NEWNow you can hearken to Fox Information articles!

California’s battle over taxes and regulation is colliding with a broader financial shift, as rich residents and entrepreneurs take their cash elsewhere — delivering a windfall of capital, jobs and taxpayers to red-state rivals.

That shift is already seen in migration patterns throughout the nation.

From 2021 to 2024, Texas and Florida posted the most important internet inhabitants features, whereas California and several other northeastern states recorded a few of the steepest losses, in accordance with IRS and U.S. Census Bureau knowledge.

CALIFORNIA WEALTH TAX PROPOSAL HEMORRHAGES $1T AS BILLIONAIRES FLEE

These migration tendencies at the moment are colliding with a political battle over how the Golden State taxes its wealthiest residents.

On the heart of the controversy is a proposed poll initiative backed by the Service Staff Worldwide Union that might impose a one-time 5% wealth tax on Californians with belongings exceeding $1 billion, together with unrealized features.

If the measure qualifies for the November poll and is permitted by voters, it could apply retroactively to anybody who lived in California as of Jan. 1, 2026.

Supporters say the measure would increase funding for healthcare and schooling, whereas critics warn it might drive funding and expertise out of the state.

California Gov. Gavin Newsom has lately stated he opposes the Billionaire Tax Act. (Wally Skalij/Los Angeles Instances/Getty Photos)

These issues come as revenue migration knowledge already exhibits cash shifting out of a number of historically blue states.

IRS figures point out a number of historically blue states shedding billions of {dollars} in adjusted gross revenue — the revenue used to calculate federal taxes — as residents transfer to lower-tax states, notably throughout the South and Solar Belt.

CONSERVATIVE STATES SEE LOWER INFLATION THAN LIBERAL ONES NATIONWIDE, WHITE HOUSE DATA SHOWS

Steve Moore, co-founder of Unleash Prosperity, stated California’s tax base will proceed to erode as extra high-profile tech billionaires relocate forward of the proposed wealth tax.

“California’s tax base took a large hit on the finish of final yr. Silicon Valley billionaires left the state, taking their wealth and future wealth with them,” Moore stated, attributing these strikes to the proposed 2026 Billionaire Tax Act, which targets the state’s ultra-wealthy.

“These enterprise tycoons are operating to states like Florida and Texas due to decrease taxes, financial freedom and future financial prosperity,” he stated, describing it as “voting with their ft.”

“It’s common sense for enterprise leaders to select locations for future monetary success reasonably than financial suffocation,” he added.

MAMDANI’S RISE IN NYC MIRRORS ECONOMIC FLIGHT TO THE SOUTH, STUDY SHOWS

California Gov. Gavin Newsom stated the wealth tax ought to be dealt with on the nationwide stage. (Invoice Pugliano/Getty Photos)

California Gov. Gavin Newsom has additionally come out towards the proposed wealth tax, warning it might backfire at the same time as he defends the state’s current progressive tax system.

“For months, I’ve been preventing this, as a result of it’s precisely what I feared would occur — and now it has. That is one thing I’ve been warning about for years,” Newsom informed The New York Instances.

Newsom stated he has lengthy opposed the measure and believes taxing the ultra-wealthy ought to be addressed on the nationwide stage reasonably than state by state.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

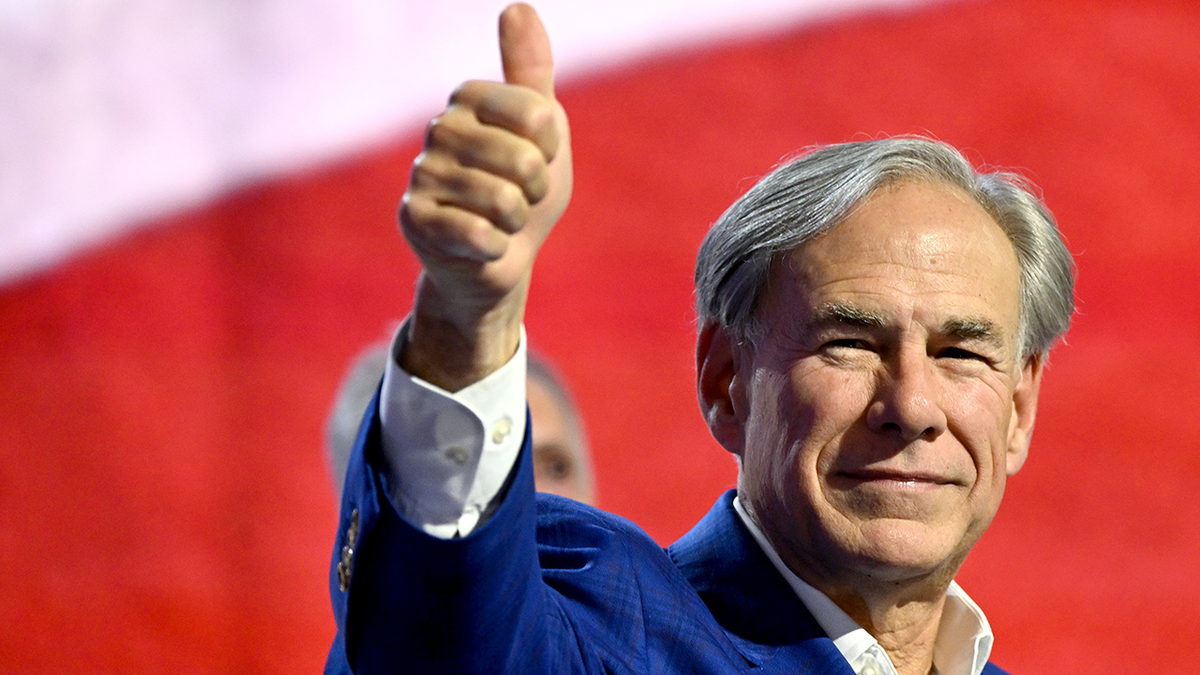

Texas Gov. Greg Abbott’s workplace informed Fox Information Digital that he’ll proceed welcoming companies and residents fleeing California to his state. (David Paul Morris/Bloomberg through Getty Photos)

At the same time as Newsom raises alarms, Republican governors in Florida and Texas say they’re already benefiting from companies and residents leaving California.

Texas Gov. Greg Abbott’s workplace echoed that sentiment, saying the state continues to attract firms searching for decrease taxes and a lighter regulatory atmosphere.

“Folks and companies vote with their ft, and they’re frequently selecting to maneuver to Texas greater than every other state,” Abbott spokesman Andrew Mahaleris stated.

He added that Texas’ lack of company and private revenue taxes and its predictable regulatory local weather have made it a sexy vacation spot for firms weighing a transfer out of California.

Florida Gov. Ron DeSantis known as the California proposal “financial madness.”