NicoElNino/iStock by way of Getty Pictures

FINVESTMENT PERFORMANCE (%) as of September 30, 2025

| Whole Return | Annualized Return | |||||

|---|---|---|---|---|---|---|

| Qtr | YTD | 1 Yr | 3 Yr | 5 Yr | Inception* | |

| Palm Valley Capital Fund (MUTF:PVCMX) | 2.35% | 3.77% | 3.68% | 7.13% | 6.03% | 6.85% |

| S&P SmallCap 600 Index (SP600G) | 9.11% | 4.24% | 3.64% | 12.80% | 12.93% | 8.10% |

| Morningstar Small CapIndex | 7.99% | 8.80% | 9.15% | 16.24% | 12.25% | 8.50% |

* Inception date for the Palm Valley Capital Fund is 4/30/19 Efficiency knowledge quoted represents previous efficiency and doesn’t assure future outcomes. The funding return and principal worth of an funding will fluctuate in order that an investor’s shares, when redeemed, could also be value kind of than their unique value. Present efficiency of the Fund could also be greater or decrease than the efficiency quoted. Efficiency of the Fund present to the latest monthend might be obtained by calling 904-747-2345. As of the newest prospectus, the Fund’s Investor class gross expense ratio is 1.51% and the web expense ratio is 1.26%. Palm Valley Capital Administration (PVCMX) has contractually agreed to waive its administration charges and reimburse Fund working bills by way of at the least April 30, 2026. Efficiency would have been decrease with out waivers in place. |

Rise of the Machines

You are taking over the world, Jensen. -President Trump to Nvidia (NVDA) CEO (September 2025)

Expensive Fellow Shareholders,

Earlier than James Cameron’s field workplace megahits Avatar (2009) and Titanic (1997), he directed The Terminator (1984). Contemporary from his lead function in Conan the Barbarian, Arnold Schwarzenegger was solid as a cyborg murderer despatched again in time from 2029 to 1984 Los Angeles. Schwarzenegger wasn’t the director’s first option to play the Terminator. The function was initially turned down by Slyvester Stallone and Mel Gibson. The movie’s financiers even recommended O.J. Simpson, however Cameron reportedly didn’t really feel O.J. could be plausible as a killer. Cameron later acknowledged that casting Arnold “should not have labored,” because the Austrian Oak would by no means mix right into a crowd as an infiltration unit. Remarked Cameron, “However the great thing about motion pictures is that they do not must be logical…if there is a visceral, cinematic factor taking place that the viewers likes, they do not care if it goes in opposition to what’s doubtless.” As fact is commonly stranger than fiction, the wildly common, implausible Wall Road epic generally known as Purchase the Dip ( ‘CUZ NUMBER GO UP) is the longest operating, largest blockbuster hit by a longshot. Over $60 trillion in U.S. field workplace receipts and counting.

The present U.S. bull market is probably the most enduring ever, by our reckoning. Optimists have minimized this cycle’s advance by religiously adhering to a popularized bear market classification of a 20% decline from a latest peak. Below this charitable definition, the present bull run is comparatively younger—a mere adolescent within the chronicles of market cycles. But, on the newest “official” cycle trough recognized on October 12, 2022, the S&P 500 ((SP500), (SPX)) was nonetheless greater than any level earlier than two years prior, which was a interval showered with exceptional fiscal and financial lodging. The 2022 dip wasn’t a bear occasion as a result of it did not minimize deep sufficient, like spilling a couple of drops from a bottle of champagne.

If not 2022, then absolutely 2020’s lockdown plummet certified as a bear market, proper? Improper, in our opinion. Whereas the start of the pandemic produced significant worth in lots of shares, the chance was gone within the blink of an eye fixed. The S&P 500 lived at a loss higher than 20% for barely greater than 3 weeks and was hitting new data inside 5 months! This was not a teachable second for buyers, as evidenced by the Washington-driven mania that quickly adopted.

# Consecutive Buying and selling Days S&P 500 was >20% Beneath its Report Excessive

| Date Vary | Description | # Days in a Row | Max Drawdown* |

|---|---|---|---|

| September – October 2022 | Inflation + Tightening | 24 | -25.4% |

| March – April 2020 | Pandemic | 17 | -33.9% |

| Sept. 2008 – December 2010 | Housing Bubble | 567 | -56.8% |

| July 2001 – March 2005 | Tech Bubble | 919 | -49.1% |

| October 1987 – March 1988 | Black Monday | 97 | -33.2% |

| March 1974 – January 1976 | OPEC / Inflation | 452 | -48.2% |

| April 1970 – October 1970 | Nifty Fifty Bust | 121 | -36.1% |

| March 1953 – January 1954 | Korean Battle Recession | 202 | -28.7% |

| April 1930 – August 1952 | Nice Despair | 5,567 | -86.2% |

| * Supply: Bloomberg; S&P 500 closing costs, drawdown is % change from report excessive; Previous efficiency isn’t a assure of future outcomes. |

