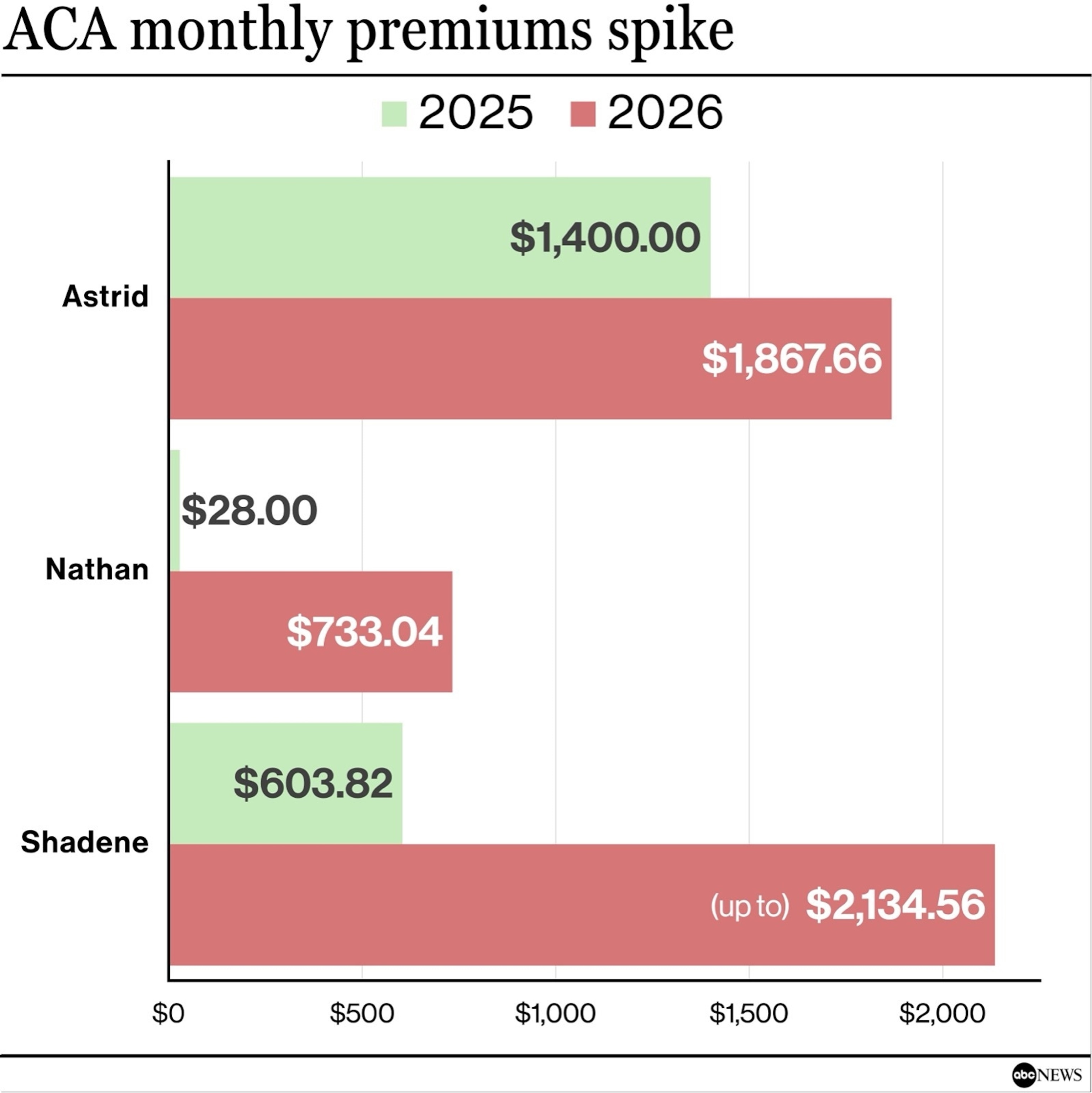

Colorado mother Astrid Storey, a thyroid most cancers affected person with an autoimmune dysfunction, was lately notified that her month-to-month premiums underneath the Reasonably priced Care Act (ACA) will soar by almost $500 in 2026. A naturalized U.S. citizen from Panama, she mentioned she’s now considering what was as soon as unthinkable: giving up her American dream and transferring to a rustic with common well being care.

Nathan Boye of Orlando, Florida, has diabetes and mentioned he is been knowledgeable the month-to-month premiums for his ACA coverage would soar from $28 to greater than $700. The married father-of-three mentioned he’s now contemplating foregoing medical health insurance altogether.

