Chase Final Rewards factors, a bank card rewards forex, give cardholders entry to a few of the greatest resort and airline redemption switch companions within the factors and miles enterprise. Plus, Chase Journey℠, the issuer’s easy-to-use journey portal, permits you to redeem your factors for bookings like rental vehicles, resorts, flights, excursions and actions.

Regardless of growing competitors from American Specific Membership Rewards, Citi ThankYou Rewards, Capital One miles, Bilt Rewards and Wells Fargo Rewards, Chase Final Rewards has maintained its place as one of the worthwhile and helpful transferable currencies.

When you’re able to get severe about touring extra for much less, here is the whole lot you want to learn about the best way to earn, redeem and switch your Chase Final Rewards factors.

What are Chase Final Rewards factors?

Final Rewards factors are the forex of choose Chase-branded bank cards and a favourite bank card rewards forex right here at TPG. You possibly can earn Chase Final Rewards factors for on a regular basis spending on sure playing cards after which redeem them for a variety of issues, comparable to reward playing cards, money again and journey.

TPG values Chase factors at 2.05 cents apiece per our June 2025 valuations, largely as a result of you may switch these versatile factors to numerous journey companions to maximise their redemption worth.

Associated: The last word information to bank card software restrictions

How do I earn Chase Final Rewards factors?

There are a lot of methods to earn these worthwhile factors at charges of 1 to eight factors per greenback spent, relying on the Chase bank card you carry and the kind of buy. Nevertheless it’s vital to know two varieties of Chase bank card rewards: Final Rewards factors and money again.

The primary three playing cards beneath earn absolutely transferable Final Rewards factors all by themselves, whereas the remaining 4 are technically marketed as cash-back bank cards.

Nonetheless, you probably have an Final Rewards points-earning card, you may mix your Chase Final Rewards in a single account, successfully changing your cash-back rewards into absolutely transferable factors. Be aware that this is not doable with the Ink Enterprise Premier® Credit score Card (see charges and costs).

Day by day E-newsletter

Reward your inbox with the TPG Day by day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

For that reason, having a couple of Chase card could make sense to maximise your incomes and redeeming potential.

Listed here are the eight playing cards that let you earn Chase Final Rewards factors.

Chase Sapphire Most popular Card

Welcome supply: Earn 75,000 bonus factors after spending $5,000 on purchases within the first three months of account opening.

That is the usual welcome supply, price $1,538 based mostly on our June 2025 valuations.

Annual payment: $95

Why you need it: The Chase Sapphire Most popular® Card (see charges and costs) is a incredible all-around journey bank card. Along with incomes bonus factors on journey (amongst different classes), it comes with no overseas transaction charges and lots of journey perks, together with delayed baggage insurance coverage, journey interruption/cancellation insurance coverage and first automobile rental insurance coverage.

To study extra, take a look at our full evaluate of the Chase Sapphire Most popular

Apply right here: Chase Sapphire Most popular® Card

Chase Sapphire Reserve

Welcome supply: Earn 100,000 bonus factors and a $500 Chase Journey credit score after spending $5,000 on purchases within the first three months from account opening.

The welcome supply is price $2,550, in line with TPG’s June 2025 valuations.

Annual payment: $795

Why you need it: Put merely, you need the Chase Sapphire Reserve® (see charges and costs) for its incomes energy and perks that may simply cowl the annual payment. These embrace an easy-to-use annual journey credit score price $300, an annual $500 credit score for resorts booked by means of The Edit by Chase Journey (break up into two bi-annual credit), Precedence Go Choose lounge entry and entry to the rising listing of latest Sapphire lounges.

To study extra, take a look at our full evaluate of the Chase Sapphire Reserve.

Apply right here: Chase Sapphire Reserve®

Sapphire Reserve for Enterprise

Welcome supply: Earn 200,000 bonus factors after spending $30,000 on purchases within the first three months from account opening.

