ElenVD/iStock through Getty Pictures

By Scott Kennedy, Produced with Colorado Wealth Administration Fund

Introduction

Two Harbors Funding (NYSE:TWO) had a tricky quarter on ebook worth, with a larger-than-expected decline. A few of this may be attributed to their authorized loss and hedging alternative. We nonetheless see TWO as weaker than prime friends. At present pricing, we view shares as a maintain.

Commentary

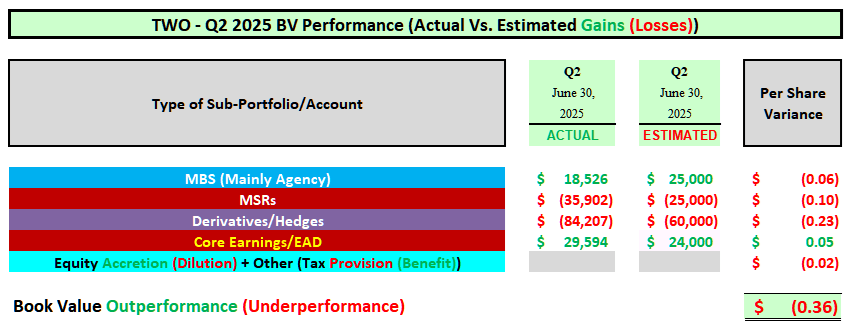

- Quarterly BV Fluctuation: Minor – Modest Underperformance (2.4% Variance).

- Core Earnings/EAD: Modest Outperformance ($0.054 Variance).

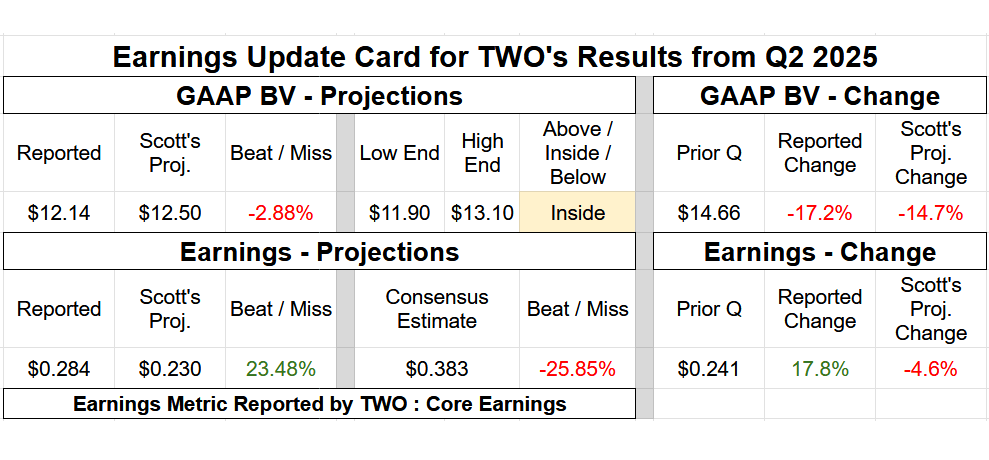

A little bit of an underperforming quarter relating to Two Harbors Funding’s BV, in my view. I projected TWO would report a extreme (14.8%) quarterly BV lower. Compared, TWO reported a extreme–very extreme (17.2%) quarterly BV enhance. Bear in mind, Q2 2025 was a very risky quarter for company mREIT shares relating to BV fluctuations.

There was a “distinctive” occasion that notably negatively impacted TWO’s BV throughout Q2 2025. This has to do with an ongoing authorized dispute with their prior exterior supervisor.

As well as, TWO made some hedging selections that negatively impacted the corporate’s BV however positively impacted core earnings/EAD throughout Q2 2025. As such, allow us to first evaluate TWO’s efficiency versus my expectations.

First, comparable to a few different company mREIT sub-sector friends, TWO largely maintained the scale of the corporate’s on-balance sheet fixed-rate company MBS/funding portfolio by the tip of the quarter. Compared, after TWO’s damaging authorized ruling and attraction denial in Might 2025, I in the end assumed administration would start to “shed” property to lift money throughout Q2 2025. At first, I didn’t imagine administration wanted to do that. Nevertheless, my assumption modified after administration’s 6/18/2025 commentary along with the Q2 2025 frequent inventory dividend discount. Specifically, the next quote from TWO’s CEO and President, Mr. Greenberg:

“…The lowered dividend displays our projected static returns in future quarters as we regulate our portfolio in gentle of this accrual…”

Trying again, maybe this was a little bit of a “pre-mature” assumption on my finish. That stated, asset gross sales throughout elements of Q2 2025 would have been barely extra useful than most of June 2025. Nevertheless, throughout late June 2025, MBS pricing rapidly moved larger, which largely offset this assumption. In the long run, even with my common assumption of a modest portfolio discount not coming to fruition, TWO’s web valuation acquire throughout the firm’s on-balance sheet fixed-rate company MBS/funding portfolio largely matched my expectations throughout Q2 2025 (see BV desk beneath; 1st row of accounts). If something, a really minor underperformance.

