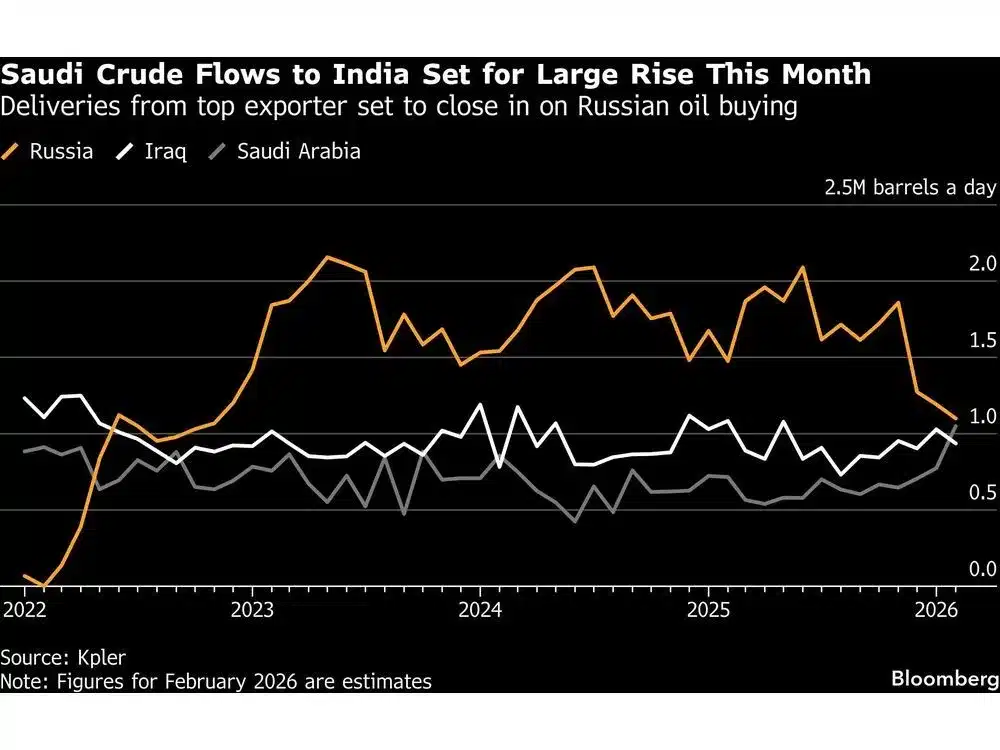

India prepares to import the highest volume of crude oil from Saudi Arabia in over six years this month, driven by ongoing US efforts to curb purchases of Russian oil. Saudi shipments are projected to reach 1 million to 1.1 million barrels per day (bpd), the highest level since November 2019, according to data from Kpler tracked by lead research analyst Sumit Ritolia.

Closing the Supplier Gap

These volumes align closely with Russian supplies, marking a notable reduction in the gap between the two major exporters. The disparity had grown significantly after India increased its Russian oil imports following the 2022 Ukraine invasion.

US Influence and Russian Decline

Pressure from the US intensified recently when President Donald Trump claimed India agreed to halt Russian oil imports as part of a trade agreement. Indian officials have not publicly responded to the statement. Russia may still lead as India’s top supplier this month if its exports hit the upper estimate of 1.2 million bpd, but volumes are expected to decline further.

India became a key buyer of discounted Russian crude after the Ukraine conflict, peaking at 2 million bpd. Next month, imports from Russia are forecast to drop to 800,000 to 1 million bpd. A maintenance shutdown at Nayara Energy Ltd.’s refinery—fully reliant on Russian oil amid European Union sanctions—will further reduce volumes in April and May.

Strategic Implications

For Russia, diminishing market share in India undermines a vital export channel lost from Europe due to the war. Saudi Arabia’s gains position it to reclaim dominance in one of the world’s fastest-growing oil markets, bolstering its regional influence.