deepblue4you/iStock by way of Getty Photographs

Engine Verify

A Temporary Layover. Because the pilots of your monetary journey with CDT, we deal with every change of the calendar yr as a short layover in our time along with you. Granted the solace of slightly further time earlier than our subsequent annual efficiency evaluation, every year-end is a chance to momentarily exit the cockpit, seize an espresso and mirror on the earlier 12 months. Earlier than we start this cathartic look again, we foremost wish to thanks on your continued help and confidence in CDT.

As a group, we really feel very strongly that we provide unimaginable worth to our companions and we by no means take as a right the nice accountability and belief that you’ve charged us with. You and your loved ones’s monetary wellbeing is our highest precedence and is the ethos that drives our Make investments Above the Clouds dedication. With that promise of security in thoughts, allow us to dive into our annual engine test.

Engine #1 – Returns

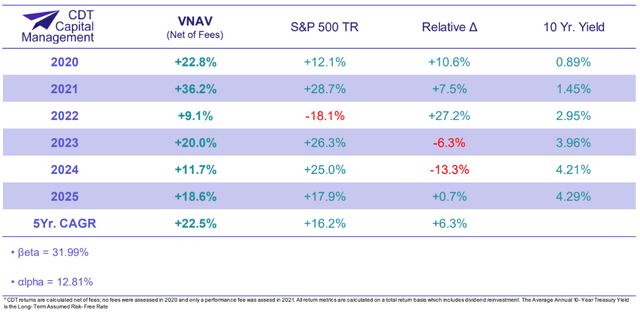

Efficiency. For the fifth consecutive yr, CDT is proud to report a greater than honest return for our companions. On a complete return, and after charges foundation, we outperformed our benchmark, the S&P 500 Complete Return Index (SP500TR) and met our inside goal of a sturdy long-term high-teens return for our companions.

Since our inception, for the previous 5 years and three months, we now have compounded capital at a +22.5% price in comparison with the benchmark’s very respectable +16.2% compounding return. In that very same timeframe, we now have produced a wholesome +12.81% of alpha, which is a comparative measure of our historic returns towards the SP500TR adjusted for danger. Our absolute and risk-adjusted outperformance displays each our self-discipline and the continued evolution of our funding technique.

Funding Technique. Investing boils right down to an easy-to-follow logic sequence. Discover and spend money on above-average folks, endeavoring to do above-average issues, at firms that produce above-average and dependable money flows and most significantly, pay below-average costs on your curiosity. There isn’t any assured method for funding success, however we strongly imagine that our standards utilized with diversification, persistence, and a little bit of luck is more likely to produce rewarding long-term outcomes.

Above-Common Individuals. At CDT, we leverage the insights of above-average folks to drive our funding course of. Our proprietary insider exercise algorithms are tasked with driving our inventory screening course of, which ensures that we’re budgeting our analysis efforts and give attention to solely these firms during which we observe high-conviction insider (CEO, CFO, Administrators and different Named Government Officers) buying exercise.

Put in another way, we discover and spend money on firms during which above-average persons are additionally shopping for the shares of the businesses they handle. Reliably, this course of has yielded a wonderful alternative set for us to start out from, and the callout this yr is the sheer range of the group.

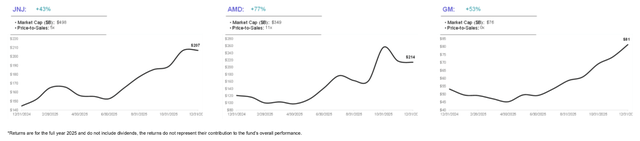

Beneath is a pattern set of the businesses that drove our returns this yr. From international pharmaceutical firms, to airways, to semiconductor designers, to regional utility firms, to automobile producers, this yr, we earned our stripes as proud generalists.