Second, TWO’s MSR sub-portfolio barely underperformed my expectations throughout Q2 2025. This was primarily resulting from the truth that TWO’s UPB barely elevated throughout Q2 2025 (sub-portfolio dimension). Not like the prior quarter, TWO made new bulk purchases of $6.4 billion (together with very minor move acquisitions and recaptures of $0.2 billion) throughout Q2 2025. After quarterly roll-off and prepayments, this resulted in a quarterly UPB enhance of $2.0 billion, which versus my projection of a quarterly UPB lower of $3.0 billion. Since MSR valuations decreased in late June 2025 as charges/yields rapidly decreased, this issue, together with a fractionally larger-than-anticipated quarterly CPR enhance that led to larger amortization, straight resulted in a barely extra extreme MSR valuation loss when in comparison with my expectations (see BV desk beneath; 2nd row of accounts).

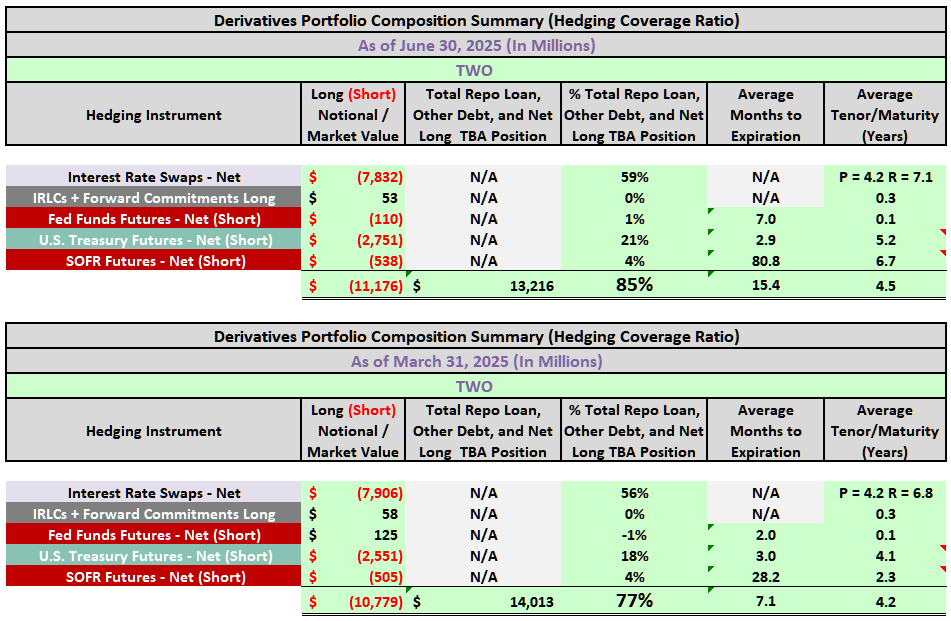

Third, TWO’s derivatives sub-portfolio modestly underperformed my expectations throughout Q2 2025. This was the most important BV disappointment/shock, in my view. This was primarily resulting from 2 associated components. First, as famous earlier, I assumed TWO would start to promote property (and terminate underlying derivatives) to build up money/capital for the upcoming notable contingent legal responsibility that was booked in the course of the quarter. As famous earlier, this, for essentially the most half, did not happen inside TWO’s MBS/funding portfolio throughout Q2 2025. As such, it’s logical {that a} discount additionally didn’t happen inside TWO’s by-product devices sub-portfolio. Since mortgage rates of interest/U.S. Treasury yields rapidly web decreased in late June 2025, this straight resulted in a bigger derivatives web valuation loss when in comparison with my expectations (bigger by-product portfolio dimension). Second, on prime of this, TWO wound up really growing the corporate’s hedging protection ratio from 77% as of three/31/2025 to 85% as of 6/30/2025. Merely put, even when my 1st assumption didn’t happen (discount of each MBS/investments and derivatives), I didn’t assume administration would really enhance hedges throughout Q2 2025 (at worst they might be maintained). New rate of interest payer swaps (although largely offset by new receiver swaps) and a bigger web (brief) futures place merely elevated the severity of TWO’s complete derivatives web valuation loss versus my expectations (see BV desk beneath; 3rd row of accounts). Nevertheless, as will likely be mentioned subsequent, this technique positively impacted TWO’s core earnings/EAD when in comparison with my expectations.

