect choices.

Fund Technique within the Face of Potential Bubbles

Our fund’ s strategy is to keep away from companies which might be valued excessively primarily based on future projections of money flows. Loss aversion tends to go down when one is successful.

Subsequently, our goal is to sidestep any sectoral bubble bursts, mitigating the influence on our portfolio past common market corrections.

Prime Performers and their Contribution

Our high contributors to our efficiency have been Alphabet, Prosus, and Carvana. Then again, our backside performers have been Lululemon, Chipotle, and Builder FirstSource.

Backside Performers and their Contribution

A couple of traces in honor (or disgrace) for the businesses that made this listing.

Alphabet (Google): A Foundational Lengthy-Time period Maintain

Alphabet was the preliminary funding when the fund was established. We imagine the market has underestimated the numerous aggressive benefits, or “moats,” surrounding its core enterprise. Considerations in regards to the decline of its search enterprise, early stumbles in AI launches, and the potential influence of the antitrust court docket resolution have been overblown and closely discounted the inventory worth. Many of those perceived dangers have since lessened, making it the top-performing “Magazine 7” inventory in 2025.

This stays a long-term holding. Nevertheless, in step with all portfolio corporations, we should carefully monitor key efficiency indicators, together with:

The continued affect of AI on its search performance. The extent of capital expenditure directed towards AI improvement. The expansion trajectory of its cloud computing phase.

Moreover, we imagine the market has but to totally recognize the worth of different enterprise models, similar to Waymo.

Prosus (PRX.AS): Funding Thesis

Prosus is a core, long-term holding primarily valued for its substantial stake in Tencent, an organization we imagine has important development potential and a powerful international aggressive benefit. A key component of our thesis is that Prosus’s present market capitalization is lower than the worth of its Tencent holding alone.

The Sum-of-the-Components Alternative: Along with the Tencent stake, Prosus holds an estimated $35 billion in different listed and unlisted belongings. Nevertheless, administration has confronted challenges in decreasing the persistent low cost between the worth of the underlying Tencent stake and Prosus’s whole valuation.

Future Consideration:We’ll take into account a direct funding in Tencent, taking tax implications under consideration, if administration is unable to successfully shut this valuation hole within the close to future.

Carvana (CVNA) continues to exceed execution expectations, efficiently gaining market share and delivering worthwhile income development. The latest surge in December was largely attributed to its inclusion within the S&P 500, which additionally validates our preliminary funding thesis. Given the numerous enhance in its valuation, I’ll look to trim this place in 2026. This potential resolution could be pushed by seizing higher-return alternatives elsewhere (alternative value), quite than a insecurity within the firm or its administration crew.

Lululemon (LULU): We view Lululemon as a long-term compounder and a comparatively latest addition to our portfolio. We established our place throughout a market pullback stemming from points with merchandise execution. Whereas the corporate faces the headwind of tariffs and elevated competitors within the US from rivals like Vuori and Alo Yoga, our funding thesis relies on continued worldwide growth, significantly in China, which we count on to drive earnings development. Nevertheless, we would want to reassess our funding resolution if Lululemon fails to realize optimistic mid-single-digit comparable gross sales development within the US.

Builder First Supply (BLDR) is positioned as a powerful long-term holding, demonstrating glorious capital administration with a Return on Invested Capital exceeding 20%. As a key producer and provider within the constructing supplies sector, the corporate generates substantial free money circulation. This money is strategically allotted to acquisitions inside the fragmented market and important inventory repurchases, having already retired roughly a 3rd of its excellent shares.

Regardless of the present housing market recession, the outlook stays optimistic. The U.S. faces a persistent housing deficit of three to five million houses. A robust restoration and subsequent efficiency are anticipated for BLDR as soon as the underlying housing affordability disaster is addressed, resulting in a broader trade rebound.

Chipotle Mexican Grill (CMG): Chipotle’s efficiency in 2025 was disappointing, primarily as a result of heightened competitors and margin strain ensuing from elevated labor and meals prices that outpaced menu worth will increase. The market punished the inventory for a short lived slowdown in same-store gross sales development. Regardless of this difficult 12 months, our conviction in CMG as a long-term holding stays strong. The corporate maintains a powerful model, superior unit economics, and a transparent runway for growth. We view the present market pessimism as a shopping for alternative and intend to deal with CMG as a foundational, multi-year holding.

Our means to remain largely detached to mark-to-market actions in our portfolio corporations when they don’t seem to be reflective of underlying enterprise points, stays certainly one of our aggressive benefits. Our means to resist volatility comes from our deep due diligence and understanding of corporations we personal, the collective persistence of our traders and our dispassionate, rational strategy to investing.