Demonstrators collaborating in “No Kings” protest march in New York Metropolis, October 18, 2025.

Ucg/UCG/Common Photographs Group through G

And Doug Butchart, whose spouse, Shadene, resides with the neurological dysfunction amyotrophic lateral sclerosis (ALS) mentioned he would not understand how he’ll pay for her drugs. A retired mechanic from Elgin, Illinois, Butchart mentioned he is gotten a discover that the month-to-month premiums on his spouse’s ACA coverage will climb to $2,000. Mixed with an annual deductible of greater than $8,000 and $10,000 in out-of-pocket bills, he mentioned his spouse’s well being care prices will whole greater than his month-to-month Social Safety test, which they each stay on.

ACA month-to-month premiums spike

ABC Information

An estimated 22 million of the 24 million ACA market enrollees are at the moment receiving enhanced premium tax credit to decrease their month-to-month premiums, which have been a part of the unique ACA laws and expanded in 2021 in the course of the COVID-19 pandemic underneath the American Rescue Plan. However with the tax credit set to run out on the finish of this 12 months, many policyholders are studying the ACA, generally known as Obamacare, will not be reasonably priced until Congress intervenes.

An extension of the tax credit was not included in President Donald Trump’s megabill, which was signed into legislation in July.

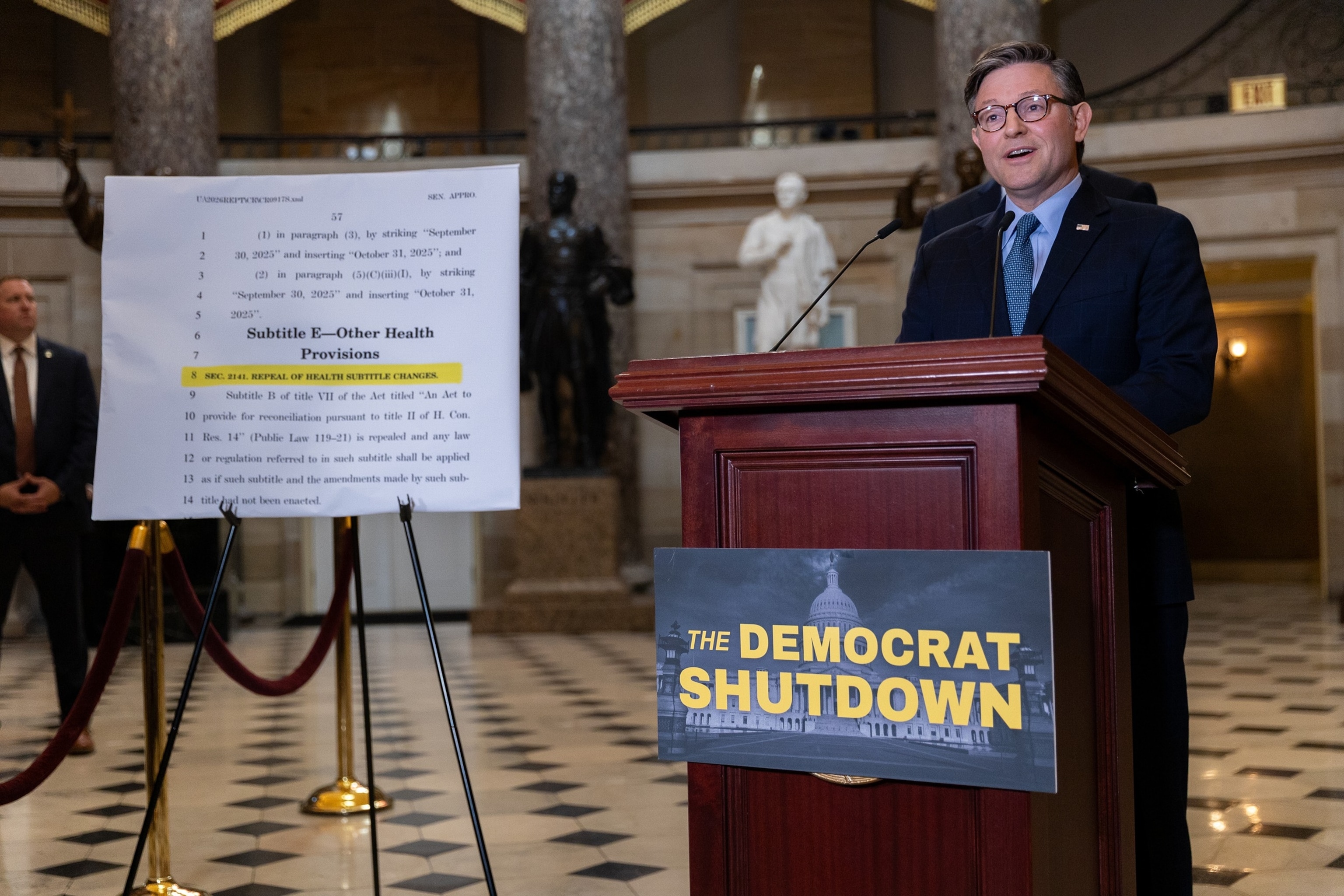

The problem has turn out to be a political soccer, prolonging the federal government shutdown, now the longest in U.S. historical past.

Nearly all of Democrats have refused to vote to reopen the federal government till Republicans agree to increase the ACA subsidies. However GOP leaders say they will not negotiate till a clear funding invoice passes and the federal government reopens.

As either side blame one another for the shutdown, thousands and thousands of Individuals who purchased into the ACA market discover themselves caught within the crossfire of the stalemate.

Premiums set to rise even with out the tax credit

Storey, a graphic designer and proprietor of a small enterprise in Denver, mentioned she would not obtain the ACA tax credit. However in a discover from her insurance coverage supplier, Blue Cross Blue Defend, which she shared with ABC Information, her month-to-month premiums are set to rise from $1,400 to almost $1,900.

ACA policyholder Astrid Storey (center) poses on this undated photograph along with her husband, Denis, and daughter, Harley.

Courtesy of Astrid Storey

“I’ve an autoimmune illness, and I even have thyroid most cancers. So, I had very particular wants as to which docs and which medicines I wanted to have lined on this plan,” Storey mentioned, including that she has a $2,000 deductible and plenty of out-of-pocket bills.