Transferring on, TWO’s core earnings/EAD modestly outperformed my expectations throughout Q2 2025. This was a “vibrant spot” to the quarter in my view and mainly saved TWO from one other share suggestion vary downgrade. TWO’s quarterly core earnings/EAD outperformance was primarily because of the following when in comparison with my expectations: 1) barely smaller web curiosity expense resulting from sustaining a bigger on-balance sheet fixed-rate company MBS/funding portfolio dimension; 2) barely larger web servicing revenue resulting from a barely bigger MSR sub-portfolio dimension; 3) very comparable TBA NDR revenue (resulting from a accurately anticipated comparatively unchanged off-balance sheet web lengthy TBA MBS place); and 4) modestly extra web periodic curiosity revenue on rate of interest swaps and U.S. Treasury futures revenue (present interval hedging revenue; primarily because of the aforementioned addition of some lower-cost rate of interest payer swaps, Treasury futures, and SOFR futures). For the sixth straight quarter, operational bills got here in largely as anticipated.

So, a blended quarter for TWO relating to the corporate’s general efficiency. TWO will definitely underperform the corporate’s company mREIT sub-sector friends relating to a extreme—very extreme quarterly BV lower. Nevertheless, most of this lower was already anticipated. As well as, TWO reported a good quarterly enhance in core earnings/EAD.

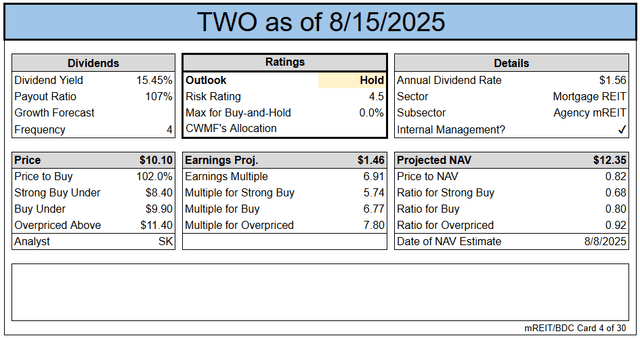

Since I already downgraded TWO again in late Might 2025 because of the firm’s $200 million contingent legal responsibility accrual, I don’t imagine one other downgrade is warranted from at this time’s earnings outcomes.

That stated, I proceed to imagine TWO remains to be not in the identical “class” as AGNC Funding Corp. (AGNC), Dynex Capital, Inc. (DX), or Annaly Capital Administration Inc. (NLY) relating to long-term operational efficiency. As famous final quarter, 1 quarter of TWO BV outperformance versus these friends is just “1 chapter in a ebook.” TWO’s current damaging authorized ruling has taken an excellent “chunk” out of the corporate’s out there capital over the foreseeable future and BV throughout Q2 2025.

As such, a danger/efficiency ranking of 4.5 for TWO stays applicable within the present surroundings/over the foreseeable future.

Bear in mind, though most company mREITs have little or no credit score danger, these firms nonetheless should navigate the next dangers: 1) unfold/foundation; 2) leverage; 3) prepayment/extension; and 4) rate of interest (relating to derivatives). As a reminder, my/our fashions proceed to undertaking 1 – 2 (25) foundation level (“bp”) Federal (“Fed”) Funds Charge cuts in some unspecified time in the future in the course of the 2nd half of 2025. That is already “baked” into present sector suggestion ranges/value targets.

BV Efficiency (Precise Vs. Estimated)

The REIT Discussion board

Change or Keep

- BV/NAV Adjustment (BV/NAV Used Interchangeably): Our projection for present BV/NAV per share was adjusted: Down ($0.35) (To account for the Precise 6/30/2025 BV/NAV Vs. Prior Projection). Worth targets have already been adjusted to mirror the change in BV/NAV. The replace is included within the card beneath and the subscriber spreadsheets.

- Share Suggestion Vary (Relative to CURRENT BV/NAV): No Change.

- Danger/Efficiency Ranking: No Change. Stays at 4.5.

Hedging

- Hedging Protection Ratio: Enhance from 77% to 85%.

The REIT discussion board

Earnings Outcomes

The REIT Discussion board

Observe: BV on the finish of the quarter. Subscriber spreadsheets and targets use present estimates, not trailing values.

Valuation

The REIT Discussion board

Ending Notes/Commentary

TWO did not present the corporate’s IXM determine this quarter in its earnings press launch (6th quarter in a row). As said in prior quarters, this metric will not be an correct comparability to core earnings/EAD and positively “skewed” TWO’s efficiency when in comparison with each sub-sector and broader sector friends. TWO’s IXM metric had/has some “fascinating” methodologies versus each GAAP accounting and core earnings/EAD, so I’m glad it was omitted as soon as once more this quarter by the corporate.

TWO is presently deemed appropriately valued (therefore our HOLD suggestion). TWO has some insulation in a “higher-for-longer” rate of interest/yield surroundings through the corporate’s MSR sub-portfolio. Nonetheless, I wish to see unfold stabilization over a interval longer than merely 1 quarter, together with TWO’s inventory value buying and selling at a barely to modestly extra engaging valuation earlier than contemplating an funding.

Subscribers even have to think about the continuing authorized issues relating to TWO’s formal exterior supervisor. There’s the chance for even additional authorized damages awarded to Pine River Capital Administration, except for what TWO has already accrued.