Engine #1 is Buzzing. Our insider exercise edge is barely getting sharper and wider as our algorithms proceed to evolve and profit from expertise in addition to our continued analysis on the topic. Moreover, in partnership with our buddies at DNSC.AI, we now have made nice strides in incorporating AI into our day-to-day operations to additional this ever-expanding lead.

Engine #2 – Danger

Danger Controls. Investing with out sturdy danger controls is like boarding a long-distance flight realizing the aircraft has just one working engine. You’ll most likely get to your vacation spot, however on the slightest disturbance within the air, everybody could be gripping their passenger armrests so onerous that it could go away a everlasting impression behind.

We would like your expertise with us to be much more snug than a white-knuckle trip within the sky. That’s the reason danger administration is woven into each a part of the CDT funding course of. We imagine firmly that our danger practices are simply as essential if no more essential than our insider and investing experience alone.

Earlier than we dive into our danger administration technique specifics, it’s price noting that we’re an anomaly within the hedge fund area. We don’t brief single shares, and we don’t use esoteric monetary devices to hedge danger.

Which means, we eschew from the standard long-short mannequin. It’s our perception that mathematically, a powerful long-only hedging technique leads to some, however considerably much less efficiency drag throughout up markets and aggressive safety throughout down markets.

Layers of Management. We underwrite our danger with two layers of controls, a Micro Portfolio and Macro Portfolio layer.

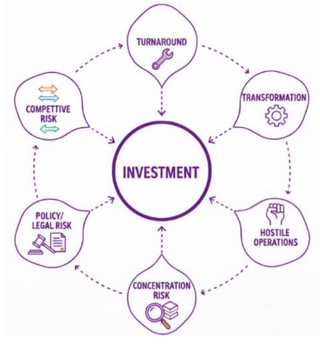

Micro Portfolio Danger. Every funding candidate is given an entire danger diagnostic or a test listing of potential pitfalls that we use to calculate our model of an anticipated risk-adjusted return. Extra ranges of debt; a enterprise transformation; focus dangers; hostile nation operational danger, and so forth.

This can be a essential step within the valuation means of any enterprise that almost all textbooks look over or ignore utterly. I can’t let you know what number of firms on the floor look nice on paper till we kick the tires. For instance, again in November, Zebra Applied sciences (ZBRA) hit our insider radar.

On the floor, the valuation of the $12.6B enterprise appeared engaging at lower than a 14x P/E, a modest debt burden and respectable return on incremental invested capital. It regarded like a worthwhile funding candidate – however the wheels got here flying off once we did our danger evaluate.

What these engaging statistics don’t let you know is that administration had entered right into a transformative acquisition of business touchscreen supplier, Elo Contact for $1.3B. The issue, administration virtually actually paid an excessive amount of for a enterprise producing ~$80M in EBITDA (earnings earlier than curiosity, taxes and depreciation) (press launch).

At over 16x EBITDA, the acquisition blew out the capital construction with debt and introduced vital execution danger leading to an anticipated risk-adjusted return effectively beneath our threshold of security. We want the corporate effectively on their M&A journey, we simply gained’t be making that trek with them.

Avoiding dodgy propositions just like the one posed by Zebra is essential to our efficiency during times of market turbulence when market dangers have a possibility to compound company-specific dangers – internally, we now have a saying that sums up this angle, it’s our intention to compound capital, not compound dangers.

Macro Portfolio Danger. Reserves comprised of money, money equivalents (Treasury payments) and government-backed mortgage-backed securities fluctuate based mostly on the output of a purely quantitative chance of danger mannequin, or PRM, during which danger is outlined because the lack of principal.

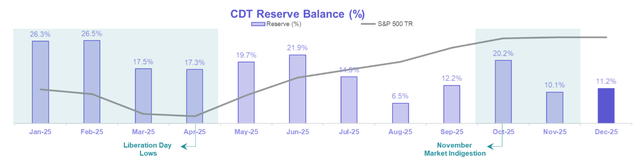

The PRM framework depends upon a number of elements, however the principal elements are Insider Sentiment and inventory market valuation. As we glance again on how this technique carried out in 2025, there have been two essential reserve builds and opportunistic releases that did precisely what our system was designed to do – anchor returns when the turbulence hits, after which deploy sidelined capital at a market drop low cost.

