With tax season on the horizon, credit card enthusiasts may wonder if they have to pay taxes on the rewards they earned in 2025.

The good news? Generally, credit card rewards are not considered taxable income. However, certain types of rewards, such as checking account bonuses and credit card referral bonuses, may prompt your bank to send you a 1099.

Let’s break down when you should expect a 1099 for your rewards, along with the steps you should take if you believe you received one in error.

Are credit card rewards taxable?

Most of the time, credit card rewards are not taxable.

This is because you must spend money to earn rewards in most credit card reward programs. To earn a welcome bonus, you’ll have to meet a spending requirement. You receive points and miles in exchange for making purchases with your card.

So, generally speaking, rewards you earn from everyday card spending and credit card perks (such as statement credits) aren’t considered taxable income. Instead, they’re often considered rebates on your regular spending.

However, there is an exception. Bonuses received without spending (think: referral bonuses and automatic bonuses for opening a new bank account) are considered taxable income. This is because you don’t have to spend on the card to earn rewards.

If you earned a chunk of points or miles from multiple referral bonuses or opened up a bank account with a welcome bonus just for signing up, you may receive a 1099 this year.

Related: Can you pay taxes with a credit card?

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Which credit card rewards are taxable?

As mentioned, most rewards you earn from credit cards are not taxable. The one exception here is a referral bonus you receive when someone applies for a credit card through your referral link.

The bonus is considered income since you don’t have to spend to get these rewards. It’s worth noting, however, that the person you referred to won’t need to pay taxes on the bonus they earn for completing a spending requirement.

Is cash back taxable?

In most cases, no. A 2010 IRS memorandum states that cash back earned from credit card spending is not taxable income.

However, if you receive it as part of opening a bank account where you didn’t have to complete a minimum spending requirement, this is considered taxable income, and you must report it on your tax return.

Related: Best cash-back credit cards

Are business credit card rewards taxable?

Just like with personal cards, welcome bonuses and the rewards you earn from making purchases on your business credit card are not considered taxable income.

However, when claiming business expenses, you can only claim the net cost of an item after any statement credits you receive as a credit card perk, rather than the full cost before the credits are applied.

Related: Best business credit cards

Are bank account welcome bonuses taxable?

Yes. Bonuses for opening new bank accounts are under the same umbrella as credit card referral bonuses since you don’t have to spend to earn them. This means they’re taxable, according to the IRS.

