southtownboy/iStock through Getty Photographs

The DKCI Fund was up 9.36%1 in June (-3.52% YTD1 & +45.33% trailing twelve months1).

In June we sat down and bought updates with a majority of our giant investments, and we’ll spotlight their short-term developments in addition to the long-term outlooks under. We even have a pair upcoming IPOs that ought to present an excellent return for the fund.

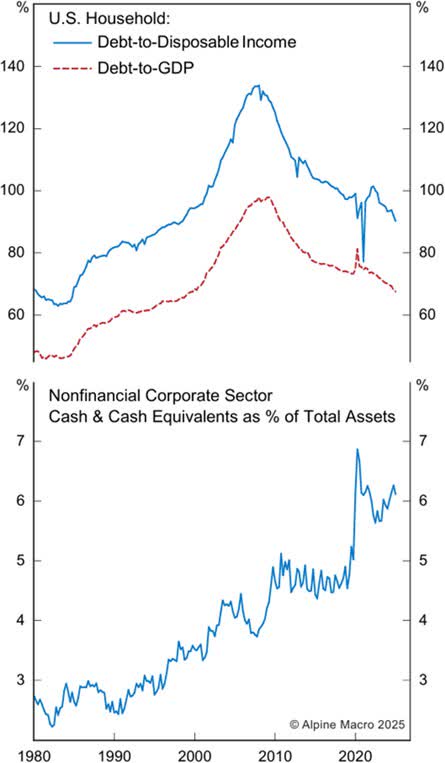

From a macro perspective, the day-to-day market volatility has been tied to the political atmosphere. Nevertheless, we see a powerful second half of the 12 months that carries into 2026 as a result of firm earnings are sturdy; shopper and firm steadiness sheets are sturdy; and inflation goes in the correct path, which implies rates of interest ought to proceed to go in the correct path, which can help inventory market multiples.

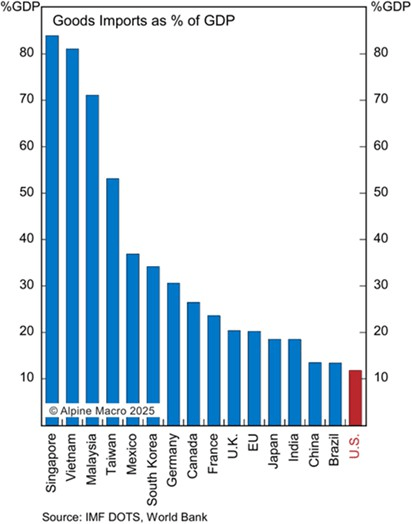

Should you run the numbers on growing inflation on account of tariffs in opposition to declining home/rental charges and continued decline in companies, the general inflation fee remains to be set to say no. Imports are necessary, particularly for sure industries, however they aren’t as necessary to the general financial system because the headlines would make it appear.

1 Time weighted return as of June 30, web of charges and bills

The November 2026 mid-terms are necessary, and Trump and the remainder of the Republicans might want to shift focus away from tariffs to extra interesting initiatives like tax cuts and deregulation. However, we nonetheless don’t wish to put money into companies with tariff publicity.

After we undergo our investments one after the other, the quantity of progress and alternative over the subsequent 6-12 months is extraordinarily engaging. We’ll focus on just a few of the businesses under which have had latest notable developments.

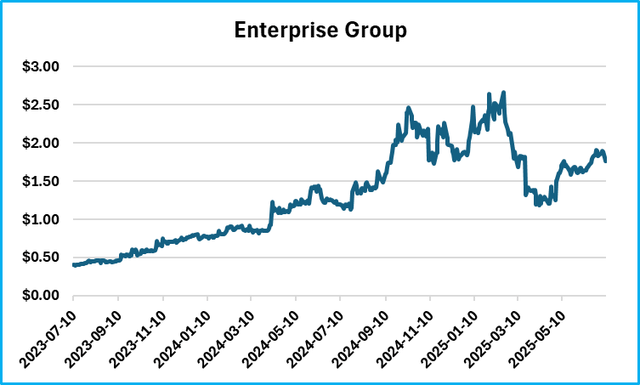

Enterprise Group (E)(E:CA)

- Enterprise closed their acquisition of Flex Power Canada on Could 8th. Their subsequent quarter will embody roughly 2/3rd of Flex’s quarter, which can give buyers a glimpse into the profitability of the ~60 service contracts and 17 generators in operation.

- Now Coastal GasLink and the LNG Canada export facility in Kitimat are operational, and the primary ever cargo of Canadian LNG was despatched to Asia on the finish of June. The inaugural cargo comes almost 15 years after the primary software for a licence to export LNG from the West Coast was submitted to federal regulators. This contains 7 years of building and estimated $48B in prices. Canada LNG is the bottom price pure gasoline on the planet, which helps important demand throughout a time of constrained energy provide.