This supply is price an astounding $4,100 based mostly on TPG’s June 2025 valuation.

Annual payment: $795

Why you need it: The Chase Sapphire Reserve for Enterprise℠ (see charges and costs) is the perfect card for enterprise homeowners with journey bills. The cardboard presents 4 factors per greenback on airfare and resorts booked direct, 3 factors per greenback on social media and search engine promoting, a $300 annual journey credit score and a $500 credit score for resort bookings made by means of The Edit (break up up into two bi-annual credit).

Be taught extra: Who ought to get the Chase Sapphire Reserve for Enterprise card?

Apply right here: Sapphire Reserve for Enterprise

Ink Enterprise Most popular Credit score Card

Welcome supply: Earn 90,000 bonus factors after spending $8,000 on purchases within the first three months from account opening.

This welcome supply is price $1,845 in line with TPG’s June 2025 valuation.

Annual payment: $95

Why you need it: The Ink Enterprise Most popular® Credit score Card (see charges and costs) is without doubt one of the greatest bank cards for small-business homeowners, providing 3 factors per greenback on the primary $150,000 spent in mixed purchases on journey, delivery, web, cable and cellphone providers, and promoting made with social media websites and serps every account anniversary 12 months.

To study extra, take a look at our full evaluate of the Ink Enterprise Most popular

Apply right here: Ink Enterprise Most popular® Credit score Card

Ink Enterprise Money Credit score Card

Welcome supply: Earn as much as $750 money again: $350 bonus money again after spending $3,000 on purchases within the first three months and an extra $400 after spending $6,000 on purchases within the first six months from account opening.

Annual payment: $0

Why you need it: The Ink Enterprise Money® Credit score Card (see charges and costs) earns bonus money again on classes like gasoline stations, eating places, workplace provide shops and web, cable and cellphone providers. Cardholders are topic to a $25,000 cap annually on mixed purchases at eating places and gasoline stations and mixed purchases at workplace provide shops and on web, cable and cellphone providers.

You possibly can convert these earnings to Final Rewards factors you probably have one of many three rewards playing cards talked about above.

To study extra, take a look at our full evaluate of the Ink Enterprise Money

Apply right here: Ink Enterprise Money® Credit score Card

Ink Enterprise Limitless Credit score Card

Welcome supply: Earn $750 bonus money again after spending $6,000 on purchases within the first three months from account opening.

Annual payment: $0

Why you need it: The Ink Enterprise Limitless® Credit score Card (see charges and costs) earns limitless 1.5% cash-back rewards on each buy. These cash-back earnings will be transformed to Chase Final Rewards factors you probably have one of many points-earning playing cards listed above, which means your small enterprise can primarily earn 1.5 factors per greenback spent on all expenses made with this card.

To study extra, take a look at our full evaluate of the Ink Enterprise Limitless

Apply right here: Ink Enterprise Limitless® Credit score Card

Chase Freedom Flex

Welcome bonus: Earn $200 money again after spending $500 within the first three months of account opening.

Annual payment: $0

Why you need it: The Chase Freedom Flex® (see charges and costs) earns 5% money again on choose bonus classes that rotate each quarter (on as much as $1,500 in mixed spending; activation required). You possibly can convert these rewards to worthwhile Chase Final Rewards factors should you even have a points-earning bank card.

To study extra, take a look at our full evaluate of the Freedom Flex

Apply right here: Chase Freedom Flex®

Chase Freedom Limitless

Welcome supply: Earn $200 money again after spending $500 within the first three months of account opening.

Annual payment: $0

Why you need it: The Chase Freedom Limitless® Chase Freedom Limitless® earns no less than 1.5% money again on all purchases, making it an awesome selection for spending in nonbonus classes like pet bills and residential enchancment. These earnings will be transformed to worthwhile Chase Final Rewards factors you probably have one of many points-earning playing cards listed above.