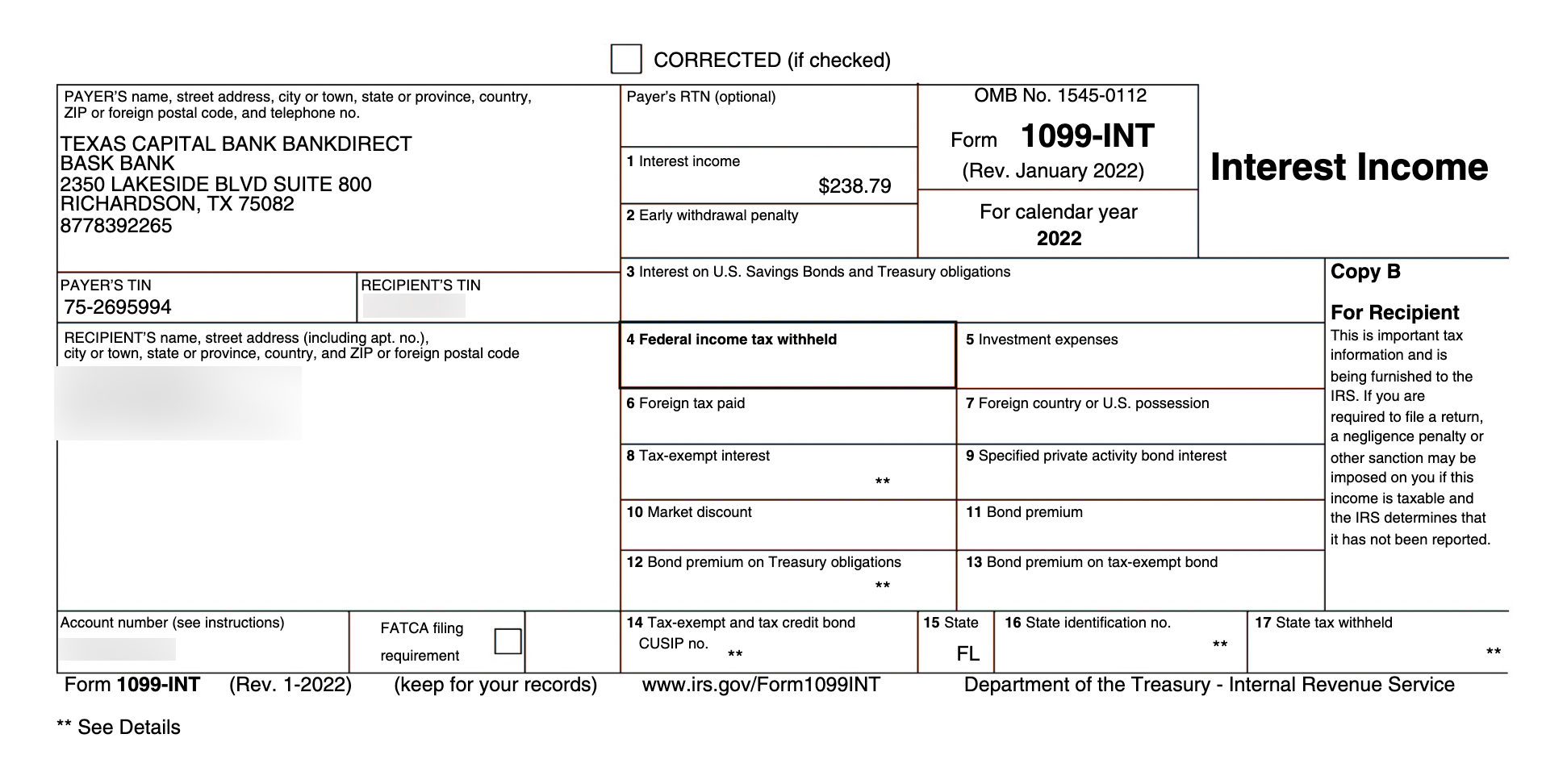

TPG senior editor Lyndsey Matthews received two 1099 forms from checking account bonuses after signing up with SoFi and American Express in 2025. The bonuses were included with interest earned on those accounts last year — both of which are considered taxable income.

Just like with credit card referral bonuses, there’s no guarantee you’ll get a 1099 for these bonuses, but you’re expected to claim them as income regardless.

Will I receive a 1099 for my credit card rewards?

Sometimes, you’ll receive a 1099-MISC or a 1099-INT if you have received taxable rewards.

A 1099 is often called an information return document for the IRS that shows the income you’ve received from a third party.

Not all issuers will send these forms. It’s recommended that you maintain your own records since you’ll still need to report all your income, even if you don’t receive a 1099.

Related: If I cash out my points and miles, do I have to claim it on my taxes?

Which issuers send 1099 forms for credit card rewards?

If you earn $600 or more from referral bonuses, you should expect to receive a 1099 form from most major issuers. If you’re expecting a 1099 and it doesn’t come, you can request one or estimate the income.

It’s important to note that you must report this income to the IRS, even if the bank doesn’t send you a 1099.

In other circumstances, you can contact the issuer for clarification or correction if you receive a 1099 that you believe was issued in error.

Historically, banks have treated statement credits and bonus points as rebates on spending, which the IRS does not view as taxable income. So far, we haven’t seen banks issue 1099s for statement credits, but we’ll keep an eye on it.

Where do I report my credit card rewards income on a 1099?

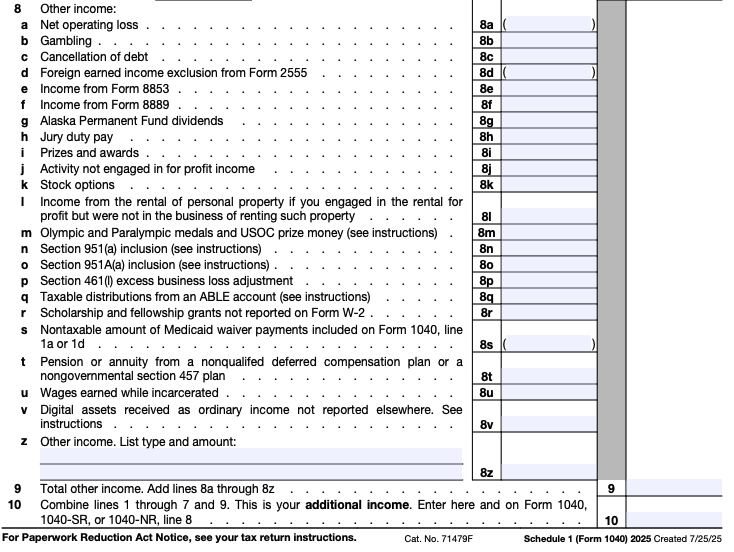

You should include the income under the heading “Other income” on line 8z of your 1040 as reported under the “Other income” from Schedule 1.

If you need to calculate referral bonus value, use the issuer’s valuation of its points or miles or a third-party valuation.

For example, Capital One values its miles at 1 cent per point, while TPG’s February 2026 valuations place them at 1.85 cents per point. When calculating the value of Capital One referrals, it’s often in your best interest to use its 1-cent-per-point valuation.

Bottom line

Even if you’ve received thousands of dollars in value from credit card welcome bonuses and everyday spending, you generally won’t have to pay taxes on these awards.

However, that is not the case if you’ve received bonus rewards from opening bank accounts or collecting multiple referral bonuses. You will have to pay taxes on these rewards.

Be sure to keep notes on your income sources. While many banks will issue 1099s for these earnings, some may not. However, you will still be expected to pay taxes on these earnings since they’re considered income.

If you’re concerned about owing taxes for your credit card rewards or have further questions, we recommend consulting a tax professional.

Related: Earn points, miles and cash back while doing your taxes