We submit that if a bear market takes much less time to play out than your subsequent haircut, it isn’t a bear market. The final time buyers skilled a downturn extreme and extended sufficient to maim animal spirits was in the course of the 2008 Credit score Disaster . Regardless of monumental intervention from the federal government and Federal Reserve, it took the market 5.5 years to get well its pre-crisis peak, which was ahead of the 7 yr claw again after the dot com bubble burst. Even these cycles had been truncated in comparison with earlier intervals. Within the Nineteen Seventies, equities went sideways for a decade. Shares spent 1 / 4 century climbing out of the Nice Despair’s market crater earlier than reasserting new highs. The present technology of buyers has been conditioned to anticipate a painless expertise. We’re smooth.

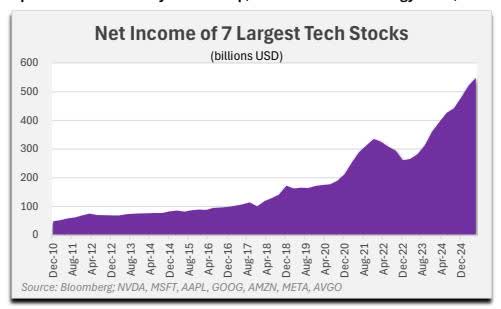

In equity, the passage of time alone isn’t adequate justification for shares to take an compulsory retreat. Undoubtedly, earnings progress for the market’s largest enterprises has been spectacular. Twenty years in the past, one know-how firm was among the many S&P 500’s ten most worthwhile companies (Microsoft (MSFT)). Ten years again, two made the record. Right now, six out of the ten highest incomes companies hail from the tech sector, and the share of S&P earnings from its prime ten earners has reached a report 35% in comparison with 23% a decade in the past. The seven largest corporations within the Index by market cap, that are all know-how companies, have skilled a six-fold surge in collective earnings over the past ten years to exceed half a trillion {dollars} yearly. We’re so outdated we keep in mind when windfall earnings taxes on Exxon (XOM) had been floated in the course of the oil value spike of 2005-2008, when the oil large crossed $30 billion of earnings, and once more in 2022, when the White Home mentioned Exxon made “more cash than God.”

Bulls have argued that valuations for the market’s leaders will not be as prolonged as in March 2000, as if being much less overvalued than the tech bubble’s absolute peak is a convincing place. Again then, the market was propelled by Web and telecom exuberance, with Cisco, Intel (INTC), and Lucent Applied sciences among the many largest U.S. corporations. The mixture market capitalization of those ten companies crested at 36% of 1999 GDP. Right now, AI enthusiasm abounds, and the worth of the highest ten mega caps is 80% of GDP. They’re much greater cogs within the financial wheel than the cohort from 25 years in the past. The present group is buying and selling for 35x mixture earnings (39x for simply tech members), when summing the market caps of the highest companies and dividing by their collective earnings. It is a princely a number of underneath virtually any situation. When you have got the world’s largest corporations accounting for the most important share of financial output in a century and with report revenue margins busting on the seams, a sub 3% earnings yield feels a bit backward-looking.