To study extra, take a look at our full evaluate of the Freedom Limitless

Apply right here: Chase Freedom Limitless®

Do Chase Final Rewards factors expire?

Chase Final Rewards factors don’t expire, offered you retain no less than one card that earns Final Rewards factors open. When you cancel your whole Final Rewards playing cards, you will need to redeem or switch your factors earlier than closing the final card. In any other case, you’ll forfeit the factors.

What are Chase Final Rewards factors price?

TPG values Chase Final Rewards factors at 2.05 cents apiece per our June 2025 valuations. That is largely as a result of array of worthwhile switch companions, comparable to World of Hyatt and Air Canada Aeroplan.

These choices offer you loads of flexibility in your redemptions, making Chase’s bank card rewards an awesome ecosystem for vacationers.

Nonetheless, you will get various values for Chase factors should you pursue different redemption alternatives. For instance, Final Rewards factors are price as much as 2 cents per level when reserving eligible journey by means of Chase Journey, relying on the cardboard and the precise redemption (see your rewards program settlement for full particulars).

Beginning Oct. 26, 2027, factors earned on the Sapphire Reserve and Sapphire Most popular will solely be redeemable at a price of 1 cent per level for purchases not eligible for Factors Increase. Cardholders who utilized previous to June 23 will proceed to have the choice to redeem for 1.5 cents per level in the event that they maintain the Sapphire Reserve and 1.25 cents per level in the event that they maintain the Sapphire Most popular till then.

When you have a Chase enterprise card that gives elevated redemption charges for Chase Journey, your redemption charges are staying the identical.

You may even have entry to Chase Pay Your self Again as a cardholder of any of the above playing cards, and there are often presents to redeem Chase factors for merchandise or reward playing cards at an enhanced worth.

Lastly, Chase factors are price 1 cent apiece if used for easy money again.

The best way to redeem Chase Final Rewards factors

When redeeming Chase Final Rewards factors, you could have three primary choices:

- Fastened-value, non-travel redemptions (e.g., money again, reward playing cards and Apple merchandise)

- Fastened-value Chase Journey bookings

- Transfers to journey companions

The “greatest” possibility is determined by your journey wants. Factors are right here to save lots of you cash, and it’s best to use them because it fits you. That being mentioned, it’s best to purpose for the best worth at any time when doable. Here is a have a look at your choices for redeeming Chase bank card rewards.

Switch to journey companions

Chase Final Rewards presents 14 switch companions, together with 11 airways and three resort applications. All switch ratios are 1:1 (although there are occasional switch bonuses), and you will need to switch factors in 1,000-point increments.

As a result of most transfers are instantaneous, you may preserve your Chase factors in your Final Rewards account till you might be able to switch them, which offers glorious flexibility.

Transferring Final Rewards factors to journey companions is commonly probably the most worthwhile method to redeem your hard-earned factors. Our favourite candy spots embrace:

- High-tier Hyatt resorts: The World of Hyatt award chart is cheap in comparison with many rivals. You possibly can guide a few of the most upscale Park Hyatt properties in the complete portfolio, together with the Park Hyatt Maldives Hadahaa and the Park Hyatt London River Thames, for 25,000 factors per night time throughout off-peak dates. Since these resorts routinely promote for near $1,000, you may simply get no less than 4 cents per level. There’s additionally nice worth on the decrease finish of the Hyatt award chart. Class 1 resorts vary from 3,500 to six,500 factors per night time, relying on peak, commonplace and off-peak pricing.

- Iberia flights to Madrid: Spherical-trip flights from New York’s John F. Kennedy Worldwide Airport (JFK), Chicago’s O’Hare Worldwide Airport (ORD) and Boston Logan Worldwide Airport (BOS) to Spain’s capital will solely set you again 32,000 Avios in off-peak blue-class financial system, 59,000 factors in off-peak premium financial system or 81,000 factors in off-peak enterprise class once you switch your Chase factors to Membership Iberia Plus (previously often known as Iberia Plus). Contemplating that the majority airways cost no less than 60,000 miles for a one-way business-class award to Europe, you are primarily getting a 50% low cost.

