yanguolin/iStock by way of Getty Photos

Quick Studying

- The Brown Advisory U.S. Versatile Fairness technique employs a price philosophy to a broad spectrum of funding alternatives throughout each “development” and “worth” equities. Portfolio Supervisor Maneesh Bajaj seeks to put money into enticing companies when the market presents them at discount costs, enabling him to dynamically alter the portfolio, capitalizing on market dislocations whereas actively managing focus dangers.

- The latest surge in fairness markets, pushed by a small group of mega-cap know-how shares, highlights each the dangers of index focus and the necessity for energetic administration and considerate diversification to guard portfolios.

- Lengthy-term worth is unlocked via rigorous analysis, endurance, and a deal with intrinsic enterprise high quality quite than short-term developments.

A versatile funding technique empowers buyers to regulate their portfolios in response to evolving alternatives and dangers, quite than adhering to inflexible allocations. Maneesh Bajaj, Portfolio Supervisor, emphasizes that he’s not constrained by conventional type packing containers, whether or not development or worth. As a substitute, he and the crew search alternatives wherever they come up, guided by a clear-eyed view of intrinsic worth and long-term potential.

This flexibility permits a dynamic response to market dislocations — moments when worry, uncertainty or macroeconomic shocks trigger costs to diverge from fundamentals, equivalent to these seen in 2024 when markets have been pushed extra by momentum and hypothesis and in early 2025 after the tariff-induced shock of “Liberation Day.” These dislocations, whereas unsettling, usually current fertile floor for disciplined, long-term buyers.

The State of the Market

The U.S. large-cap fairness market, significantly the Russell 1000® Progress Index and S&P 500® Index, has seen distinctive efficiency, reaching report highs on a number of events over the previous few years. Amid this euphoria, it could be straightforward to imagine that each one U.S. shares have reached meteoric ranges. But, while you drill down past the headlines, you discover that these beneficial properties have been pushed by a comparatively slender group of shares: a mix of the “Magnificent Seven,” the highest 10 largest corporations, and AI-related names, a lot of which overlap.1 This focus has led to a skewed illustration of the broader market, with these shares considerably influencing index efficiency.

A big a part of these beneficial properties was pushed by the joy surrounding the potential for synthetic intelligence (AI), with the world’s greatest know-how corporations investing closely on this rising know-how. Chipmaker NVIDIA (NVDA) (which rallied 171.2% in 2024) noticed its earnings quickly multiply as AI depends closely on its superior semiconductors.2

We will’t emphasize strongly sufficient that it’s largely unattainable to foretell the near-term path of the inventory market. Skewing one’s portfolio closely towards a powerful bullish or sturdy bearish perception is theory. We consider that investing in equities ought to be a balancing act, not an train in inserting bets on one facet of the dimensions or the opposite. At any given time, we have to weigh the danger and alternative we see within the economic system, within the inventory market and in particular person corporations — all to steadiness the potential constructive and detrimental outcomes of each funding we make.

Index Focus

The dominance of the “AI commerce” and the mega-cap shares underlines the primary motive why energetic fairness methods have been unable to match the market’s efficiency in recent times. It’s straightforward to overlook that when buyers confer with “the market,” they’re actually referencing particular market indices — for U.S. large-cap core, it’s the S&P 500 Index. These indices don’t really symbolize the market however quite are funding merchandise created by corporations equivalent to MSCI, S&P, FTSE Russell, and so forth.

These indices function a consultant subset of a selected market by deciding on a pattern of related corporations as outlined by the index supplier’s specific methodology. Designed to be consultant of the market, the S&P 500 is broadly accepted because the benchmark for U.S. large-cap equities. Whereas it serves its objective as a reference level, its development methodology is mechanistic.