S&P 500 Ten Largest Firms by Market Capitalization

High 10 Common 75.8 High 10 Common 57.1

March 24, 2000: Tech Bubble Peak | September 30, 2025: Current | ||||||

|---|---|---|---|---|---|---|---|

| Firm | Market Cap (billions) | P/E | Firm | Market Cap (billions) | P/E | ||

| 1 | Microsoft | 561 | 64.1 | 1 | Nvidia | 4,533 | 52.4 |

| 2 | Cisco Techniques (CSCO) | 547 | 215.0 | 2 | Microsoft | 3,850 | 37.8 |

| 3 | Normal Electrical (GE) | 522 | 48.8 | 3 | Apple (AAPL) | 3,779 | 38.1 |

| 4 | Intel | 464 | 63.4 | 4 | Alphabet ((GOOG) (GOOGL)) | 2,943 | 25.5 |

| 5 | Exxon | 269 | 34.0 | 5 | Amazon (AMZN) | 2,342 | 33.2 |

| 6 | Walmart (WMT) | 247 | 46.0 | 6 | Meta (META) | 1,845 | 25.8 |

| 7 | Oracle (ORCL) | 245 | 128.4 | 7 | Broadcom (AVGO) | 1,558 | 82.3 |

| 8 | Pfizer (PFE) | 220 | 69.2 | 8 | Tesla (TSLA) | 1,479 | 243.8 |

| 9 | IBM (IBM) | 215 | 27.9 | 9 | Berkshire Hathaway (BRK.B) | 1,085 | 17.2 |

| 10 | Lucent Applied sciences | 203 | 61.5 | 10 | JP Morgan | 867 | 15.3 |

| *Supply: Bloomberg | *Supply: Bloomberg | ||||||

| High 10 Common | 75.8 | High 10 Common | 57.1 | ||||

| High 10 Median | 62.5 | High 10 Median | 35.5 | ||||

| High 10 Mixture | 58.7 | High 10 Mixture | 35.2 | ||||

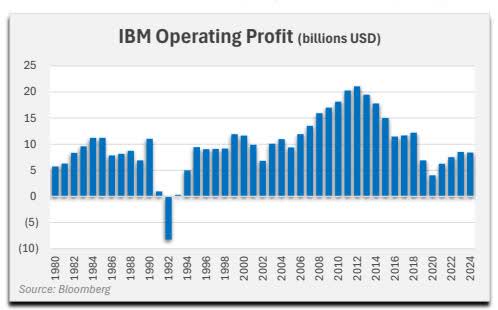

Miracles do occur, we’ll admit. IBM, which commercialized computing, was as soon as not solely the best valued firm on this planet (Sixties-80s), it was additionally an AI pioneer beginning within the Nineteen Fifties and evolving to its Deep Blue chess supercomputer within the ’90s. Though IBM hasn’t grown working revenue in 4 many years, buyers are at present attaching a 22x EBITDA a number of and 45x P/E to its stagnant enterprise. An outdated Massive Blue promoting slogan appears apropos: IBM, what makes you particular?

From our perspective, to have a bullish view on the most important know-how shares right now, three questions should be answered affirmatively:

- 1) Will AI change the world?

- 2) Will the general public firm leaders within the area stay as worthwhile?

- 3) Is it not but priced in?

For most individuals, presently , AI can finest be described as one thing between a non-event and a radically upgraded search engine. Nonetheless, even for those who, like many, anticipate AI’s affect on society to finally be life altering, you may nonetheless be unconvinced of the funding case for the marquee AI shares. Nvidia’s torrid progress and 50%+ web revenue margin, the spoils of its AI semiconductor management, will probably be exceedingly troublesome to maintain in the long term, in our opinion, given the tempo of technological evolution. Meta, #2 within the margin standings (40% web) among the many largest companies, is a close to $2 trillion tech colossus that exists primarily for leisure, utilizing machine intelligence to energy its productiveness sapping algorithms. However, even when the AI motion continues and its present principal beneficiaries stay entrenched of their catbird seats, do present valuations already replicate their moats? Is Apple at 38x trailing earnings and three% whole income progress since 2022 leaving room for any regulatory setbacks or market share fluctuations traditionally skilled by client electronics corporations? Ought to Oracle’s worth catapult greater by 1 / 4 trillion {dollars} in someday, taking it to over 60x earnings, based mostly on cloud contracts from a single, unprofitable AI frontrunner that can require huge up-front spending?

In his 2011 essay “Why Software program is Consuming the World,” Marc Andreesen described how software program was taking up giant elements of the economic system. He suggested to cease continuously questioning the valuations of the brand new technology of know-how corporations, however as an alternative to examine how they might affect the enterprise world. Within the 14 years since, software program has additional consumed not solely the economic system but additionally the investing mindshare, and the chance value of questioning tech valuations has been monumental. Palm Valley’s small cap focus exempts us from making portfolio calls about big know-how enterprises, and small cap success tales sometimes graduate from their benchmark earlier than they depart an outsized affect. Nvidia, for instance, visited the Russell 2000 for under a yr after its 1999 IPO. However, for these targeted on controlling threat, we might counsel that precise losses are extra biting than alternative losses, and shopping for mature companies at 25x-50x earnings has traditionally uncovered you to extra of the previous than the latter.

