American Tower (NYSE:AMT) is on the verge of changing into a worth play after years of poor inventory efficiency. The AFFO a number of has been re-rated to mirror slower progress in latest durations however may very well be overdone. We consider the slower progress is event-driven with a finite finish date after which extra speedy progress ought to return. On the larger fee of progress beginning in 2026, AMT seems opportunistically low-cost.

Allow us to start with a dialogue of the long-term progress of the tower enterprise, together with what prompted progress to be weak in 2020-2025.

Historic progress within the tower enterprise

Towers have constantly been one of many highest natural progress infrastructure sectors. There are 3 traits which have ensured spectacular progress for the sector:

- Colocation

- Effectivity of present infrastructure

- Pure native monopoly

A macro tower shouldn’t be high-tech in any respect. Its solely job is to be sturdy and tall. The high-tech gear is operated by tenants and merely positioned on the REIT’s tower.

Constructing of the tower is considerably costly. It requires well-located land, allowing and a complete bunch of steel. The expense is sufficiently giant such that it might be a low return for a single entity to have gear on a tower. It turns into environment friendly, nevertheless, when the identical infrastructure can be utilized for the gear of two, 3 and even 4 cell carriers.

The income multiplies as extra tenants co-locate on a tower, whereas the price stays unchanged. The actual property cap fee goes from possibly 4-5% with a single tenant as much as the excessive teenagers with 3 or 4 tenants.

The U.S.-based towers owned by American Tower and their friends have largely been in place for a very long time. They’ve already paid for themselves with the rental revenues already generated. From this level ahead, they’re money stream machines.

For the reason that tower itself is only a massive steel construction, it requires little or no capex relative to its income, making it among the many highest margin types of infrastructure. As soon as a tower will get a number of tenants, its profitability is extraordinary, and it’s somewhat uncommon for a tenant to depart a tower which has largely stored churn low (with one notable exception which we are going to get to later). There are 3 causes tenants are sticky:

- It’s not economically viable for a tenant to construct their very own tower. The hire paid by a single tenant is lower than the financial equal of a constructing.

- It is probably not allowed for a tenant to construct a competing tower, even when they needed to. Regulatory our bodies oversee components reminiscent of wavelengths and interference, which usually preserve towers a sure distance aside. There tends to solely be 1 tower in every protection radius.

- Leaving with out having a alternative tower would imply lack of protection space and certain lack of clients for the service.

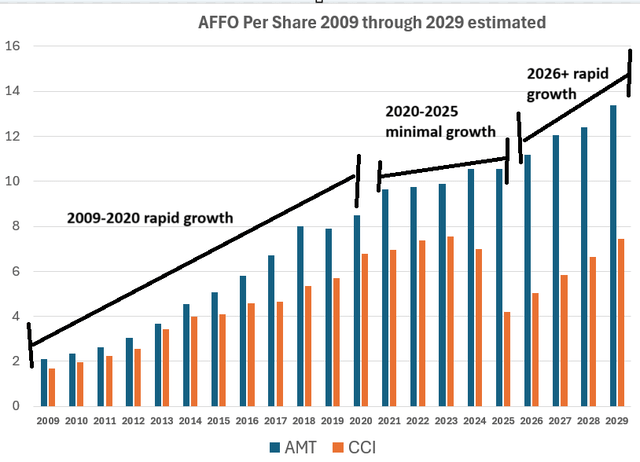

These elements of the tower enterprise have made it remarkably profitable over the long run. They’ve pushed rents up significantly nearly yearly and have a runway to proceed pushing hire. Larger hire with out larger bills has allowed AMT to extend its AFFO per share 5-fold since 2009.

S&P World Market Intelligence

There are 3 distinct durations within the graph above, which I’ve annotated under.

S&P World Market Intelligence

2009 by way of 2020 represents the speedy progress related to the colocation and rental fee progress mentioned above.

The 2020-2025 interval seems to be fairly completely different, with comparatively minimal AFFO/share progress for AMT and even unfavorable AFFO/share progress for Crown Citadel (CCI).

So what occurred?