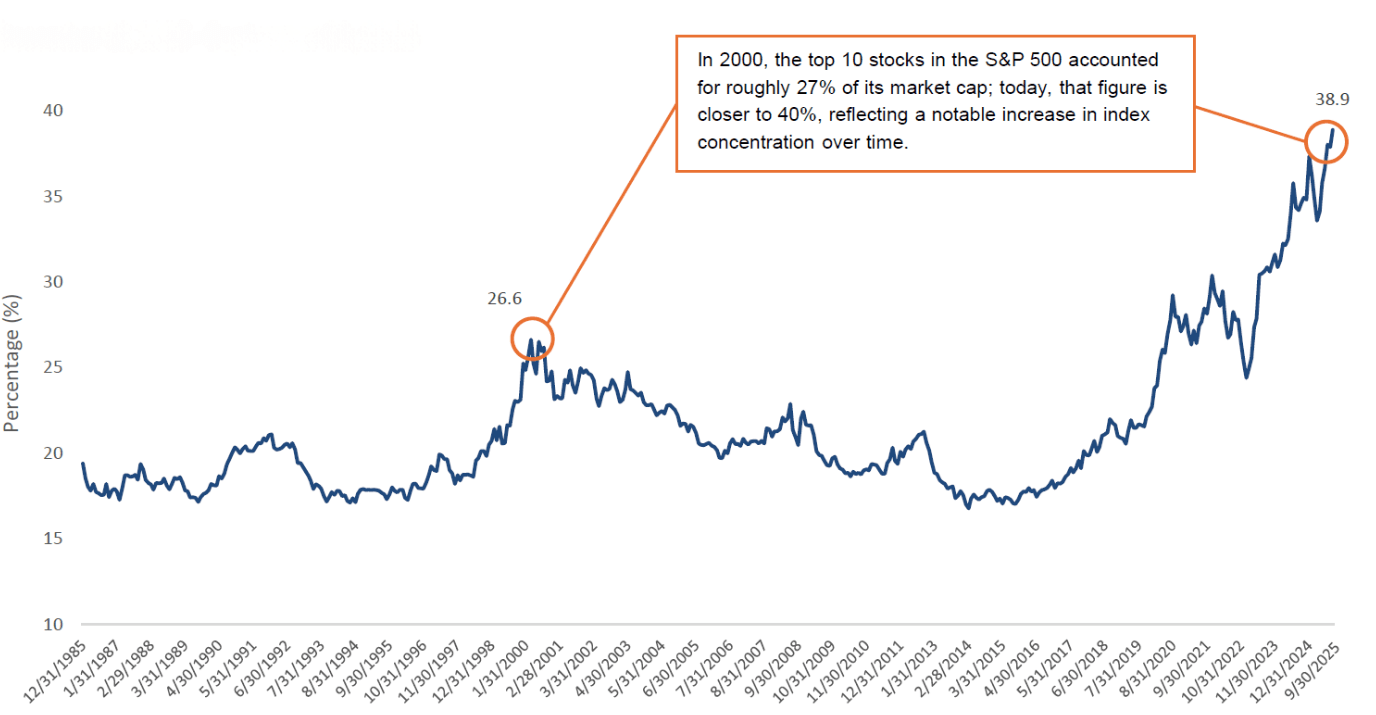

Index Focus (%): S&P 500 Index

December 31, 1985 – September 30, 2025

Supply: Factset, as of 09/30/2025. Knowledge covers the 39-year interval from December 1985 via September 2025 and makes use of the S&P 500 Index solely.

The inclusion standards, equivalent to market capitalization (at present a minimum of $22.7 billion), liquidity (minimal float-adjusted liquidity ratio of 0.75), public float (a minimum of 50%) and monetary viability (constructive GAAP earnings during the last 4 quarters and the latest quarter), are mandatory for index stability, however, in our view, they don’t seem to be enough for discerning high quality. Sector steadiness is taken into account solely in combination phrases, and constituent choice is finally on the discretion of an Index Committee.2

Now, we absolutely acknowledge the inherent bias on this critique; energetic managers will at all times problem the constraints of passive development. However the argument right here shouldn’t be rhetorical however structural, as indices depend on static thresholds, whereas energetic managers usually apply dynamic judgment and proprietary analysis. The S&P 500 Index is a useful gizmo for measuring market efficiency, however it’s not a measure of enterprise high quality, neither is it an alternative to proprietary funding analysis.

