KanawatTH/iStock by way of Getty Pictures

By Cameron Liao

At a Look

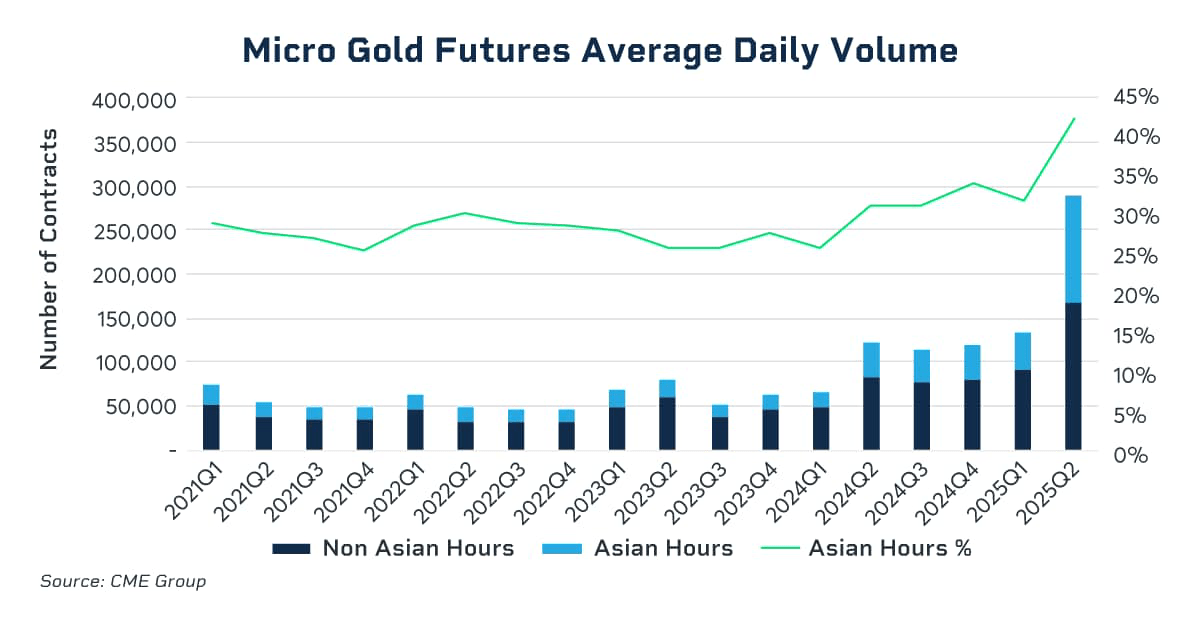

- As of Q2 2025, 42% of worldwide Micro Gold futures buying and selling quantity occurred throughout Asian hours (outlined as 6 a.m. to six p.m. Singapore time)

- China and India accounted for over half of worldwide gold shopper demand final 12 months