Lots of the largest hedge funds’ aggressive benefits come from large expertise and infrastructure investments, large-scale organizations, entry to data seconds and even milliseconds earlier than others, and extraordinary buying and selling capabilities.

We don’t compete on these components. As a substitute, our sturdy benefit lies in our structural persistence, deep elementary analysis, and the behavioral self-discipline to stay rational when the market turns into emotional.

This 12 months, we efficiently launched a number of new positions to our portfolio. We’re significantly happy with the addition of Interactive Brokers (IBKR). We additionally invested in International E On-line (GLBE), an Israel-based firm, and Adobe. I imagine Adobe is at the moment out there at a reduction as a result of an over-correction pushed by AI fears. GLBE at the moment constitutes about 3% of the portfolio, and I anticipate this proportion will enhance over time. Adobe represents a smaller, roughly 2% preliminary guess.

As we conclude this letter, we proceed to function in some of the advanced macroeconomic situations in latest historical past. Whereas inflations degree proceed to average, they continue to be above central financial institution targets. The extended tightening cycle has induced shifting expectations round fee cuts, which has created an advanced surroundings for markets.

Companion Communication

We added 8 Restricted Companions this 12 months, together with current traders including further capital to their prior investments. Our fund continues to develop as a result of mixed components of latest traders becoming a member of in as nicely organically as a result of common market-growth and us doing higher than these returns.

We launched 2 share courses originally of 2025. Class A was the unique class, with a 6% hurdle fee and Class B at a 8% hurdle with a minimal of $500K capital contribution. 3 traders took benefit of this. As talked about this was deliberate for 2025 solely and Class B is now eradicated aside from those that signed up for it in 2025.

As a part of our dedication to aligning with investor pursuits and present market requirements, we now have adopted an Amended and Restated Restricted Partnership Settlement (‘LPA’) and Non-public Providing Memorandum (PPM).

These modifications are designed to make the Fund extra investor-friendly, scale back your prices, and higher replicate our core “International Worth” fairness technique.

Key Adjustments at a Look

1. Diminished Efficiency Payment: We’re reducing the Efficiency Allocation from 25% to twenty%.

Influence: You retain a bigger share of the earnings. The 0% administration price and 6% laborious hurdle stay in place, guaranteeing we solely receives a commission after we outperform.

2. Improved Liquidity Phrases: Now we have considerably relaxed the capital lock-up and withdrawal restrictions to give you larger flexibility:

Lock-Up Interval: Diminished from 3 years to 1 12 months(4 quarters). Withdrawal Frequency: Elevated from Annual(Dec 31 solely) to Quarterly(Mar, Jun, Sep, Dec).

Discover Interval: Diminished from 90 days to 60 days.

3. Strategic Clarification (Crypto Provisions): Now we have eliminated legacy language concerning cryptocurrency mining, chilly wallets, and digital asset operations.

Purpose: This language was carried over from earlier templates and didn’t precisely replicate our mandate. Eradicating it eliminates confusion and confirms our concentrate on elementary fairness worth investing.

4. Modernization & Regulatory Compliance

Minimal Funding: The minimal preliminary funding for new subscribers has been elevated to $100,000 (beforehand $50,000). Observe: This doesn’t have an effect on current companions’ present account balances. Regulatory Updates: Now we have up to date the definitions of “Certified Shopper” and “Accredited Investor” to align with the most recent Securities and Change Fee (SEC) thresholds.

Subsequent Steps

No motion is required in your half. These modifications have been formally adopted by the Normal Companion to learn the partnership and guarantee regulatory compliance.

Our partnership with NAV Consulting, the Fund Administrator, has been invaluable. I’ve had the pleasure of working with them because the starting and look ahead to persevering with our relationship for the foreseeable future.

Akram & Associates gives audit and tax providers, and you may count on to obtain your K1s from them by March of the following 12 months.

We selected Interactive Brokers (IBKR) as our custodian and brokerage as a result of their low transaction charges, increased curiosity on money, inventory lending program, and worldwide transaction capabilities, amongst different components.

The fund’s construction permits for scalability, enabling us to accommodate further traders and funds with out considerably rising my workload. Due to our service companions, I can concentrate on what I really like most: researching corporations worldwide to establish funding alternatives.

Thanks for entrusting me together with your investments. I worth your assist and welcome any questions.

Yours sincerely,

Pratik Kodial

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.