- Liberation Day. The sudden measurement of the Trump 2.0 tariffs roiled markets within the spring. On the depths of the April lows, the market decline reached hysterical ranges and flirted with the bear market marker of -20%. Evidently, having ~1/fifth of the CDT portfolio in reserve was an unimaginable asset. We absorbed the shock with some safety in place – after which deployed that capital at superior reductions to the current previous. Extremely, the returns on that deployed capital didn’t take lengthy to materialize as tariff aid bulletins assuaged market fears and the S&P 500 TR ended the month down solely -.68%.

- November Indigestion. Comparable, however on a a lot smaller scale to Liberation Day, in November, we noticed wild swings within the inventory market throughout which, on the low, declined -4.55%. As soon as once more, going into the month with ~1/fifth of our belongings in reserve proved to be an unimaginable profit as we shortly deployed our reserved capital and reaped a tidy return because the market recovered intramonth.

In case you are questioning concerning the fluctuations in our reserve throughout the remainder of the yr, many of the motion is said to adjustments in Insider Sentiment. Our sentiment measure is a proprietary metric that we derive by analyzing the buying conduct of company insiders.

Intuitively and borne out statistically, when the world’s most knowledgeable and influential persons are discovering worth available in the market and buying their shares, the chance of danger in the entire inventory market declines, whereas the alternative is true if insider buy exercise is muted.

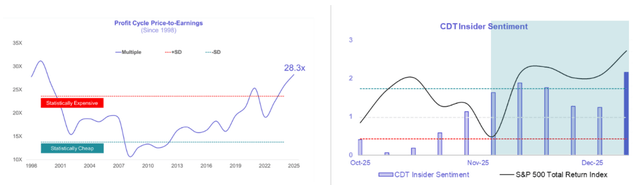

Presently, our reserve is ready to ~13.5% of our managed belongings. If not for a higher-than-normal Insider Sentiment as proven beneath on the precise, a traditionally elevated market valuation of >28x our estimate of through-the-cycle earnings at present rates of interest would place our reserve nearer to twenty%.

Wall of Fear. As beforehand talked about, our reserve course of is totally quantitative, it doesn’t permit for analyst bias to affect the numbers, nevertheless, nearly as good apply we nonetheless preserve monitor of and keep up-to-date with considerations we deem a major risk to the market and probably our investments. A few of our main considerations are the next:

- Non-public Credit score Accounting: Equally to the way in which our companions compensate us for a job effectively carried out with efficiency charges, personal credit score fund LPs pay their managers based mostly on their return efficiency as effectively. In our case and within the case of personal credit score, returns are partially outlined because the appreciation or depreciation of the fund’s owned belongings, however with one main distinction. The belongings we purchase are public securities, that means their worth is extensively identified. Non-public belongings, nevertheless, don’t have any market worth out there in any respect and are topic to supervisor enter which can lead to huge distortions within the reported worth of belongings. Underscoring this level, right here is an article outlining how two personal credit score behemoths, Apollo and KKR mark the very same mortgage at considerably completely different asset values (Bloomberg). Provided that Moody’s estimates that this market may develop to $3T in worth by 2028, we imagine that the systemic significance of personal credit score on the whole monetary system is extensively underestimated, particularly when you think about the motivation construction during which supervisor pay is tied to the asset values they partially decide themselves.

- Synthetic Intelligence Progress Constraints. Useful resource constraints corresponding to land, electrical energy and labor may gradual the development of information middle development, which in flip can gradual AI firm development. Whereas monetary constraints may probably halt it altogether. This is a crucial growth to observe because the composition of the inventory market right now is overwhelmingly reliant upon the success of AI as a transformative expertise with a blistering development trajectory with the intention to justify its wealthy valuation.