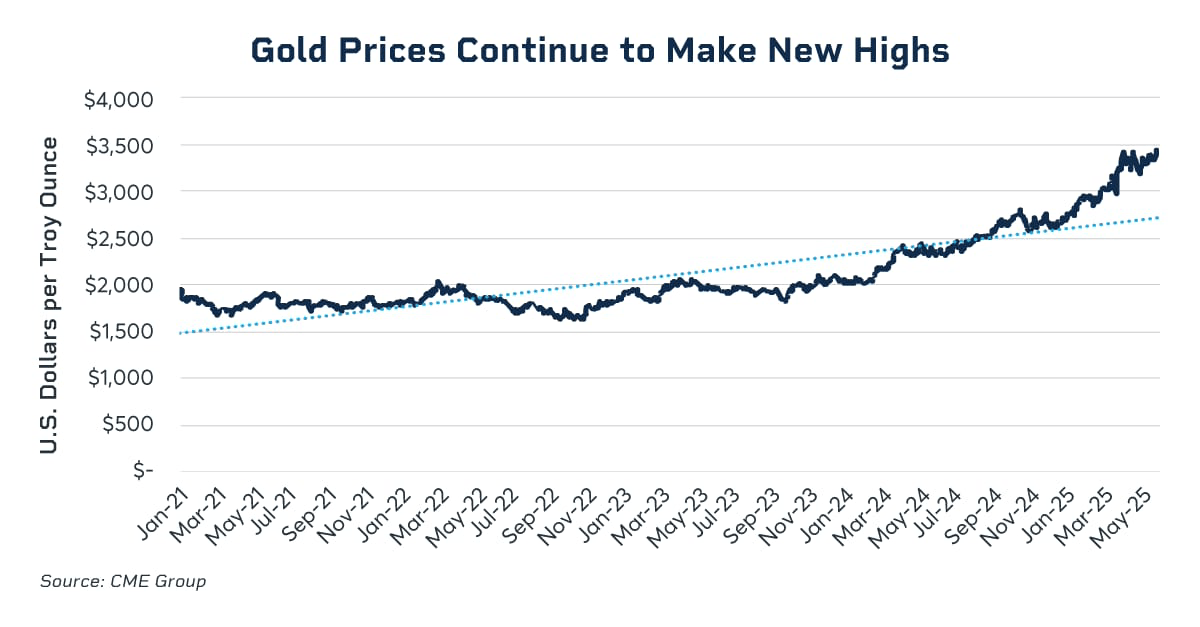

Gold has skilled a major bull run over the previous two years, with costs rising by 12% in 2023 and an additional 29% in 2024. Gold has continued its sturdy efficiency in 2025 as a perceived secure haven amid issues over uncertainty round commerce coverage, anticipated cuts in U.S. rates of interest and heightened geopolitical dangers. The value surged above $3,000 per troy ounce in March for the primary time and is buying and selling close to $3,400 as of early August.

Asia: The Engine of International Gold Demand

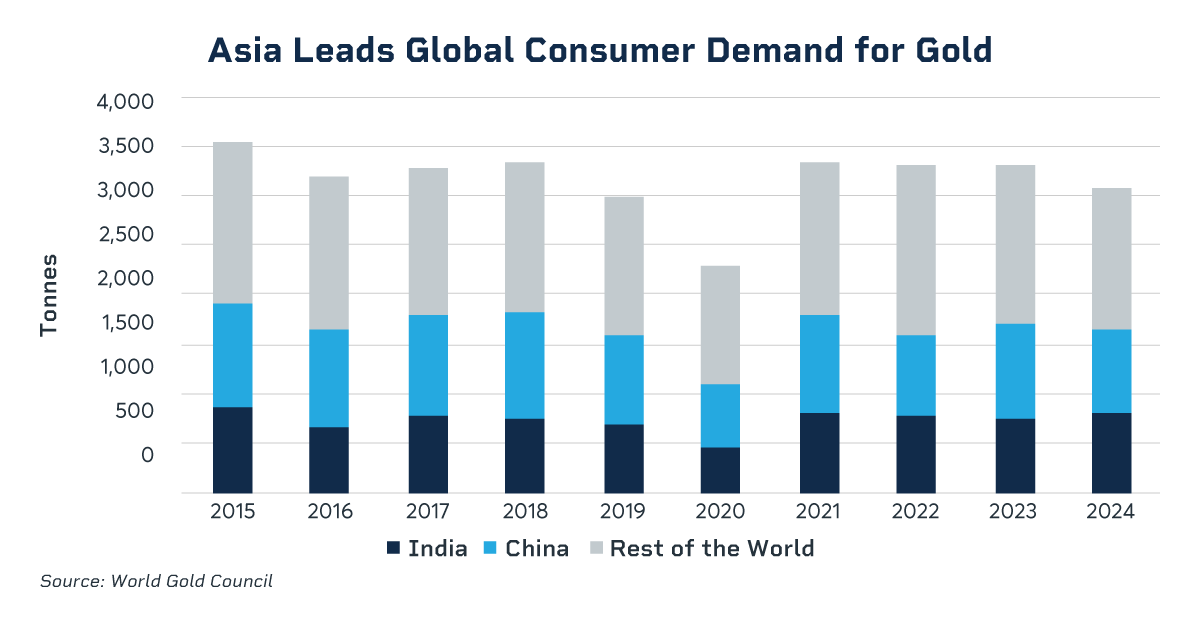

Gold, thought of a logo of wealth and a retailer of worth, is very prized in Asian cultures. China and India, with a mixed inhabitants of two.8 billion, have sturdy jewellery and funding demand, making them the world’s two largest gold shoppers. Collectively, these two nations accounted for over half of worldwide gold shopper demand in 2024, in response to knowledge from business group World Gold Council (WGC). Different economies in Asia, similar to Thailand, Malaysia, Vietnam and South Korea, are additionally important gold shoppers. With gold costs hitting current report highs, the dear metallic is garnering much more consideration as an funding asset and a secure haven amid geopolitical dangers.