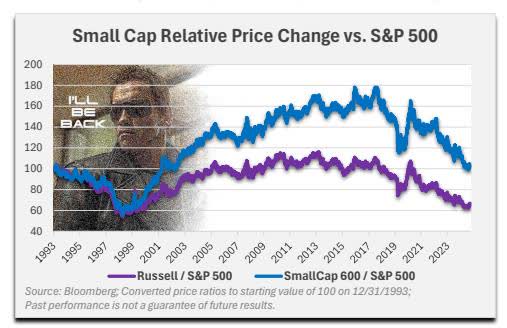

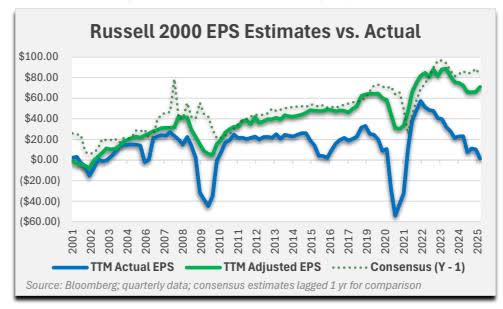

Many small cap buyers have bemoaned their underperformance versus greater corporations over the past decade. With the conviction of a well-armed bodybuilder in a biker jacket and wraparound shades, they’ve pledged again and again, “I will be again.” Though small cap indices practically commerce at their lowest value ratio versus the S&P 500 in over twenty years, there isn’t any assure they’ll reclaim the excessive floor anytime quickly, or ever. The Russell 2000, particularly, is populated with scores of low high quality, speculative companies which will depart a everlasting scar on the benchmark as they fade away and are changed. That is one purpose for the Russell’s underperformance versus the S&P SmallCap 600 within the years because the tech bubble implosion.

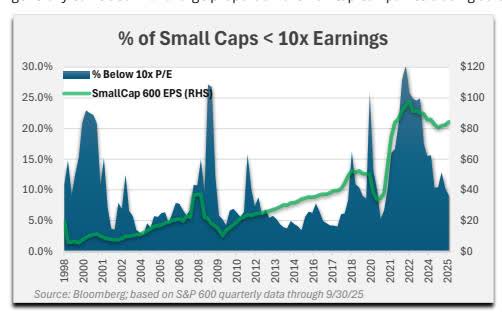

Small caps at present seem cheaper than giant caps, however they don’t seem to be low-cost by historic requirements. The median S&P SmallCap 600 constituent is buying and selling for 25x trailing earnings (30x ex-financials). Granted, earnings multiples inform solely a part of the story, and at Palm Valley, we frequently purchase positions with under regular profitability buying and selling at elevated multiples.

Nonetheless, previous intervals of compelling valuations have usually coincided with a big proportion of small cap corporations buying and selling at low multiples, similar to in 2000, 2008, and 2020. The cluster of low P/E shares lingering from 2022-2023 was an exception following the pandemic’s earnings tsunami, when small cap earnings (S&P 600) greater than doubled from deficit spending. As extra margins have waned for some companies and buyers have grow to be extra bullish on small caps, the amount of low a number of shares has declined.

The high-pressure marketing campaign by the Trump administration on the Fed to decrease rates of interest supplied the catalyst for small caps to start recovering a number of the floor ceded to giant caps, with the Russell 2000 hitting new data after the FOMC assembly on September seventeenth. We recognize the repute of the vaunted Fed being heckled down a notch. Cries of threats to the Fed’s independence appear pointless to us, since that independence hasn’t lately mattered for something in addition to the liberty to inflate belongings. But, because the Fed smear ways are rooted in a misplaced want for simpler cash, we will solely benefit from the Fed’s costume down midway. Changing Jerome Powell with the Dow (DOW) 36,000 man is not going to unravel our wealth inequality points. No matter our view that Fed price reductions are simply settling the stability for already inflated belongings and won’t meaningfully enhance entry to capital that was by no means that tight, pundits are as soon as once more claiming the elusive small cap rotation has commenced. It affords a handy speaking level for asset allocators. Nonetheless, $3 trillion of whole fairness worth for a pair thousand small caps can solely go up to now in changing publicity to mega caps.

There isn’t any scarcity of present bullish takes that conceal a completely priced small market with guises of relative cheapness, similar to undependable ahead earnings multiples or revelations data-mined from the valuation mountaintops. Small caps, as mirrored by the Russell 2000, collectively produced primarily no GAAP earnings over the trailing twelve months. When utilizing adjusted numbers that omit something administration classifies as non-recurring, small caps failed to satisfy consensus estimates or produce earnings progress in three years. It is a distinction, whether or not justified or not, that helps clarify their divergence from giant cap shares, that are much less more likely to apply materials non-GAAP changes to earnings.

Small cap revenue shortfalls haven’t been common, and buyers have been most forgiving for greater high quality corporations. They appear to be assuming the revenue positive aspects accrued because the pandemic are largely sustainable. At Palm Valley, we’re avoiding companies which have exhibited sturdy efficiency past historic norms and have seen their shares rewarded for it, successfully pricing in the established order of continued deficit spending and an setting that fosters hypothesis. We choose the shares of corporations experiencing present business stress. Because the total political machine is working to make the asset and revenue increase a unending story, ours is certainly a contrarian place! The small cap alternatives, in our judgment, exist on the uncared for periphery, not within the core.

