On Jan. 1, Vitalik Buterin introduced a New 12 months’s decision for the blockchain he devised approach again in 2013. It’s time, he declared, for Ethereum to step up and ship on its authentic mission: “To construct the world pc that serves as a central infrastructure piece of a extra free and open web.”

Buterin’s message is a well timed one. For greater than a decade now, Ethereum has supplied the tantalizing promise of a world pc, obtainable to anybody, that can be utilized to create decentralized options to Massive Tech’s data-gobbling monopolies. The blockchain popularized good contracts, and has been a springboard for 1000’s of initiatives backed by billions of {dollars}. It has additionally spawned legions of largely fly-by-night imitators.

Regardless of all of this, the promise of Ethereum all the time appears simply over the horizon. Lately, the blockchain has come to resemble that may’t-miss sports activities prospect who can’t fairly hack it within the massive leagues. As a substitute of evolving into a well-liked world pc, Ethereum nonetheless seems like a sub-culture the place cliques of insiders construct esoteric purposes for one another. In response, many within the crypto world began betting on different horses like Solana that promised to ship sensible outcomes.

Ethereum’s downside, sarcastically, has been its idealism. The blockchain has a core group that believes passionately in decentralization, and is mistrustful of something resembling formal authority. That features Buterin, who stepped again from his creation a number of years in the past, preferring to let Ethereum discover its personal path ahead.

All of that is admirable, particularly in distinction to many latest arrivals on the crypto scene, whose first and solely concern is to make a buck. Sadly, it has additionally led Ethereum builders to dither within the face of apparent issues, together with congestion and excessive fuel charges. To be truthful, the blockchain has made some vital fixes—however solely after permitting piggy-back chains, often known as layer 2s, to siphon off giant quantities of income and make the crypto panorama painfully sophisticated.

Now, although, change might be within the air. Within the final two years, each BlackRock and JPMorgan Chase have launched tokenized property that settle on to the primary Ethereum blockchain. This can be a testomony to how Ethereum stays the gold customary for safety and factors to a future the place will probably be the spine of worldwide finance. The tokenized transactions additionally legitimize Ethereum’s declare to be a common pc, and will spur the mainstream adoption of different decentralized purposes for social media, identification, and extra.

For this to occur, although, the Ethereum group would require Buterin’s ongoing management. That’s why his New 12 months’s Day put up is a welcome growth. The piece bolstered the primacy of decentralization as Ethereum’s paramount worth: “We’re constructing decentralized purposes. Purposes that run with out fraud, censorship or third-party interference. Purposes that go the walkaway check: they preserve operating even when the unique builders disappear.”

Nevertheless it additionally delivered a practical piece of recommendation to the group in search of to construct this decentralized future: Get on with it, already.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Trump airdrop coming: One more Trump token is on the way in which as Reality Social introduced an upcoming drop to its shareholders by way of Crypto.com. The corporate added the token won’t be transferable and “can’t be exchanged for money” however may turn into redeemable for Trump Media reductions. (FT)

Memecoin distress: In a 12 months that noticed silver outperform each different asset, Bitcoin notched a 5% lower in 2025. However the greatest losers of 2026 have been memecoins with Dogwifhat down 91%, $TRUMP down 93% and Milei’s $LIBRA down 99%. (WSJ)

Higher late than by no means: The U.S. head of PWC, echoing earlier statements from its Massive 4 friends, says the consulting agency determined to “lean in” to crypto in mild of the brand new regulatory surroundings. The agency is actively offering audits and recommendation to shoppers. (FT)

Bitcoin bounces again: The crypto market is off to a powerful begin in 2026 as Bitcoin climbed over $93,000 and altcoins posted positive aspects even because the financial influence of occasions in Venezuela stay unsure. (Bloomberg)

Counting cash: In a key growth in company accounting, the usual setting physique FASB will formally discover whether or not corporations can deal with stablecoins as money equivalents. (WSJ)

MAIN CHARACTER OF THE WEEK

@cipherstein

Ilya Lichtenstein, the mastermind behind the multi-billion greenback Bitfinex hack, is the newest crypto felony to stroll free. He now faces a destiny many would regard as worse than jail—resuming home life together with his rapper spouse Razzlekhan.

MEME O’ THE MOMENT

@lopp

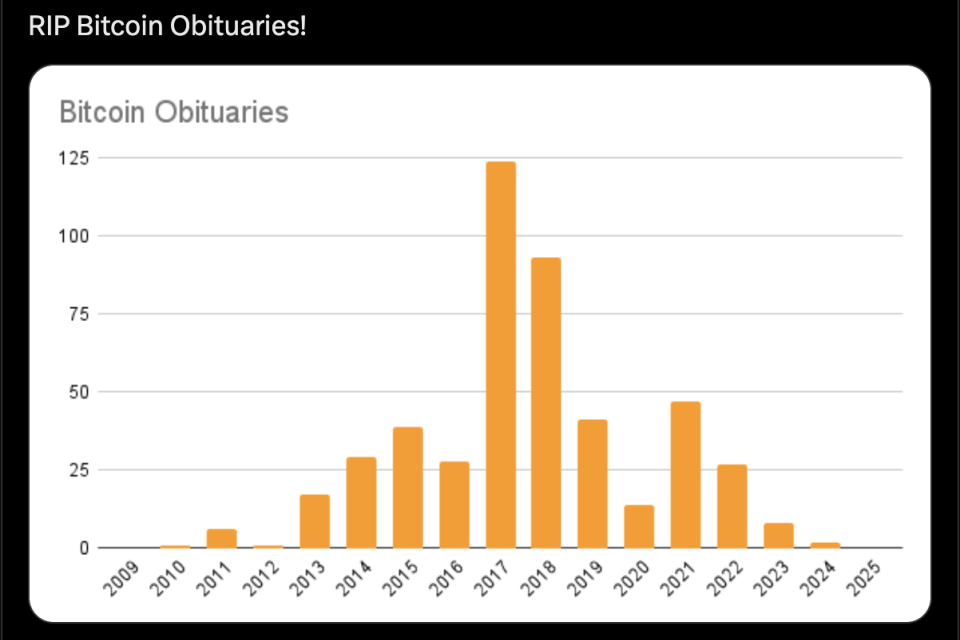

It was as soon as trendy for journalists to grab on worth slumps with a purpose to write sneering columns predicting Bitcoin’s demise. These “Bitcoin obituaries” persevered nicely after the forex’s viability grew to become clear, however now seem to have lastly light altogether.