I am an unabashed fan of the Delta SkyMiles® Reserve American Categorical Card (a lot in order that I wrote an entire story touting my love for this card).

The Delta Amex Reserve has gotten me into many a Delta Sky Membership airport lounge, awarded me with an annual companion certificates so I can convey a good friend or member of the family alongside after I fly, helped me rating first-class and Consolation+ upgrades and a lot extra.

Proper now, there’s another reason to like the Delta Amex Reserve.

For a restricted time, new cardmembers can earn 100,000 bonus miles after spending $6,000 in eligible purchases of their first six months of card membership. TPG’s July 2025 valuations peg that bonus at $1,150.

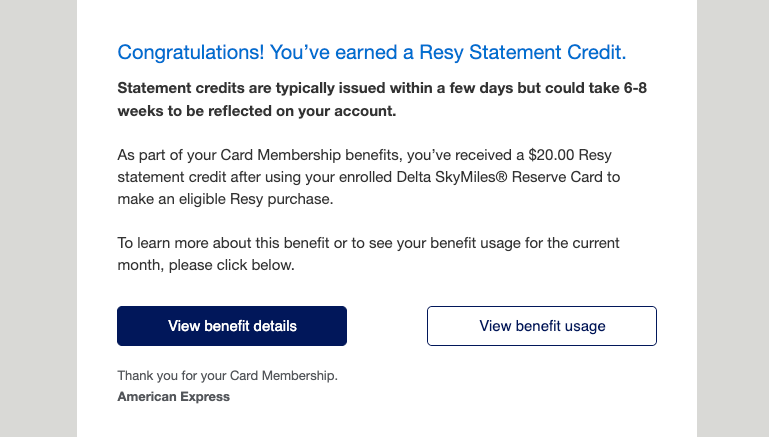

One of many best methods to reap the benefits of the Delta Amex Reserve’s many perks is to make use of the month-to-month Resy assertion credit score. Cardholders can obtain an announcement credit score of as much as $240 yearly (as much as $20 month-to-month) on U.S. purchases made with Resy. This profit has been surprisingly easy to earn — so easy, the truth is, that I typically earn the assertion credit score with out even realizing it.

This is how.

Associated: Do you have got a Delta Amex card? Listed here are 9 issues you could do

Playing cards that earn Resy assertion credit

It isn’t usually {that a} card makes it this simple to make use of its perks, however that is precisely what occurred to me lately. Earlier than I clarify precisely how this occurred, let’s take a look at the listing of assertion credit for playing cards that earn a Resy credit score.

The total lineup of Delta and Amex cobranded playing cards acquired annual charge bumps and altered perks in 2024, as did the American Categorical® Gold Card. I’ll solely concentrate on the playing cards with the identical assertion credit as my Delta Reserve Amex.

Every day Publication

Reward your inbox with the TPG Every day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

This is a better take a look at the annual and month-to-month assertion credit:

- Delta Stays (Delta’s lodge journey portal) for pay as you go resorts and trip leases

- Resy for eligible purchases at Resy eating places within the U.S.*

- Choose U.S. ride-hailing providers like Uber, Lyft, Revel, Curb and Alto*

*Enrollment is required for choose advantages; phrases apply.

The quantity that you would be able to obtain for these assertion credit varies by card. These are the playing cards which can be eligible to obtain all three of those assertion credit:

When you’ve got one among these 5 playing cards, you need to use the listed assertion credit to offset the annual charge, if you know the way to make use of them. TPG has a must-read information that will help you maximize these credit, so I will not repeat that right here. As an alternative, let’s get again to my shock credit score.

Incomes the month-to-month Resy assertion credit score

With my Delta SkyMiles® Reserve American Categorical Card, I stand up to $240 yearly (as much as $20 month-to-month) in assertion credit after I dine at an eligible restaurant within the U.S. that participates within the Resy reservations system and pay with my Delta Reserve Amex. It’s possible you’ll be questioning how a perk that entails eating at particular eating places was in a position to shock me, however it did.

That is as a result of you do not have to make a reservation by means of Resy to earn the credit score; you solely must pay your invoice at a restaurant listed on Resy utilizing an eligible card. I acquired an e-mail alerting me that I had earned a $20 Resy assertion credit score, although I had no recollection of eating at a taking part restaurant.

My husband was out of city then, so the one eating out I had been doing was visiting the McDonald’s drive-thru to get Completely happy Meals for the youngsters. As a lot as my youngsters love a fast and low-cost meal from McDonald’s, I knew that could not have triggered the credit score. (McDonald’s has its personal superior rewards program, although.)

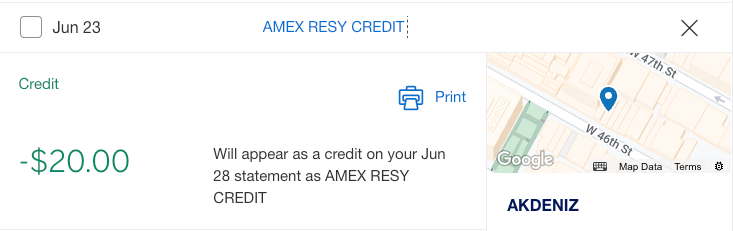

Fortunately, Amex makes figuring out which cost triggered the Resy credit score simple. I logged in to my account and located the restaurant’s identify was listed within the $20 credit score transaction. The shock meal was one my husband had eaten whereas he was in New York Metropolis. Thriller solved!