Through the quarter, the Palm Valley Capital Fund elevated 2.35%, trailing the 9.11% acquire for the S&P SmallCap 600 and seven.99% enhance for the Morningstar Small Cap Whole Return index. Small cap shares outperformed giant caps in the course of the interval on investor expectations of Fed easing and decreased considerations concerning the affect of tariffs on company earnings. Efficiency was strongest for the extra speculative elements of the market, with the Russell 2000 Index outperforming the S&P SmallCap 600 by over 300 foundation factors within the third quarter. The Fund held 73.5% in money equivalents at first of the quarter and 74.1% on the finish. Excluding money and the affect of fund bills, the Fund’s fairness positions rose by 6.46% over the three months.

We acquired 4 positions in the course of the third quarter, together with three names new to the Fund—Teleflex (TFX) (ticker: TFX), Robert Half (RHI) (ticker: RHI), and LKQ (ticker: LKQ)—and one returning member, Avista (AVA) (ticker: AVA).

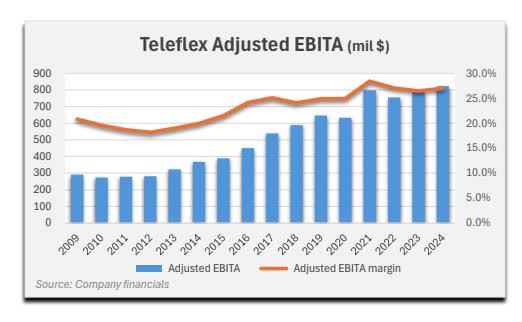

Teleflex produces single-use medical units (92% of income) utilized by hospitals and healthcare suppliers in essential care and surgical procedures, together with catheters, stents, clips, and instruments utilized in anesthesia, respiratory, and urological purposes. The corporate’s inventory has been punished as a result of short-term income weak point in sure classes along with investor uncertainty about latest main strategic selections, together with a big, debtfinanced acquisition introduced in February on the identical day that administration offered a plan to separate the enterprise into two unbiased corporations. Teleflex affords income stability with excessive working margins and beneficiant free money circulation. Shares are buying and selling close to a report low valuation regardless of above-average enterprise high quality.

Robert Half gives staffing and consulting companies by way of the Robert Half and Protiviti manufacturers. The agency focuses on finance and accounting placements and in addition gives labor for know-how and workplace roles. Outcomes have been pressured by weak point within the staffing business, which has disconnected from the higher labor market as a result of distinctive options of the post-COVID economic system. Moreover, some buyers have considerations concerning the ongoing demand for finance staffing if AI displaces sure jobs.

Whereas Robert Half’s staffing developments have mimicked the business, general efficiency has been supported by sturdy developments for the Protiviti consulting section, which has successfully leveraged Robert Half’s sources into successful share in opposition to Massive 4 rivals. Though trailing outcomes for all the firm are under regular, Robert Half stays worthwhile and money generative. It has zero debt and affords a 7% dividend yield, which is supported by money circulation. The corporate’s goal white collar market might expertise a delayed demand trough versus blue collar momentary labor, however we’re assured Robert Half will probably be an business survivor.

LKQ Company (LKQ) is the most important distributor of aftermarket and recycled auto elements in the USA and Europe. It is a roll-up success story. Within the U.S., the corporate focuses on collision merchandise (e.g., headlights, fenders, bumpers, paints). In Europe, LKQ’s elements providing is usually mechanical in nature (e.g., engines, brakes, suspension). Not like different main auto elements distributors, LKQ sources a major share of its elements by recycling outdated autos bought from auctions and saved on the agency’s junkyards. Promoting auto elements for broken autos has usually been a recession resistant enterprise. Demand is pushed by a number of elements together with the variety of repairable auto insurance coverage claims, elements inflation and complexity, the growing older and measurement of the automotive parc, the willingness of insurers to make the most of non-OEM elements, and structural developments similar to accident avoidance know-how and the shift to digital autos.

LKQ’s inventory has fallen as declines in repairable claims have negatively impacted the corporate’s outcomes. Administration attributes the developments to a weak economic system, excessive auto insurance coverage charges, and elevated restore prices, that are inflicting car homeowners to defer and ignore repairs. These are cyclical elements. LKQ has lengthy outperformed business auto claims by way of excessive service ranges and share positive aspects. The corporate’s key aggressive benefit is its in depth distribution community that ends in fill charges considerably greater and quicker than most rivals. Moreover, LKQ affords restore retailers a number of choices for elements, starting from OEM to new aftermarket to recycled. Whereas LKQ at present has 2.5x leverage, the corporate generates prodigious free money circulation and may delever rapidly. The inventory lately touched a five-year low and is buying and selling for 10x earnings, 8.5x EBITA, and gives a 3.9% dividend yield.

