Larysa Shcherbyna/iStock by way of Getty Photos

By Tarso Veloso

At a Look

- On June 13, the U.S. Environmental Safety Company (EPA) proposed greater biofuel mixing necessities for 2026 and 2027

- Because the shift towards renewable fuels boosts soybean oil demand, Soybean Oilshare futures and choices provide a streamlined method to buying and selling the connection between soybean oil and soybean meal

As demand for animal protein and vegetable oils continues to rise globally, roughly 85% of all beans harvested are crushed into two major merchandise: soybean oil and soybean meal. Soybean meal, a high-protein animal feed, is a staple within the agricultural business, whereas soybean oil has purposes in meals, gas and industrial sectors.

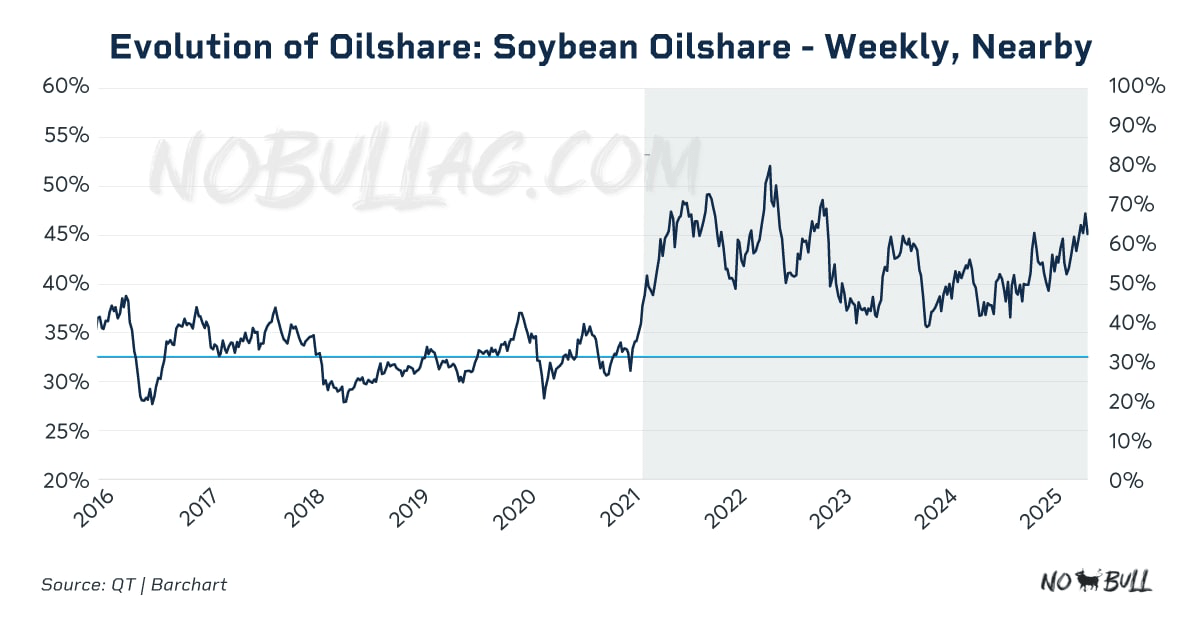

With so many purposes, the soybean market is a multifaceted atmosphere the place the worth of soybean oil and soybean meal can range significantly. A pivotal measure that helps market individuals in negotiating this complexity is oilshare, a time period used to explain the worth share of the soybean crush attributable to soybean oil. With the expansion in renewables driving extra soybean processing all over the world, the idea of oilshare has gained prominence as soybean oil is more and more utilized within the manufacturing of biomass-based diesel gas.

This rise in demand and the need to hedge value adjustments have fuelled the event of Soybean Oilshare futures and choices, which give a extra environment friendly means for market individuals to navigate this relationship. I just lately had a dialog with Susan Stroud, founder and analyst at No Bull Agriculture, to get her ideas on the state of the soybean market, the potential dangers forward, and the significance of understanding oilshare.

Tarso Veloso: Worth adjustments in soybean oil and soybean meal instantly influence oilshare. What are you seeing by way of soybean manufacturing?

Susan Stroud: 2025 marks the fourth consecutive document yr of worldwide soybean manufacturing, and that is unsurprisingly leading to document ending shares by way of each amount and shares as a proportion of general demand.

On the demand aspect, we additionally see document exports and international crush, supported by rising protein demand and increasing biofuel mandates.