- Useful resource Constraints – Electrical energy (Monetary Instances)

- Monetary Constraints – Oracle & Blue Owl (CNBC)

- Market Focus (Apollo)

Engine #2 is Buzzing. The mixture of our two-layer danger management construction has produced a traditionally sturdy monitor file of danger administration, as evidenced by wholesome alpha technology. Our micro controls preserve us from stacking or compounding dangers, whereas our macro controls place us to soak up and in the end revenue from market turbulence.

Above the Clouds

2025 was one other profitable yr. We generated sturdy after-fee returns for our companions, continued to refine and increase our course of via our unending pursuit of analysis, and final however not least, we launched CDT Wealth, an unique wealth-management platform designed particularly for you, our restricted companions.

As this reflection attracts to an in depth, we stay dedicated to our pursuit of Investing Above the Clouds. The yr forward will convey new challenges, but in addition new alternatives for our playbook to establish and capitalize on. With an incredible quantity of momentum coming into 2026, we’re excited for what lies forward. We sincerely thanks as soon as once more on your belief and sit up for serving you and your households within the yr to return.

Authorized Info and Disclosures

This memorandum expresses the views of the writer as of the date indicated and such views are topic to alter with out discover. CDT Capital Administration (“CDT”) has no obligation or obligation to replace the data contained herein. Additional, CDT makes no illustration, and it shouldn’t be assumed, that previous funding efficiency is a sign of future outcomes. Furthermore, wherever there may be the potential for revenue there may be additionally the opportunity of loss.

This memorandum is being made out there for instructional functions solely and shouldn’t be used for some other function. The data contained herein doesn’t represent and shouldn’t be construed as an providing of advisory providers or a suggestion to promote or solicitation to purchase any securities or associated monetary devices in any jurisdiction. Sure data contained herein regarding economics developments and efficiency relies on or derived from data offered by unbiased third-party sources. CDT believes that the sources from which such data has been obtained are dependable; nevertheless, it can’t assure the accuracy of such data and has not independently verified the accuracy or completeness of such data or the assumptions on which such data relies.

Disclosures

This presentation doesn’t represent funding recommendation or a suggestion. The writer of this report, CDT Capital Administration, LLC (“CDT”) shouldn’t be a registered funding advisor. Moreover, the presentation doesn’t represent a suggestion to promote nor the solicitation of a suggestion to purchase pursuits in CDT’s suggested fund, CDT Capital VNAV, LLC (“The Fund”) or associated entities and will not be relied upon in reference to the acquisition or sale of any safety. Any provide or solicitation of a suggestion to purchase an curiosity within the Fund or associated entities will solely be made via supply of an in depth Time period Sheet, Amended and Restated Restricted Legal responsibility Firm Settlement and Subscription Settlement, which collectively comprise an outline of the fabric phrases (together with, with out limitation, danger elements, conflicts of curiosity and costs and prices) regarding such funding and solely in these jurisdictions the place permitted by relevant regulation. You might be cautioned towards utilizing this data as the premise for making a choice to buy any safety.

Sure data, opinions and statistical knowledge regarding the business and common market developments and circumstances contained on this presentation had been obtained or derived from third-party sources believed to be dependable, however CDT or associated entities make any illustration that such data is correct or full. You shouldn’t depend on this presentation as the premise upon which to make any funding determination. To the extent that you simply depend on this presentation in reference to any funding determination, you accomplish that at your personal danger. This presentation doesn’t purport to be full on any subject addressed. The data on this presentation is offered to you as of the date(s) indicated, and CDT intends to replace the data after its distribution, even within the occasion that the data turns into materially inaccurate. Sure data contained on this presentation contains calculations or figures which have been ready internally and haven’t been audited or verified by a 3rd occasion. Use of various strategies for getting ready, calculating or presenting data could result in completely different outcomes, and such variations could also be materials.

Editor’s Observe: The abstract bullets for this text had been chosen by Searching for Alpha editors.