T-Cellular shopping for Dash shocked the tower trade

In 2020, T-Cellular (TMUS) purchased Dash. There have been 4 main wi-fi carriers (TMUS, AT&T, Verizon and Dash) and instantly, it turned 3.

Regulators on the time of the merger have been involved that having solely 3 carriers would scale back competitors, so that they aimed to determine a brand new 4th main participant. To accommodate regulators, Increase Cellular was acquired by DISH in 2020 as a part of the Dash/T-Cellular merger.

DISH was speculated to be that 4th participant, however largely failed to attain actual scale. It has since merged with Echo Begin, however has nonetheless largely did not scale.

This had ramifications for the tower REITs as a result of their low churn trade instantly turned excessive churn.

With TMUS now proudly owning Dash, overlapping gear turned redundant. Any tower that was leased to each TMUS and Dash was going to face churn as quickly because the Dash leases expired.

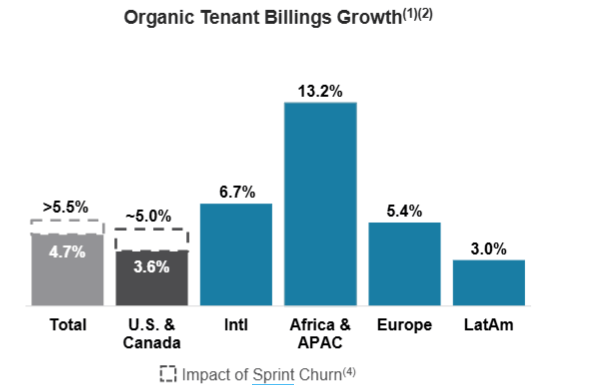

These have been lengthy leases, with some expiring annually. Dash churn remains to be taking a chunk out of progress. Beneath is AMT’s natural tenant billings progress in 1Q25.

AMT

Development was 4.7%, however it might have been 5.5% with out the Dash churn.

Some durations have extra Dash churn impression and others have much less, however the web impact has been dramatically slowed progress for the tower REITs within the 2020 by way of 2025 interval.

The core enterprise remains to be rising properly. Rental charges are nonetheless rolling up at a superb tempo. It’s simply that the constructive progress is being offset by misplaced income as Dash leases expire.

AMT’s 10-Q explains that Dash churn will proceed to be a headwind by way of the top of 2025.

“We anticipate that our churn fee in our U.S. & Canada property phase will stay elevated by way of 2025 as a result of contractual lease cancellations and non-renewals by T-Cellular, together with legacy Dash Company leases, pursuant to the phrases of our grasp lease settlement with T-Cellular US, Inc. entered into in September 2020”

As all of that is contractual, it must be included in steerage and analyst numbers for 2025.

Dash churn is everlasting however finite.

2026 appears to be when the expansion is meant to start out again up at 7%-10% yearly in keeping with consensus estimates.

AMT market value weak spot

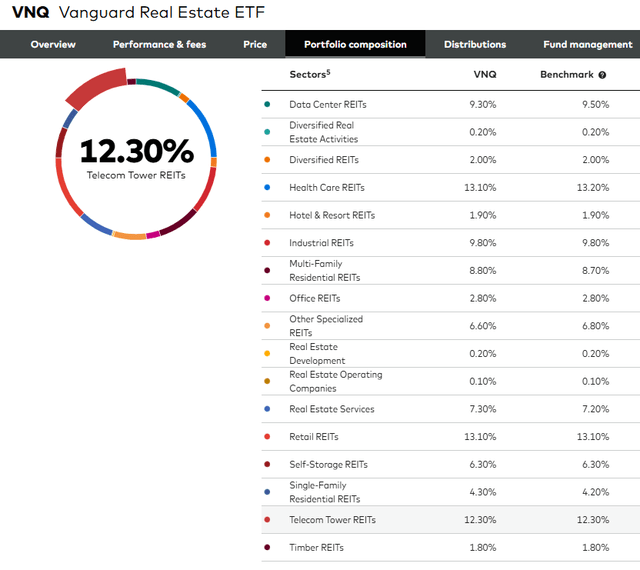

For the reason that tower REITs are fairly giant in market cap, they make up 12.3% of the REIT index and thus a 12.3% weight in ETFs just like the Vanguard Actual Property ETF (VNQ)

Vanguard

We have now been considerably underweight towers the final 5 years, usually having between 0% and 5% publicity. We have been involved with Dash churn in addition to the excessive AFFO a number of at which the sector traded.