- Final e-newsletter, we highlighted certainly one of Flex’s everlasting installations in Alberta the place the generators are used to energy and warmth a neighborhood middle. These generators save the constructing from drawing on {the electrical} grid and save the constructing vitality prices (good ROI). There are additionally case research the place the generators are used to energy and warmth giant rental buildings.

- Throughout our latest assembly with Enterprise many of the dialogue was round increasing their energy options in everlasting installations. They plan on focusing on the design & construct corporations like Stantec (STN)(STN:CA), the place they’ll be concerned early within the building course of.

- We anticipate the enterprise to point out important energy within the second half of this 12 months with sturdy Q3 and This fall earnings in 2025.

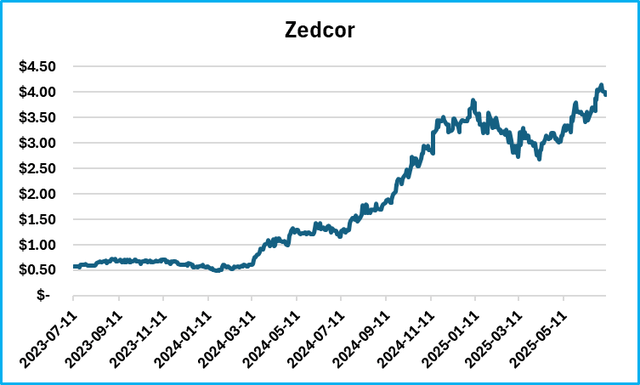

Zedcor (ZDC)(OTCPK:ZDCAF)(ZDC:CA)

- Zedcor inventory continues to carry out properly because the enterprise continues to execute their technique. They’re nearing Amazon certification, so in the event that they win that enterprise, we’d considerably increase our forecasts.

- Raymond James made an excellent level of their, that Blackline Security (BLN)(BLN:CA)(OTCPK:BLKLF) which is rising at ~20% with ~10% EBITDA margins, trades at 23x EBITDA, whereas Zedcor is rising at 70% with 35% EBITDA margins, trades at HALF the a number of.

- This is only one instance of why Zedcor has important upside from these ranges. Based mostly on our mannequin, if Zedcor hits 2027 targets, it can generate $48M in money earnings. At that stage we’d anticipate the inventory to be above $9/share in comparison with buying and selling at $4/share as we speak.

- The above situation doesn’t think about enterprise wins, just like the potential Amazon deal or success of their new larger margin product Z-Field.

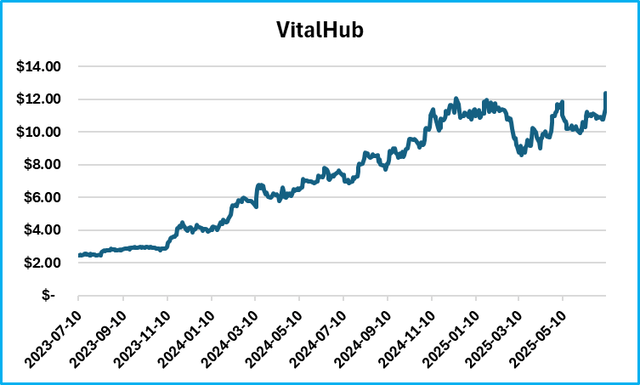

VitalHub (VHI)(OTCQX:VHIBF)(VHI:CA)

- We met with VHI administration in June, and the main focus of the dialogue was on progress, margins, and outlook. They only introduced the acquisition of Novari Well being for $44M which matches their said focus of rising their affected person referral software program. 90% of affected person referrals are nonetheless achieved by fax/cellphone. Novari and VitalHub’s Strata software program are seeing sturdy progress as this a part of the healthcare system digitizes. Identical to VitalHub’s previous acquisitions, they’ll be capable of cross-sell Novari, in addition to rapidly enhance their profitability. Throughout our assembly, VHI famous how rapidly they consider their latest Induction acquisition will attain their profitability targets.

- They’ve three AI merchandise in R&D on account of shopper demand. It’ll in all probability be in 2027 when these merchandise are being rolled out in scale, however they’ve a big quantity of knowledge to coach off of.

- We requested administration in regards to the latest shelf prospectus they filed. The quantity ($200M) is only a placeholder, they usually don’t plan on utilizing it anytime quickly, but it surely offers them the pliability to lift rapidly and effectively if a big acquisition comes throughout the desk. In the event that they purchase one other $35M in income over the subsequent 12 months, that may price them roughly $100M and they’re at the moment sitting on $40M of money, no debt, and producing ~$30M of money per 12 months.

- The Novari acquisition will get them to $120M in income they usually in all probability do one other $35M in acquired income inside a 12 months which will get them to $175M in gross sales together with natural progress.