Priya Telang, dressed because the Grim Reaper, holds an indication card protesting cuts to healthcare on the primary day of open insurance coverage enrollment, November 01, 2025 in Northglenn, Colorado.

Tom Cooper/Getty Photographs for Financial Securi

Storey, 45, mentioned she bought her coverage via Join for Well being Colorado, her state’s ACA portal, and has been working with a dealer offered by the insurance coverage service to assist navigate the added prices.

Storey mentioned her husband, Denis, who has been doing contracting work for her enterprise, has taken a part-time job at a Starbucks to assist make ends meet. However Storey mentioned there’s a restrict to how rather more she will pay for well being care.

Senate Minority Chief Chuck Schumer (D-NY) speaks at a press convention with different members of Senate Democratic management, October 15, 2025.

Anadolu through Getty Photographs

If her premium rises to $2,500 a month, she mentioned that she and her household will promote all their belongings and depart the nation. Storey mentioned additionally has citizenship in Panama and Spain, the latter of which has common well being care.

“I’ve lots of emotions about being run out of my nation due to well being care prices,” Storey mentioned. “The American dream is a disappointment in relation to well being care.”

In an announcement to ABC Information, Anthem Blue Cross Blue Defend mentioned that its ACA plan charges “mirror the care and prices we anticipate members to make use of subsequent 12 months. Like different insurers, we’re seeing increased utilization and extra advanced care amongst ACA members — notably in emergency room visits, behavioral well being and specialty pharmacy. As an illustration, ACA members use the ER at almost twice the speed of these with employer-sponsored protection.”

Laid off as a consequence of tariffs, now dealing with greater than a 2,500% soar in premiums

Boye, from Florida, mentioned he at the moment pays $28 a month for his ACA plan via Blue Cross Blue Defend, and that 90% of the drugs he wants to regulate his diabetes are lined.

He was notified final month that the month-to-month premium is about to rise to $733 with out monetary assist, a 2,518% improve.

Boye informed ABC Information on Thursday that after doing extra analysis and reapplying via the ACA portal, he discovered a plan that has month-to-month premiums of $113 a month, contingent on a $620 tax credit score.

Boye mentioned he certified for the ACA tax credit after he was laid off earlier this 12 months as an operations supervisor for an organization that imported medical provides from China.

“We needed to shut down due to the tariff. It made it not possible to import,” Boye mentioned.

ACA policyholder Nathan Boye of Orlando, Florida, poses along with his three kids on this selfie, Dec. 25, 2024.