This underweight turned out to be lucky, because the sector had a somewhat dismal 5-year return.

SA

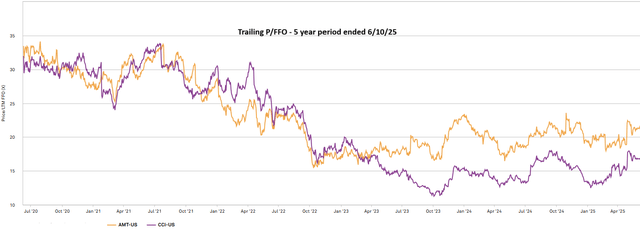

5 years in the past, tower REITs have been thought-about the cream of the crop. They traded at multiples within the 30s on the assumption that the speedy progress would final for a very long time. These multiples have been most likely too excessive.

AMT continued to develop earnings, however at a a lot slower tempo, and the market appears to as soon as once more consider the latest tempo is everlasting. The multiples of the tower REITs have dropped to round 20X.

S&P World Market Intelligence

There appears to be a bit an excessive amount of extrapolation of latest historical past in the best way the market is pricing REITs.

On this case, the weak progress of 2020-2025 is attributable to an outlined occasion (Dash buyout by TMUS). That occasion is ending, and progress is more likely to return to a better stage.

If the analyst estimates calling for 7%-10% annual progress in 2026 and past are right, AMT is buying and selling opportunistically.

We’re beginning to limp right into a place.

Why only a limp in somewhat than a full place?

Properly, the subsequent few quarters will proceed to be difficult on comps.

In September 2024, American Tower offered its enterprise in India for 182 billion INR, or roughly $2.2B USD. As such, the upcoming quarters (2Q25 and 3Q25) can have difficult comps because the prior 12 months to which they’re in contrast will nonetheless embody revenues from their India enterprise.

Additional, the remainder of 2025 will nonetheless have Dash churn headwinds.

It’s in 2026 that the expansion ought to resume to a fuller tempo. Maybe the market might be forward-looking and value that in early, which is why we’re shopping for some shares now. Nonetheless, it might be considered as a “show-me story” the place the market is not going to give AMT credit score till they really see the expansion in 2026. As such, it may very well be lifeless cash for an additional 6 months, so we’re preserving a somewhat small place.

Total, I just like the prospects of AMT. The underlying enterprise stays robust. The steadiness sheet and money flows are exceptionally good. It’s also the bottom a number of approach to spend money on knowledge facilities, as AMT trades far cheaper than Digital Realty (DLR) or Equinix (EQIX).

I feel AMT’s CoreSite possession pairs properly with the tower enterprise. Since towers are so low capex, they will plow money flows from towers into the very capital-intensive buildout of information facilities. On this style, they need to be capable to seize related knowledge heart progress to DLR, simply at a less expensive a number of.

Dangers to AMT

The perennial danger to tower REITs is their full publicity to a single product. Whereas tower infrastructure has traditionally been very resilient, the injury to AMT can be catastrophic if macro towers have been to be disrupted.

- 5G has at occasions been thought-about a risk to 4G towers, though in newer durations it appears to work extra in tandem with the macro tower community.

- Satellites can threaten macro towers in additional rural areas, however doubtless don’t compete on latency in excessive density areas.

I can’t determine the risk which may ultimately take out macro towers, however that doesn’t imply it might probably’t occur. I simply won’t be good sufficient to see the long run tech that displaces it.

Upside situation

The massive upside situation can be a 4th actual participant rising. Perhaps EchoStar will lastly get out of its personal means and truly construct out an actual community.

Such an occasion can be an enormous win for towers. Quite than having 3 tenants co-located on every tower, they may have 4. The revenues can be virtually strictly additive, with minimal additional bills.

The underside line

Tower progress shouldn’t be damaged; it has simply been offset with churn. Because the churn subsides, the expansion ought to return, which makes the now decrease a number of on AMT doubtlessly opportunistic.