- Based mostly on the above, they need to get to $200M in income inside 2-3 years and streamline acquired corporations’ revenue margins to ~35% EBITDA margins (in all probability even larger). This equates to ~$70M of EBITDA which ends up in a market cap of ~$1.6B, or about $28/share which is 130% greater than the place the inventory is buying and selling as we speak.

- Should you consider the 2-3 12 months outlook and technique, then these numbers above can be not less than 100% larger than the place analysts at the moment sit.

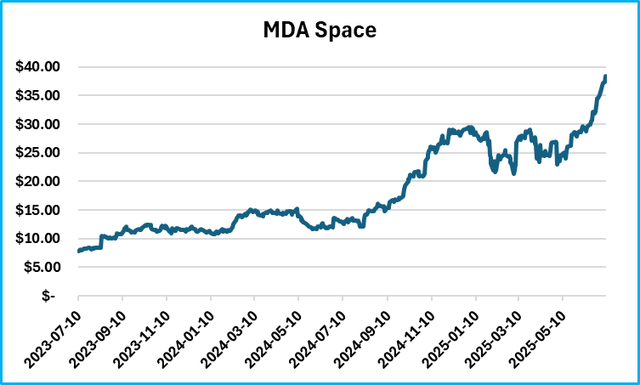

MDA Area (MDA)(OTCPK:MDALF)(MDA:CA)

- MDA closed their acquisition of Satixfy originally of July and up to date information helps important authorities funding for the Lunar Gateway, the place MDA constructs the Canadarm3.

- The space-based business is accelerating and MDA nonetheless trades at a comparatively low cost valuation when factoring of their progress and profitability.

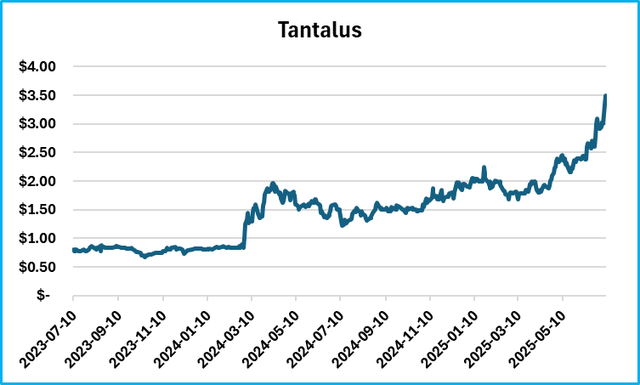

Tantalus (GRID)(OTCPK:TGMPF)(GRID:CA)

- Now we have had a small funding in Tantalus since they reached commercialization of their TruSense Gateway expertise, which is utilized by utilities to observe their electrical grid. It supplies granular entry to crucial information which improves resiliency and reliability.

- The latest information from Tantalus, is that they’ve their first giant order for his or her TruSense product which helps a reasonably important progress outlook and comes with recurring income. We are going to add to our place as their TruSense providing beneficial properties extra momentum.

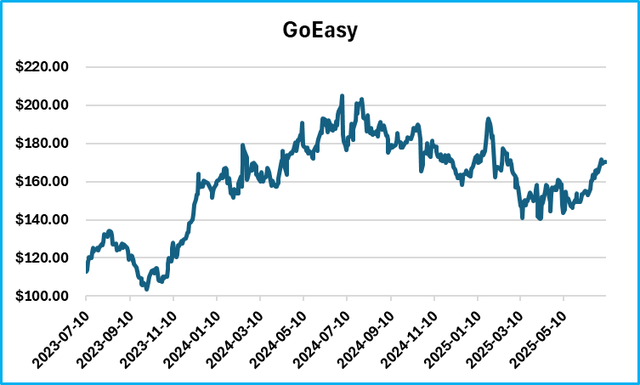

GoEasy (GSY)(OTCPK:EHMEF)(GSY:CA)

- We lately met with the brand new CEO of GoEasy and got here away with confidence that the long-term progress trajectory remains to be intact.

- In June they reached their $5B mortgage ebook goal, which was 6 months forward of schedule. They’ve now shifted discussions to attaining a $10B mortgage ebook.

- Of their phrases, “demand for our merchandise is phenomenal.” They maintain diversifying their product set and will probably be launching a card product later this 12 months. One of many principal takeaways was that there’s a lot of potential progress nonetheless in entrance of them.

- Their late-stage delinquencies are coming down month over month and their income yield ought to proceed to enhance by means of the 12 months based mostly on will increase in ancillary merchandise, improved collections and total effectivity.

Remaining Ideas

We see the primary components of inflation, charges, and earnings progress driving the market larger. The fund stays concentrated in a handful of excessive progress compounders that ought to have sturdy returns within the second half of the 12 months and into 2026.

In case you have any questions or feedback, please be at liberty to achieve out.

Regards,

J.P. Donville & Jesse Gamble

data@donvillekent.com

Editor’s Observe: The abstract bullets for this text have been chosen by In search of Alpha editors.