But, this extra rigorous evaluation has been much less efficient in a market dominated by the AI momentum commerce. On the similar time, the present lack of diversification in indices can current hidden dangers. Eric Gordon, CFA, portfolio supervisor at Brown Advisory, wrote about a few of the sector developments our crew is seeing in his most up-to-date Fairness Beat: Something However Routine. Of word, he shares that “basically, AI information middle demand exhibits no indicators of cracking, [yet] almost each peer we spoke with believes this theme will finally finish badly for buyers.”

Diversification: Constraints and Alternatives

We consider latest market dynamics underscore the significance of a versatile method. Market focus has been a lot mentioned, and even the phrase “bubble” has been thrown round. However had the Magnificent Seven not been included, the S&P 500 would have posted detrimental earnings development in 2023. Massive-cap indices have benefited immensely from the dominant leaders in software program, cloud computing and AI. This momentum has delivered some sturdy returns, nevertheless it additionally introduces hidden dangers for passive buyers, significantly the erosion of diversification and susceptibility to sector-specific shocks.

Defining funding success purely on efficiency phrases can go away buyers uncovered to hidden and avoidable dangers. The market’s excessive focus of returns exemplifies such threat and underpins the qualities past efficiency that energetic methods additionally supply: threat mitigation via diversification, less-correlated returns and the power to offer draw back safety, in addition to the potential to outperform throughout extra turbulent and down-market circumstances.

Whereas it may be tempting to deal with a number of acquainted investments, preserving your portfolio diversified is a straightforward (however not straightforward) means to assist handle threat. Diversification additionally helps easy out the ups and downs of market volatility, permitting your portfolio to remain resilient via altering circumstances over the long term.

A versatile technique may also help keep away from these pitfalls by actively reallocating capital based mostly on fundamentals quite than index weightings, enabling buyers to sidestep overvalued areas and uncover mispriced alternatives throughout the complete market spectrum.

A Framework for Discovering Lengthy-Time period Worth

We consider that anybody well-versed in securities valuation, as we anticipate all thorough buyers to be, would acknowledge that each “development” (prospects of development) and “worth” (extra exactly, valuation) are important elements of the identical equation in basic investing. But, buyers and asset allocators usually lean towards one, neglecting the opposite. Progress buyers generally dismiss funding alternatives that will not be rising at a charge above a sure arbitrary threshold, whatever the inventory’s enticing value and return potential. Equally, worth buyers would possibly deliberately overlook corporations experiencing speedy development as a result of their inventory costs are buying and selling at a a number of exceeding a self-imposed restrict, ignoring the likelihood that these corporations might develop into considerably extra precious sooner or later.

Portfolio Supervisor Maneesh Bajaj’s course of for figuring out alternatives is methodical:

- Valuation Self-discipline: Estimating a spread of intrinsic worth based mostly on future money flows and enterprise outlook.

- High quality Filter: Investing solely in companies with sturdy economics and shareholder-friendly administration.

- Catalyst Consciousness: Understanding what would possibly unlock worth — be it a turnaround, regulatory change or strategic shift.

- Time Arbitrage: Being affected person whereas others chase short-term developments.

This framework was evident in his resolution to reinvest in The Charles Schwab Company (“Schwab”), an organization our funding crew is aware of properly. Schwab confronted important headwinds throughout the 2023 regional banking disaster, together with deposit outflows and steadiness sheet stress on account of rising rates of interest. Over time, Schwab’s steadiness sheet has improved. Whereas it’s not absolutely repaired, we consider it’s in a a lot stronger place: A good portion of its longer-dated securities have matured, high-cost borrowings have declined, and capital ratios have improved. Our funding crew’s means to observe and dynamically react to such company-specific adjustments permits us to reply when alternatives current themselves.

Turning Volatility Into Lengthy-Time period Alternative

It’s going to come as no shock to our long-term Versatile Fairness shoppers that, among the many prime ten holdings within the portfolio a decade in the past, three names — Mastercard (MA), Visa (V) and Berkshire Hathaway (BRK.A) — nonetheless rank among the many prime ten in the present day. These corporations have been sturdy performers, contributing considerably to Versatile Fairness returns over this prolonged timeframe, although not persistently yearly. There have been instances when these shares meaningfully underperformed, impacting the general efficiency.