We additionally purchased a small place in Avista Company (AVA) in the course of the quarter. Based in 1889, Avista is an electrical and pure fuel utility working in Washington, Oregon, Idaho, and Alaska. We repurchased its shares after a weaker than anticipated earnings report and a decline in its inventory value. Whereas the corporate has suffered impairments on a few of its clear power investments, its core utility enterprise continues to carry out nicely and makes up most of our valuation. We imagine profitable price instances in its regulated utility enterprise will create earnings readability and progress in 2025 and 2026. In our opinion, Avista is at present attractively priced, buying and selling at 14x anticipated earnings, 1.2x tangible e book worth, and affords a 5.2% dividend.

| High 10 Holdings (9/30/25) | % Property |

|---|---|

| Sprott Bodily Silver Belief (PSLV) | 2.45% |

| Amdocs (DOX) | 2.44% |

| Kelly Providers (KELYA) | 1.77% |

| Heartland Categorical (HTLD) | 1.75% |

| WH Group (OTCPK:WHGLY) ADR | 1.49% |

| Sprott Bodily Gold Belief (PHYS) | 1.47% |

| Northwest Pure (NWN) | 1.28% |

| Chord Vitality (CHRD) | 1.23% |

| ManpowerGroup (MAN) | 1.01% |

| Forrester Analysis | 0.98% |

Through the third quarter, we offered our funding in Seaboard (SEB) Company (ticker: SEB). Seaboard was acquired in late 2024 at a big low cost to tangible e book worth, which elevated within the first a part of 2025 to just about 50%. Though the corporate’s working outcomes are risky as a result of its participation in cyclical industries like hog farming, grain buying and selling, and marine transport, century-old Seaboard has generated earnings all through numerous enterprise cycles. The asset-heavy firm is aggressively deploying money flows into modernizing and increasing its infrastructure. Seaboard’s shares rallied sharply within the quarter, exceeding our valuation.

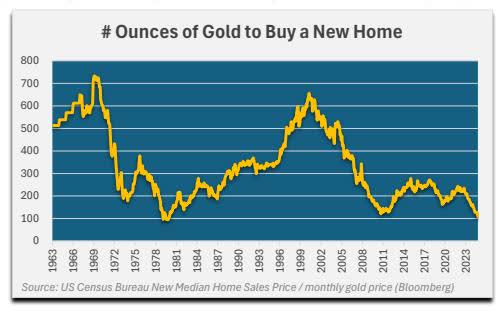

The Fund’s three largest contributors within the third quarter had been the Sprott Bodily Siver Belief (PSLV) (ticker: PSLV), Seaboard, and the Sprott Bodily Gold Belief (ticker: PHYS). Silver and gold catapulted greater over the three months ending September thirtieth, extending a powerful surge in 2025. It is the R.E.M. commerce: Return to Simple Cash. We have owned valuable metals within the Fund for the final 5 years as a bulwark in opposition to inflationary insurance policies, given our excessive allocation to money equivalents. Regardless of important volatility, silver and gold have prolonged their buying energy in the course of the period of rotating asset bubbles, even outpacing housing inflation. Because the metals costs have shot greater this yr, we have offered a portion of our shares within the Sprott Trusts to handle the weightings. This has created realized positive aspects within the Fund, which we have now partly offset by realizing losses (“tax loss trades”) on parts of different positions between their scheduled quarterly monetary reviews.

The Fund had two positions negatively impacting efficiency by greater than 10 foundation factors in Q3, Flowers Meals (FLO) (ticker: FLO) and Amdocs (ticker: DOX). Flowers Meals, a market chief in bread and snacks within the U.S., got here underneath stress in the course of the quarter as a result of continued challenges within the branded bread class. Because the rising value of dwelling weighs on center to lower-income customers, there was a shift from branded to extra reasonably priced private-label breads. Moreover, broader well being and wellness developments have softened demand throughout the standard bread class. In response, Flowers is transitioning its portfolio by way of innovation and lately acquired manufacturers, similar to Easy Mills. The corporate is increasing into higher-growth “better-for-you” segments, the place outcomes have been encouraging for natural breads and snacks. Whereas working efficiency is more likely to stay underneath stress by way of the rest of 2025, we imagine a stabilization in core branded bread volumes—mixed with continued progress in its healthoriented class—ought to help a return to extra normalized revenue margins in 2026. Flowers’ inventory is at present buying and selling at 13x our estimated 2025 EPS. Regardless of being out of favor, Flowers has maintained its market-leading manufacturers, generates significant money circulation, and has an extended historical past of navigating by way of business headwinds.

Amdocs, which is without doubt one of the Fund’s largest positions, posted a modest share value decline within the interval regardless of persevering with to ship regular positive aspects in working revenue. Buyers much less aware of the corporate could also be confused by latest decreases within the prime line, which stemmed from an intentional disposition of sure no-margin, non-core companies. Our valuation for Amdocs has elevated reliably through the years. As a result of firm’s working stability, wonderful stability sheet, and robust aggressive place in serving to its clients modernize their networks, we assign the shares an above common valuation a number of.