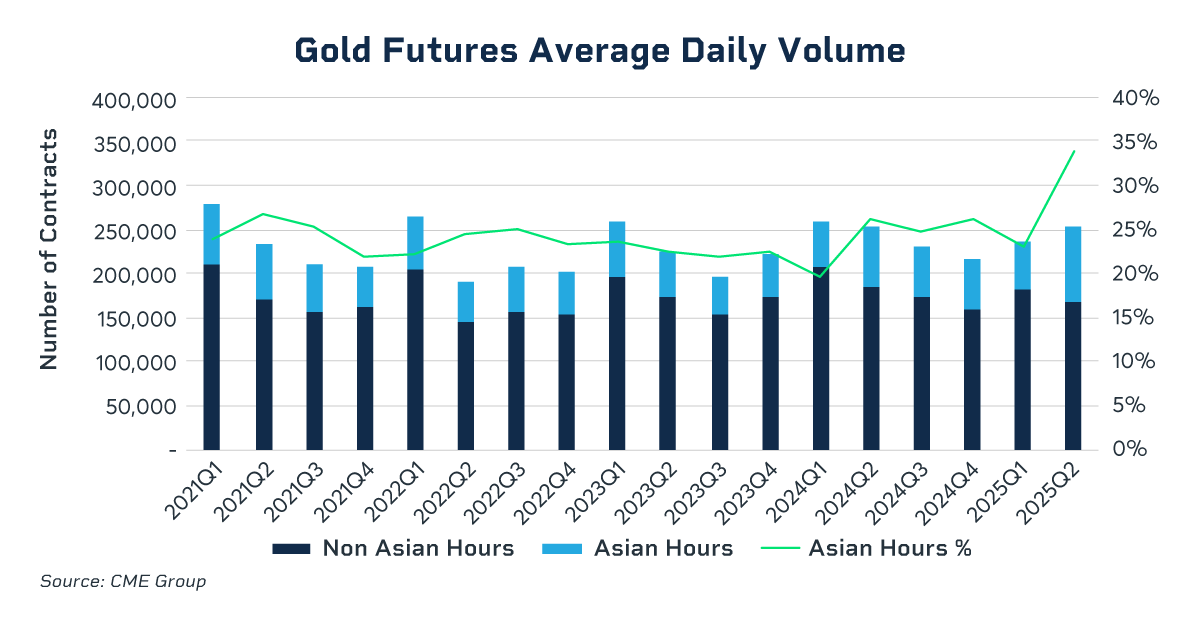

Derivatives Buying and selling Positive factors Traction in Asia

Asia’s sturdy urge for food for the yellow metallic is more and more extending to derivatives buying and selling. Liquidity in COMEX Gold futures (GC) throughout Asian hours (outlined as 6 a.m. to six p.m. Singapore time) has surged with gold costs. Traditionally, Asian hours quantity accounted for about 25% of whole buying and selling quantity; this share grew to over one-third within the second quarter of 2025. This elevated buying and selling exercise throughout Asian hours displays rising curiosity in derivatives buying and selling from market individuals within the area, which in flip facilitates extra environment friendly worth danger administration.

Micro Gold Experiences a Surge in Buying and selling Volumes

The expansion in liquidity is much more pronounced in Micro Gold (MGC) futures. This contract, sized at 10 troy ounces (one-tenth of the benchmark 100 troy-ounce Gold futures), caters to merchants searching for publicity in smaller heaps, which is very pertinent given the rising gold worth. Every day MGC quantity, which usually ranged from 50,000 to 60,000 contracts earlier than the current worth surge, now averages close to 300,000 contracts per day. Concurrently, the share of Asian hours exercise has additionally considerably improved. As of Q2 2025, quantity throughout Asian hours represented roughly 42% of worldwide MGC buying and selling, a 16-percentage level enhance in comparison with two years in the past.