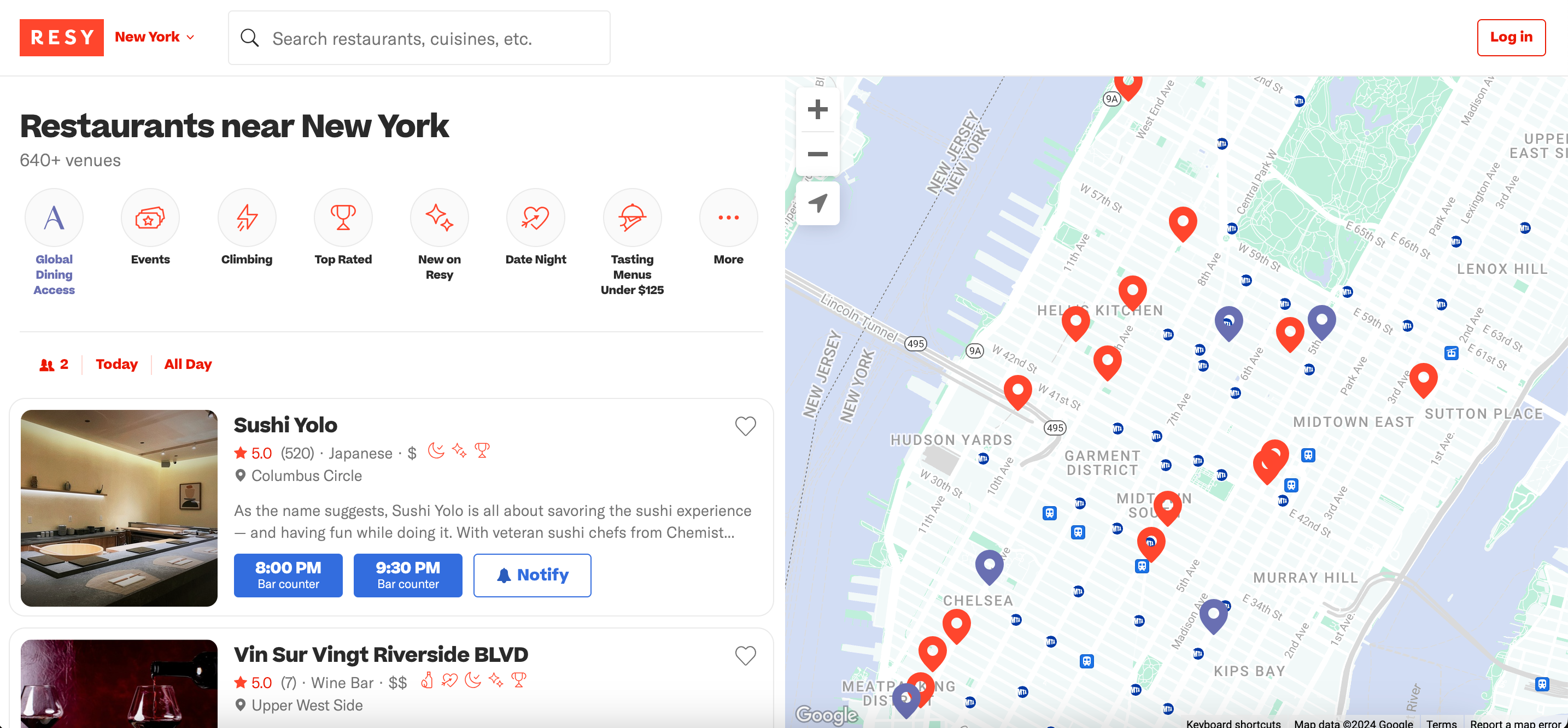

New York has an extended listing of Resy-affiliated eating places. For those who dine in New York or one other metropolitan space, you would additionally obtain a shock assertion credit score utilizing your eligible Amex card to pay in your meal.

We do not have as many taking part eating places in my hometown, so I’ve to plan extra rigorously to make use of my month-to-month Resy credit score. My technique up to now entails reviewing the listing of eating places in the beginning of the month as a reminder to cease by one for dinner or drinks in some unspecified time in the future. Or, if I’ve a visit arising, I will take a look at eating places at my vacation spot and add one to the itinerary.

Discovering Resy-affiliated eating places is straightforward. You should use the Resy web site or app to seek for close by eating places and both make a reservation or go to as a walk-in. Simply bear in mind to pay the invoice along with your eligible Amex card.

Associated: Why the Delta SkyMiles Reserve card is the very best card I’ve added to my pockets up to now 12 months

Different real-world examples

He even bought a bodily reward card at an area Resy institution for a good friend’s birthday, triggering the $20 assertion credit score. We have seen different anecdotal proof {that a} reward card buy will usually set off the assertion credit score, however your mileage could fluctuate based mostly on how the restaurant costs your card.

Backside line

Used each month, the Resy assertion credit score will be value as much as $240 per 12 months. Mixed with as much as $120 in annual ride-hailing assertion credit and the Delta Stays assertion credit score value as much as $200, that is $560 per 12 months in financial savings, which falls solely $90 in need of my Delta Reserve Amex’s $650 annual charge. Enrollment required for choose advantages.

After I issue within the card’s different advantages, like an annual companion certificates, 15 Delta Sky Membership visits per 12 months and free checked baggage, I can simply squeeze $650 in worth from this card. In case you are contemplating including a Delta Amex to your pockets, you will get much more worth within the first 12 months once you earn the introductory welcome provide.

To study extra, learn our full evaluate of the Delta Reserve Amex.

Apply right here: Delta SkyMiles Reserve American Categorical Card

Associated: Is the Delta Reserve Amex well worth the annual charge?

For charges and costs of the Delta Reserve Amex, click on right here.

For charges and costs of the Delta Platinum Amex, click on right here.

For charges and costs of the Delta Platinum Enterprise Amex, click on right here.

For charges and costs of the Delta Reserve Enterprise Amex, click on right here.