“Include me if you wish to reside.” -Terminator to Sarah Connor ( T2: Judgment Day , 1991) or U.S. Authorities to Intel Company (2025)???

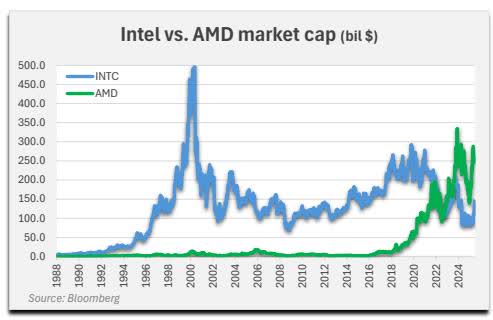

Intel was as soon as the dominant pressure in CPUs. The corporate briefly attained the best market cap on this planet in August 2000, peaking at $509 billion. Missteps allowed rivals to take share in designing and manufacturing superior chips. AMD, as soon as a pipsqueak when Wintel reigned over the PC market, surpassed Intel in market capitalization in 2022. Nvidia claimed the quickly rising GPU (graphics processing unit) market used for AI purposes. TSMC grew to become the main chip foundry, manufacturing chips designed by others. Intel’s profitability dived in 2022 as a result of underutilized capability and write-downs, and the previous chip champ posted a $20 billion web loss over the previous yr.

In August 2025, Uncle Sam took a ten% stake in Intel shortly after questioning whether or not the CEO’s ties to China offered a nationwide safety menace. Since then, the enterprise neighborhood has handed the plate to shore up Intel’s shaky funds ($50 billion debt), with fairness investments from Softbank (OTCPK:SFTBY) ($2 billion) and competitor Nvidia ($5 billion), in addition to discussions with Apple to take part within the capital elevate. It has been a shocking fall from grace for a former must-own know-how inventory. This isn’t a uncommon prevalence.

A significant U.S. funding financial institution lately suggested purchasers to be “responsibly bullish” regardless of excessive valuations because of the AI increase and anticipated Federal Reserve price cuts. That is the factor with Wall Road—valuations won’t ever be their purpose for warning. It is at all times a momentum commerce for them, and the bull market will probably be supported till the bear market has already began. That is the alternative of how we expect and make investments.

In Terminator 3: Rise of the Machines , John Connor, the longer term chief of the resistance, mentioned, “All I do know is what the Terminator taught me: by no means cease combating. And I by no means will.” We attempt to replicate that dedication in our administration of the Fund no matter whether or not that makes our unbiased technique look out of contact. Within the first installment of The Terminator , the T-800 cyborg was pelted by shotgun rounds, skilled flesh loss from a tanker truck explosion, carried out a self-extraction of its broken left eye, acquired blown in half by a pipe bomb, after which, with solely a functioning higher torso, crawled in relentless pursuit of Sarah Connor till lastly being crushed by a hydraulic press. Cannot cease, will not cease.

Within the sequel, Schwarzenegger’s Terminator character was reprogrammed from murderer to bodyguard and was tasked with battling a complicated T-1000 shapeshifting cyborg. Any time the T-1000 incurred harm (e.g., level clean blast, explosion, subzero shattering), its viscoelastic, liquid metallic physique would return to its unique kind. It is like punching a waterfall. How do you defeat that? It reminds us of a inventory market that ignores unhealthy information and insistently powers greater by summoning the collective sources of every part round it.

The third quarter was probably the most energetic for mergers in virtually 4 years, capped off by Digital Arts (EA)’ report setting $55 billion buyout at 28x EBITDA. Final week, the federal government reported that actual GDP grew on the quickest tempo in two years, after contracting in Q1 as a result of tariff uncertainty. The cognitive dissonance of demanding Fed motion whereas touting financial power is fascinating to observe. Markets have continued to react to authorities knowledge releases regardless of substantial proof that they don’t seem to be credible. Payrolls had been lately revised down by 1.5 million over the past two years ending in March, a interval throughout which we had been beforehand advised employment was white scorching. Now, the present administration contends that widespread tariffs will probably be absorbed by overseas exporters with no unfavourable penalties for People. Useless man strolling Fed Chair Powell, in an try to justify reducing charges, says tariffs will doubtless solely convey a one-time value affect. A one-time affect right here, a one-time affect there, and for many individuals, fairly quickly you are speaking about actual impoverishment!