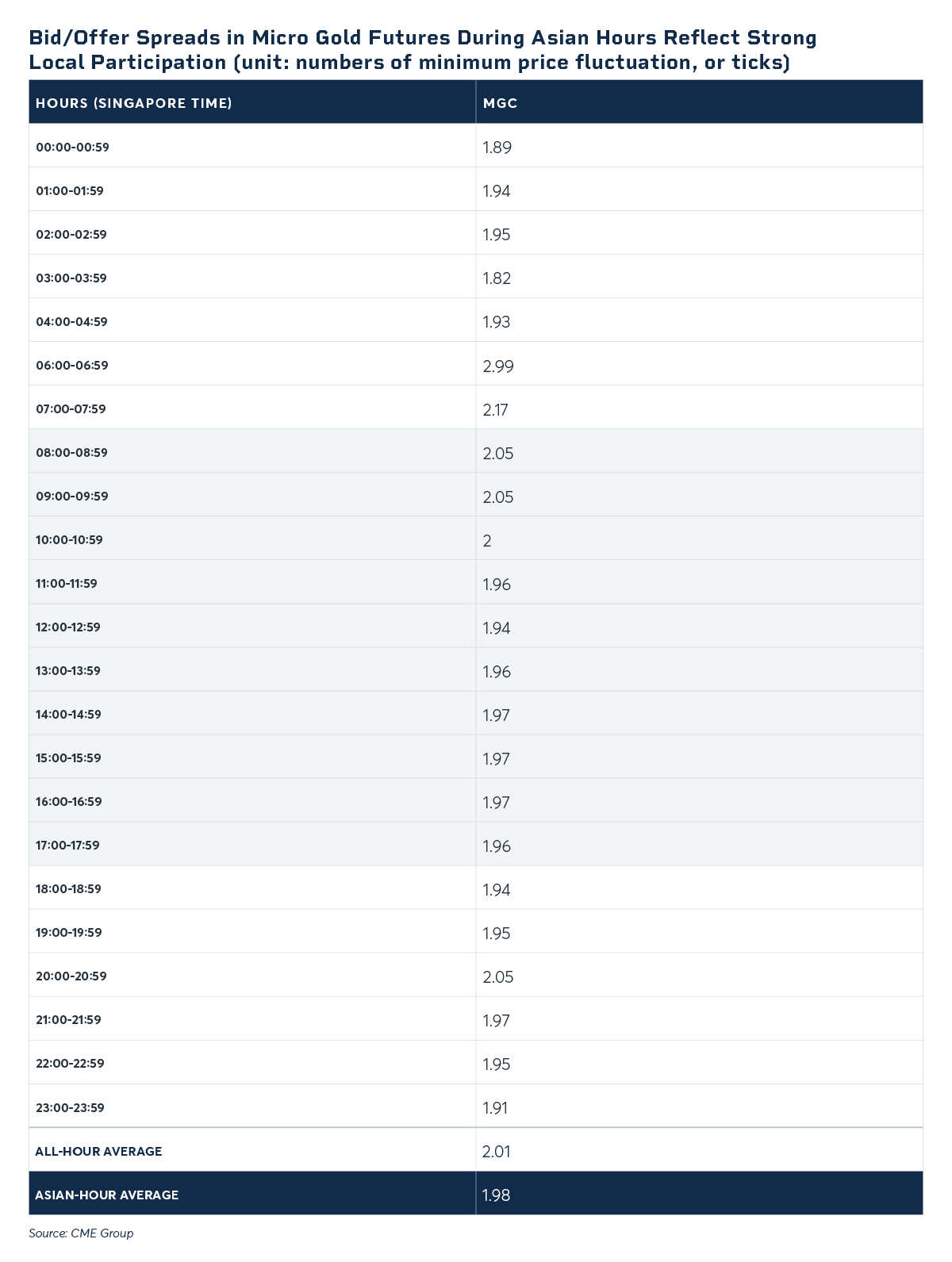

Micro Gold futures additionally present aggressive bid/supply spreads, measured in minimal worth fluctuations, or ticks. The unfold is often used to gauge market liquidity and has a direct impression on buying and selling value. Total, Micro Gold futures constantly exhibit secure liquidity, with the bid/supply spreads averaging 2.01 ticks throughout all buying and selling hours*. The market reveals a fair tighter unfold of 1.98 ticks throughout Asian hours, reflecting elevated exercise within the area/time zone.

*Based mostly on the extent 1 bid/supply unfold in essentially the most lively contract month throughout Q2 2025.

Gold to Stay Middle Stage

Wanting forward, gold costs are anticipated to stay a key focus amongst traders amid prevailing commerce, financial coverage, geopolitical and financial uncertainties. A 2025 central financial institution survey by the WGC revealed that 95% of respondents anticipate international central financial institution gold holdings to proceed rising within the subsequent 12 months, underscoring gold’s perceived position as a secure haven, a hedge in opposition to geopolitical danger and a retailer of worth.

Components similar to ongoing geopolitical conflicts, potential modifications to U.S. rates of interest, tariff coverage changes and evolving central financial institution reserve methods could possibly be supportive for gold. Conversely, record-high costs and slowing financial progress might dampen jewellery consumption. Revenue-taking, potential market corrections and competitors from different funding belongings may also mood the gold rally. Gold is poised to stay the focal point as market individuals navigate these complicated dynamics.

Editor’s Notice: The abstract bullets for this text have been chosen by In search of Alpha editors.