- Brief-haul flights to Canada: Air Canada’s Aeroplan program now makes use of dynamic pricing for Air Canada flights and a few associate airways. In consequence, you may usually discover super-cheap short-haul tickets from the U.S. to Canada. For instance, a flight from JFK to Toronto Pearson Airport (YYZ) will be booked for below 6,000 factors one-way on many dates.

Guide through Chase Journey

You possibly can guide by means of Chase Journey and redeem factors for aircraft tickets, resort stays, rental vehicles, cruises or experiences at a set money worth per level.

As a Chase Sapphire Most popular or Ink Enterprise Most popular cardholder, you may redeem factors by means of Chase Journey for 1.25 cents apiece. When you have the Chase Sapphire Reserve, your factors are price 1.5 cents every towards journey redemptions within the portal. As a reminder, the elevated redemption charges for the Sapphire Reserve and Sapphire Most popular are solely till Oct. 26, 2027.

Nonetheless, as famous beforehand, you probably have a number of playing cards incomes Chase Final Rewards factors, you may mix your factors into the account with the best worth for Final Rewards bookings. For instance, your rewards earned with the Chase Freedom Flex will be moved to your Ink Enterprise Most popular account, thus growing their worth from 1 to 1.25 cents apiece. This can be a beneficiant supply from a bank card program.

If you’ll find cheap airfare through Chase Journey, utilizing your factors for these flights could make sense to save lots of money. Plus, within the eyes of the airline, tickets booked this manner are primarily the identical as paid fares, which means you will nonetheless earn airline miles and elite standing credit.