Nathan Boye

Whereas he has picked up part-time work, he mentioned he enrolled at Valencia School in Orlando to complete his diploma in enterprise administration.

His spouse, he mentioned, has insurance coverage via her job as a trainer’s assistant on the College of Central Florida, the place she can also be finding out historical past. He mentioned their three kids, ages 11 to 16, are insured via Medicaid.

Home Speaker Mike Johnson (R-LA) speaks at a press convention on the the federal government shutdown in Washington, D.C., October 3, 2025.

Anadolu through Getty Photographs

Boye mentioned he will not be capable of pay the rise in his premiums, and is hoping Congress works out a deal to revive the ACA tax credit.

He mentioned he has mid-December to reenroll in his plan. But when the tax credit are usually not restored, Boye mentioned he’s considering making a radical change.

“I gave up on the concept of getting well being care,” Boye mentioned.

Boye mentioned he is already began researching low cost drug firms and cash-pay packages on how he should buy on his personal the 2 major drugs he makes use of to regulate diabetes. He confirmed ABC Information an bill he acquired in September indicating his insurance coverage lined the $1,669 value of his major treatment, Jardiance.

Boye mentioned his present predicament has left him feeling like a “tiny fish that doesn’t matter.”

“Realistically, I’ve no management over any of this,” he mentioned. “I am only a one that has to navigate the waters and discover a answer.”

In an announcement to ABC Information, a spokesperson for Florida Blue mentioned that, subsequent 12 months, there might be “increased insurance coverage prices for a lot of, and authorities monetary assist (premium tax credit) will lower if the improved premium tax credit expire, as they’re deliberate to.”

The group mentioned it understood members’ considerations and is dedicated to supporting members, however added that premium will increase “are an industry-wide situation, a needed however regarding response to federal regulatory modifications together with the scheduled expiration of the improved premium tax credit on the finish of 2025, in addition to the rising value and utilization of medical care and prescribed drugs.”

‘It’s actual folks that every one of that is affecting’

The Butcharts, from Illinois, traveled to Washington, D.C., this week with members of the Muscular Dystrophy Affiliation to debate their precarious state of affairs with congressional leaders, together with their two Illinois senators, Dick Durbin and Tammy Duckworth, each Democrats.

The 67-year-old Doug Butchart mentioned he wished to indicate the lawmakers “that it is for actual, that it is actual folks that every one of that is affecting.”

ACA policyholders Doug and Shadene Butchart of Elgin, Illinois, pose for a photograph in entrance of the Capitol Constructing in Washington, D.C., Nov. 4, 2025.

Courtesy of Doug Butchart

Butchart mentioned he has obtained notification, which he shared with ABC Information, that the month-to-month premiums on his spouse’s ACA coverage via Blue Cross Blue Defend of Illinois will rise from $603.82 to as much as $2,000 with out the tax credit in 2026. Based on the discover he obtained, even with a tax credit score estimated at $738, the month-to-month premium can be almost $1,400.

“It is insane,” Butchart informed ABC Information.

He mentioned his 58-year-old spouse was recognized with ALS eight years in the past, including that about 10% of ALS sufferers survive that lengthy.

Butchart mentioned his spouse’s most important treatment, Radicava, prices about $15,000 a month, and one other treatment prices $4,000 for a three-month provide.

Whereas insurance coverage has lined most of their medical prices, Butchart mentioned his spouse’s out-of-pocket bills final 12 months have been about $3,000.