Tarso Veloso: Soybean oil performs an essential position as an enter in biofuels. How do you see demand for renewable fuels impacting the soybean market?

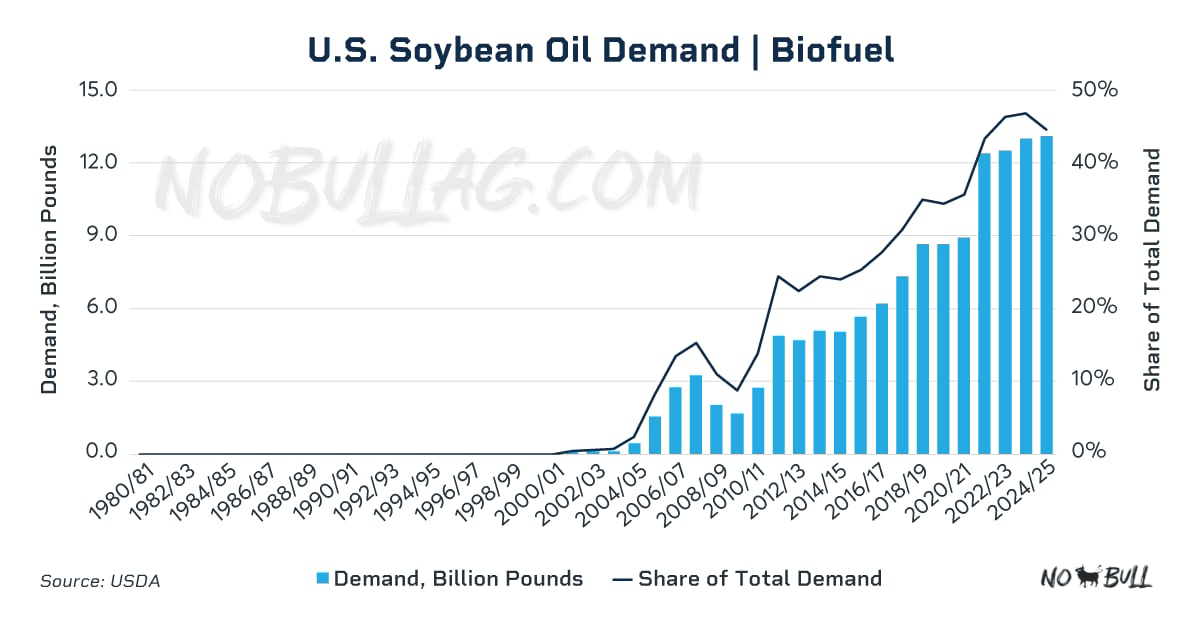

Susan Stroud: Traditionally, soybeans have been crushed for his or her protein-rich meal, used to feed livestock. Nonetheless, in recent times, the soy complicated has undergone a notable transformation as increasing biofuel mandates and the adoption of low carbon gas packages have created a surge in demand for soybean oil.

This shift has altered conventional value dynamics, with soybean oil now changing into a key driver within the complicated, and this pattern is anticipated to proceed because the renewable gas sector expands.

Tarso Veloso: These concerns have contributed to the event of Soybean Oilshare futures and choices. Why is a contract like this essential within the present market atmosphere?