Schwarzenegger’s T-800 character declared in Terminator 2 , “The extra contact I’ve with people, the extra I study.” An LLM wearing leather-based with a sawed off. For amusement, we requested AI chatbots Gemini, Chat GPT, and Grok if now is an effective time to put money into the U.S. inventory market. All of them supplied mainstream monetary recommendation, similar to it’s higher to speculate now than to attempt to time the market and the way lacking out on the perfect days can erode returns dramatically. The unoriginal solutions are what you’d anticipate from fashions constructed utilizing the collective public opinion. Dig a little bit deeper if threat issues to you.

For these of us investing from the bottom-up, does not it make sense to keep away from proudly owning shares once they commerce for considerably greater than we expect they’re value? We aren’t making an attempt to time this mature bull market—we’re sustaining our funding self-discipline. Not like the Terminator, we won’t journey again in time to 1984 valuations. Prime quality shares seem very wealthy, and that may change rapidly. Particularly for small caps, liquidity disappears while you want it most. Since algorithms now account for almost all of U.S. fairness buying and selling quantity, we anticipate the machines to amplify a decline as soon as its underway. A resurrection of the complete market cycle is crucial to injecting self-discipline again into an economic system that is grown reliant on the wealth impact. You’ll be able to program a robotic to cease, however not a person from wanting extra. Till Judgment Day, hasta la vista, child!

Thanks on your funding.

Sincerely,

Jayme Wiggins | Eric Cinnamond

Mutual fund investing includes threat. Principal loss is feasible. The Palm Valley Capital Fund invests in smaller sized corporations, which contain extra dangers similar to restricted liquidity and higher volatility than giant capitalization corporations. The flexibility of the Fund to satisfy its funding goal could also be restricted to the extent it holds belongings in money (or money equivalents) or is in any other case uninvested. Earlier than investing within the Palm Valley Capital Fund, it’s best to fastidiously contemplate the Fund’s funding goals, dangers, prices, and bills. The Prospectus comprises this and different essential data and it might be obtained by calling 904-747-2345. Please learn the Prospectus fastidiously earlier than investing. Previous efficiency is not any assure of future outcomes. Dividends will not be assured and an organization’s future skill to pay dividends could also be restricted. An organization at present paying dividends could stop paying dividends at any time. Fund holdings and sector allocations are topic to vary and will not be a advice to purchase or promote any safety. Earnings progress for a Fund holding doesn’t assure a corresponding enhance out there worth of the holding or the Fund. The S&P SmallCap 600 Whole Return Index measures the small cap section of the U.S. fairness market. The index is designed to trace corporations that meet particular inclusion standards to make sure that they’re liquid and financially viable. The Morningstar Small Cap Whole Return Index tracks the efficiency of U.S. small-cap shares that fall between ninetieth and 97th percentile in market capitalization of the investable universe. It isn’t attainable to speculate straight in an index. The Palm Valley Capital Fund is distributed by Quasar Distributors, LLC. Opinions expressed are these of the writer, are topic to vary at any time, will not be assured and shouldn’t be thought of funding recommendation. Definitions:Adjusted EBITA margin: Adjusted EBITA divided by income. Mixture P/E: P/E derived when including the market capitalizations of a complete group and dividing by the web revenue of that group. AI: Synthetic intelligence. Automobile parc: The collective whole of all registered autos in a geographic space. CPU: Central processing unit. Dividend yield: Anticipated annual dividend per share divided by inventory value. EBITA: Earnings Earlier than Curiosity, Taxes, and Amortization of acquired intangibles (i.e., working revenue). EBITDA: Earnings earlier than curiosity, taxes, depreciation, and amortization. EPS (Earnings per share): Web revenue divided by shares excellent. Free Money Circulation: Equals Money from Working Actions minus Capital Expenditures. GAAP : Usually Accepted Accounting Ideas GDP: Gross Home Product is the full worth of products produced and companies supplied in a rustic throughout one yr. IPO: An preliminary public providing is when a personal firm first affords shares to the general public. LLM: Giant language mannequin, a kind of AI educated on huge quantities of textual content knowledge. Market capitalization: Inventory costs multiplied by shares excellent. Web revenue margin: Web revenue divided by income. OEM: Unique gear producer Worth to Earnings (P/E) Ratio: A inventory’s value divided by its earnings per share. Actual GDP: Gross home product adjusted for inflation. Russell 2000: An American small-cap inventory market index based mostly available on the market capitalizations of the underside 2,000 corporations within the Russell 3000 Index. S&P 500: The Customary & Poor’s 500 is an American inventory market index based mostly available on the market capitalizations of 500 giant corporations. Tangible e book worth : Shareholders’ fairness, or whole belongings excluding goodwill and different intangibles minus whole liabilities. TTM : Trailing twelve months |

Editor’s Notice: The abstract bullets for this text had been chosen by In search of Alpha editors.