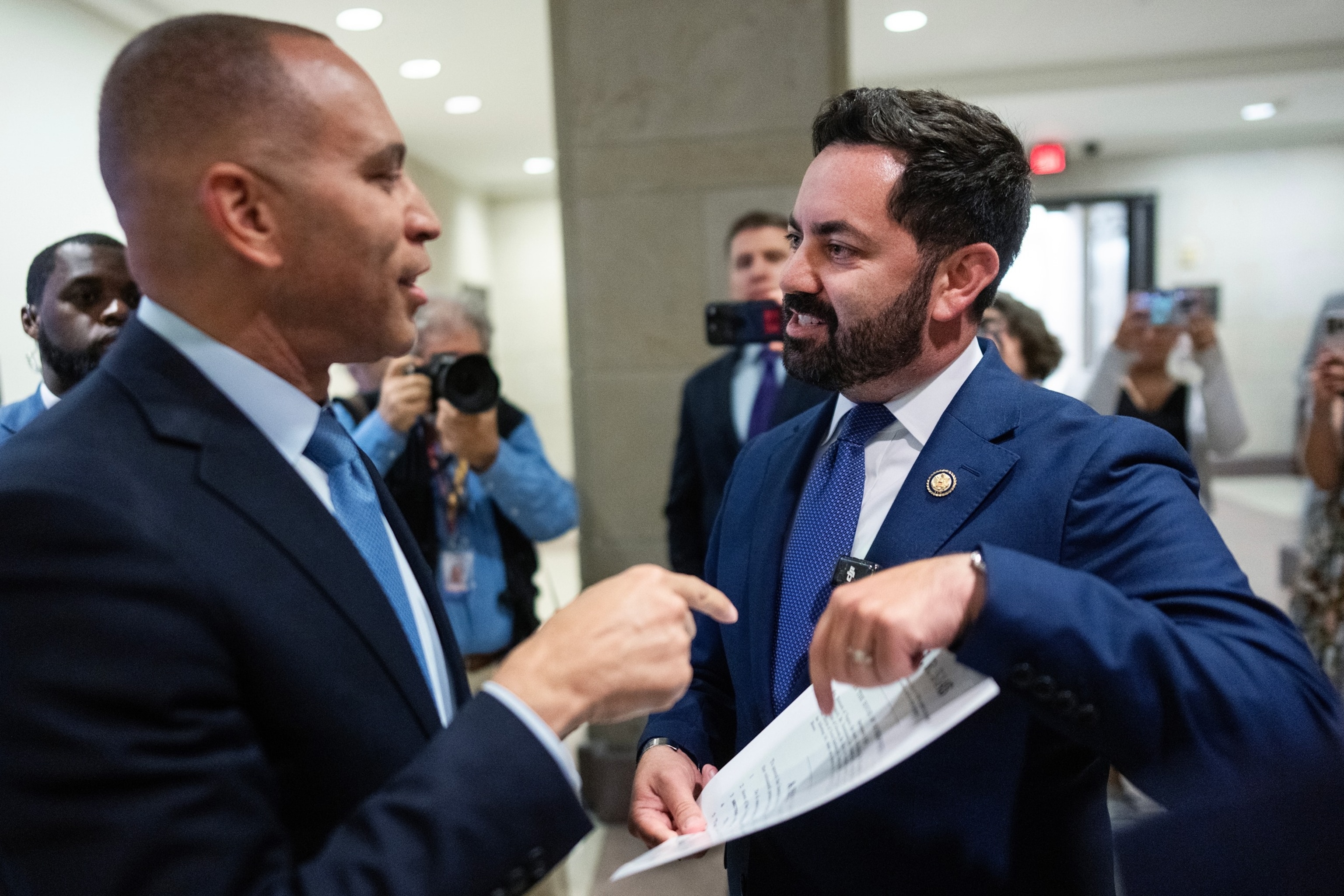

Rep. Mike Lawler, R-N.Y., proper, confronts Home Minority Chief Hakeem Jeffries, D-N.Y., about signing on to a invoice that may lengthen Reasonably priced Care Act tax credit, after a Home Democrats information convention Washington, D.C., October 8, 2025.

Tom Williams/CQ-Roll Name, Inc through Getty Imag

He mentioned that with out the tax credit, and on high of the elevated month-to-month premiums, his spouse could have an $8,000 deductible in 2026, and her out-of-pocket bills might high $10,000.

“That is some huge cash, far more cash than we get in a 12 months,” mentioned Butchart.

He mentioned he and his spouse stay off his Social Safety earnings and that she doesn’t qualify for Medicaid or any incapacity earnings.

“I do not need to put ourselves ready the place we’re in debt. I am not 20 years outdated or 30 years outdated the place I can exit and get a second job,” Butchart mentioned.

In a assertion to ABC Information, Blue Cross Blue Defend of Illinois mentioned it “stays steadfast in its dedication to a steady medical health insurance market with aggressive plan decisions within the particular person market, as we’ve for the reason that inception of the ACA.”

“The charges for 2026 protection embrace each new and present particular person ACA-compliant plans and displays industry-wide modifications to the market, together with the anticipated expiration of enhanced premium tax credit on the finish of 2025. Plans are priced to mirror anticipated well being care wants,” the corporate mentioned.

However Butchart mentioned the he nonetheless would not see how the corporate can “justify” such will increase in premiums.

“I want the people who find themselves making selections and setting the costs have been in the identical place as we’re,” Butchart mentioned.

ABC Information’ Kristopher Anderson contributed to this report.