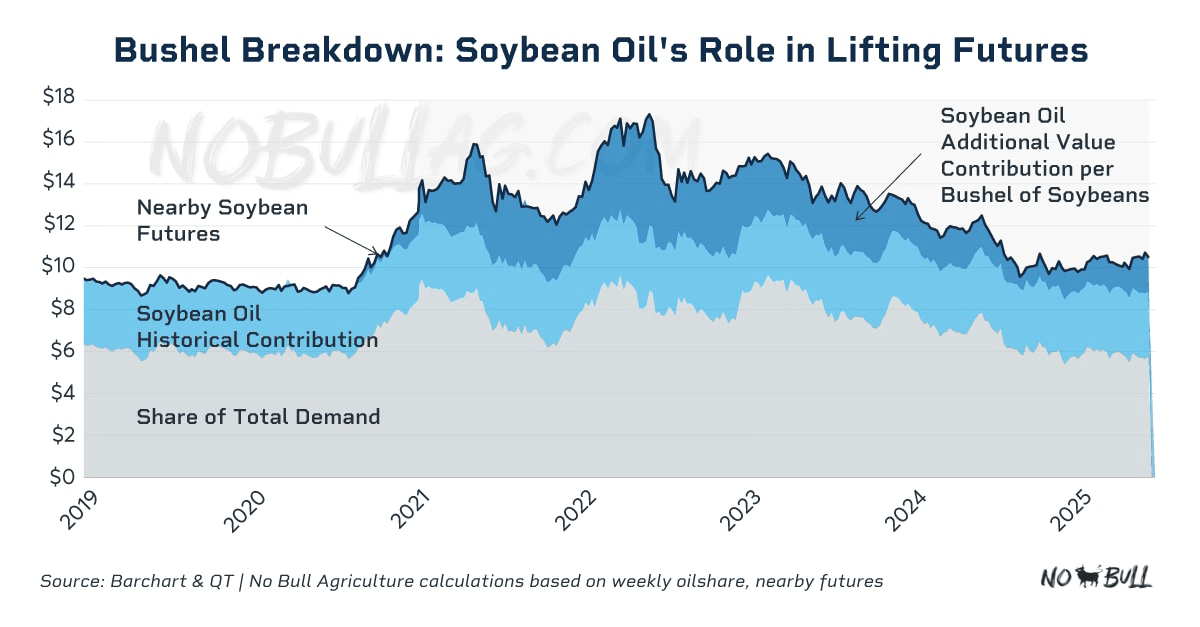

Susan Stroud: Issues have modified. On this new period of demand, soybean oil contributes extra worth to every bushel of soybeans than ever earlier than. This enhance in oil’s ‘share’ has turn out to be a elementary driver within the soy complicated and added actual worth to each bushel of soybeans.

Nonetheless, this heightened volatility and sensitivity to grease value fluctuations additionally introduces vital threat for market individuals. The Soybean Oilshare futures and choices contract supplies an important device to handle this threat.

By permitting for the direct hedging and buying and selling of the oil’s contribution to the general soybean worth, it empowers producers, processors, and end-users to navigate the evolving market panorama with larger precision and confidence.

Tarso Veloso: What do you see as the largest dangers within the soybean market within the close to time period?

Susan Stroud: Close to-term, coverage volatility poses a significant threat.

For almost 20 years, america maintained a coverage that supplied a $1-per-gallon mixing credit score to entities corresponding to biofuel producers, truck stops and petroleum corporations for every gallon of biomass-based diesel blended into home petroleum provides. This incentive utilized not solely to domestically produced biofuels but additionally to imported biofuels, finally encouraging substantial volumes of biofuel imports into the U.S. market.

Nonetheless, this coverage expired on the finish of 2024 and was changed by the Clear Gas Manufacturing Credit score, often called 45Z, in January 2025. The brand new framework introduces two vital adjustments. First, imported fuels are now not eligible for the credit score. Second, and most notably, the flat $1-per-gallon incentive has been changed by a sliding-scale credit score primarily based on the carbon depth of the gas. Underneath this technique, crop-based biofuels obtain smaller credit, whereas fuels produced from waste feedstocks are eligible for greater subsidies.

Soybean oil instructions a considerably smaller premium below the brand new coverage on account of its comparatively excessive carbon depth. In consequence, the shift from the long-standing $1-per-gallon 40A mixing credit score to the 45Z manufacturing credit score – which favors lower-carbon-intensity feedstocks – has already led to vital market disruption in early 2025.

This coverage change considerably diminished biomass-based diesel manufacturing and, consequently, demand for soybean oil as a feedstock. Though 45Z was signed into regulation in August 2022, official steerage was not launched till January 10, 2025. The market’s swift response to those particulars underscores the fast influence and volatility related to coverage dangers.

Editor’s Observe: On June 13, the U.S. Environmental Safety Company (EPA) proposed new Renewable Gas Commonplace (RFS) quantity necessities for 2026 and 2027. If finalized, these could be the very best mandated biomass-based diesel quantity within the historical past of the RFS program, based on the press launch.

Tarso Veloso: Are there some other longer-term dangers you’re monitoring?

Susan Stroud: Long term, we’ll proceed to see a world push for inexperienced vitality however want to stay conscious of the headwinds crop-based biofuels face as incentives and initiatives are more and more tied to carbon depth, leaving waste-based biofuels advantaged. Sustainability and regulatory pressures will solely mount from right here.

Editor’s Observe: The abstract bullets for this text had been chosen by In search of Alpha editors.