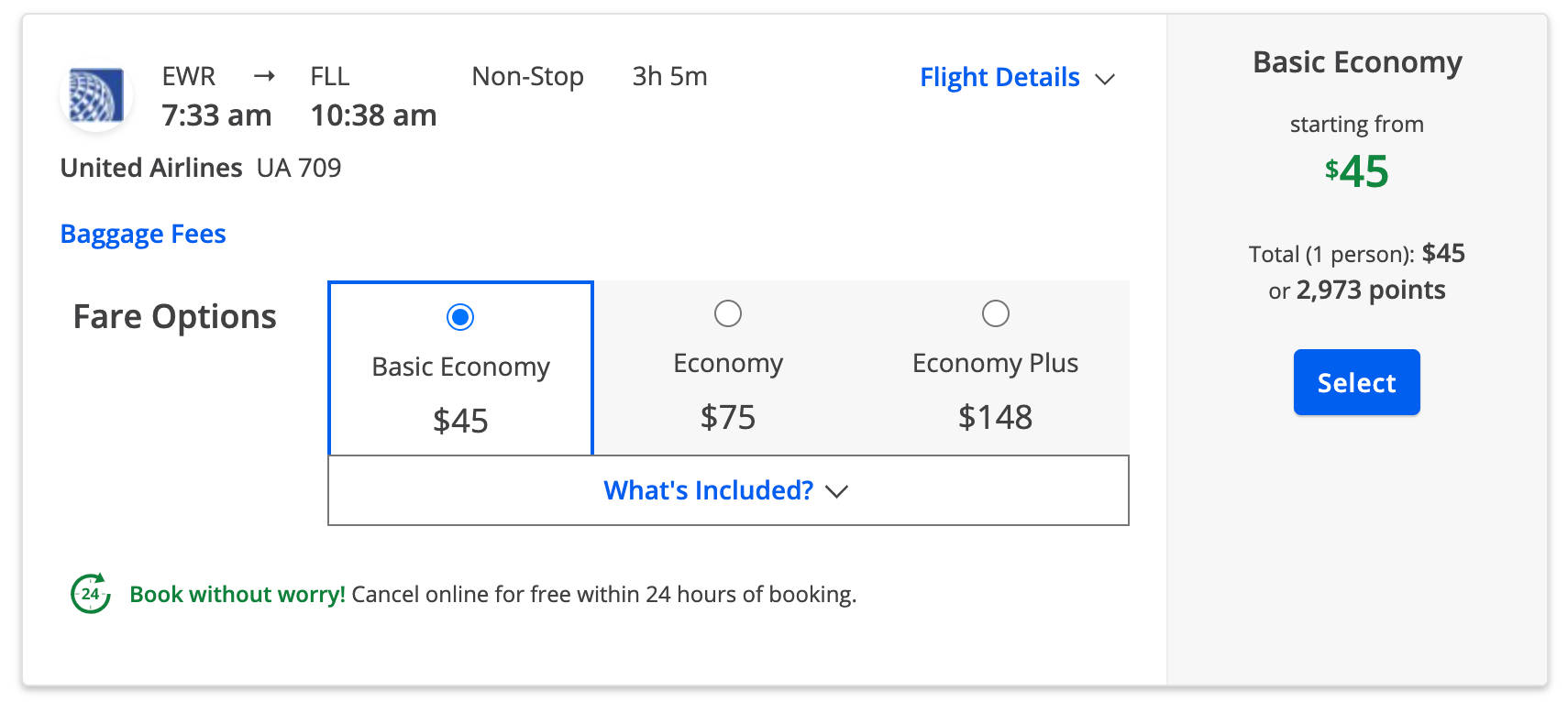

Within the case beneath, spending 2,973 Final Rewards factors from a Sapphire Reserve account to fly from Newark Liberty Worldwide Airport (EWR) to Fort Lauderdale-Hollywood Worldwide Airport (FLL) is not too shabby.

You may also think about the journey portal possibility should you solely have a handful of Final Rewards factors left, since Chase permits you to redeem factors to cowl even only a portion of the journey value. You’d then pay the remaining steadiness with money.

Lastly, this can be a first rate possibility for automobile leases, non-chain lodging and when money charges make spending factors by means of switch companions a foul worth. The resort choices are fairly different, starting from distinctive unbiased properties to chain resorts. Remember that should you guide a resort that participates in a serious loyalty program by means of Chase, you probably will not earn resort factors or be capable of reap the benefits of any elite standing perks.

Nonetheless, The Edit by Chase Journey now permits you to earn resort factors and elite advantages at choose properties. This lets you double dip, incomes rewards by means of the resort program and bonus Chase Final Rewards factors. Plus, reserving by means of The Edit offers you entry to further perks like complimentary breakfast, room upgrades, late checkout and an as much as $100 property credit score.

Take pleasure in fixed-value, non-travel redemptions

You possibly can redeem Chase Final Rewards factors for an announcement credit score or financial institution deposit at a flat price of 1 cent every. This price additionally applies to reward playing cards and Apple merchandise (outdoors of a limited-time particular).

Nonetheless, with Chase Pay Your self Again, you may redeem factors for money again at a price of 1 to 1.5 cents every, relying in your card. This redemption price is legitimate on assertion credit towards rotating buy classes. Be sure you take a look at our article on the present Chase Pay Your self Again classes.

Lastly, you may hyperlink your eligible Chase playing cards to your Amazon account and pay for purchases with the Store with Factors program. Nonetheless, you’ll solely obtain a worth of round 0.8 cents per Final Rewards level, so we do not advocate this redemption.

You may usually get a lot better worth out of Chase’s bank card rewards with this system’s switch companions and Chase Journey bookings.

Backside line

Chase Final Rewards is one among our favourite bank card rewards applications at TPG. It permits you to earn bonus factors on many on a regular basis spending classes — like airfare, resorts, eating and groceries — and select from a variety of redemption choices.

For extra inspiration, take a look at a few of our favourite Chase Sapphire Most popular redemptions and prime methods to redeem Chase factors for resort stays.