The enterprise surroundings for these corporations has been fairly dynamic, with numerous dangers surfacing over time. For Visa and Mastercard, issues equivalent to regulatory adjustments impacting income, financial slowdowns (e.g., throughout Covid), and the potential erosion of their aggressive moats by rising fintech improvements (e.g., cryptocurrency, Purchase Now Pay Later schemes) have arisen periodically throughout the holding interval. Every time, the Versatile Fairness crew has revisited the funding thesis, and, to this point, their resolution to take care of the holdings has been based mostly on a positive threat/reward evaluation.

Maneesh’s means to capitalize on market dislocations has additionally been evident in his well timed investments in distinctive corporations at enticing valuations. Notably, Netflix and Adobe have been each added to the portfolio in 2022 throughout a broad market rotation away from development shares, demonstrating a disciplined deal with long-term worth quite than short-term sentiment.

Market disruptions can even create alternatives to extend an allocation to present holdings when valuations develop into compelling. A great instance this yr was Taiwan Semiconductor Manufacturing Firm (TSM). In the course of the market sell-off in April, TSM’s share value pulled again, permitting Maneesh to extend his place. With its close to monopoly in superior chip manufacturing and important ongoing infrastructure investments, TSM stays a foundational participant within the AI and high-performance computing revolution.

In line with Versatile Fairness’s long-term philosophy and disciplined funding method, Maneesh deploys capital solely when an organization trades beneath the crew’s estimate of intrinsic worth — primarily, when it represents a real discount. He continues to uphold this self-discipline and won’t put money into a inventory just because it’s prone to go up from buyers’ newfound love for something AI.

Threat Administration: Avoiding Worth Traps

After all, no investments are with out threat, however energetic managers could be extra targeted on threat mitigation. Maneesh emphasizes the significance of distinguishing between what’s merely low-cost and what’s genuinely undervalued. A low value alone shouldn’t be a enough motive to take a position; there should be a transparent path to worth realization supported by sturdy fundamentals. To handle draw back threat, the crew depends on their steady monitoring of every funding thesis, leading to rigorous place sizing inside the portfolio. This disciplined method ensures that capital is deployed the place the margin of security is actual, not simply perceived, and that the portfolio stays skewed to essentially the most enticing investments that provide a positive mixture of upside potential and draw back threat, bettering resilience of the portfolio when the market or economic system falters.

Conclusion: Why Flexibility Issues

A versatile method to investing, one that appears past type labels and benchmarks, gives a definite benefit in navigating risky and unsure markets. By making use of a disciplined worth philosophy throughout each development and worth alternatives, we consider we will reply thoughtfully to dislocations, uncovering sturdy companies which are quickly mispriced.

In these moments, endurance, self-discipline and adaptability develop into invaluable. Fairly than viewing volatility as a menace, we see it as a supply of alternative — staying grounded in fundamentals, sustaining a margin of security and approaching every funding with a long-term, business-owner mindset.

The Brown Advisory U.S. Versatile Fairness crew searches for funding bargains amongst long-term enticing companies with shareholder-oriented managers — these with productive property and productive managers. These companies ought to have or develop aggressive benefits that end in good enterprise economics, managers who allocate capital properly, capability to regulate to adjustments on the earth and the power to develop enterprise worth over time. What Maneesh calls a “discount second” in share costs can come up for numerous causes however is commonly on account of short-term investor perceptions, momentary enterprise challenges that can enhance, firm or business adjustments for the higher or as-yet-unrecognized potential for long-term development and improvement. Regardless of the occasional funding that goes awry and stretches when the final inventory market, or our funding choice, is unrewarding, we’re optimistic concerning the long-term outlook for equities of fine companies at affordable costs and our means to search out them.

Editor’s Be aware: The abstract bullets for this text have been chosen by Looking for Alpha editors.